Press release

Loan Services Market 2020: Soaring Demand Assures Motivated Revenue Share by 2025 | Analysis by FICS, Fiserv, Mortgage Builder, Nortridge Software, Shaw Systems Associates

Global Loan Services Market Synopsis:The exclusive research report on the Global Loan Services Market 2020-2025 examines the market in detail along with focusing on significant market dynamics for the key players operating in the market. Global Loan Services Industry research report offers granulated yet in-depth analysis of revenue share, market segments, revenue estimates and various regions across the globe.

According to the market research study, the Loan Services refers to the administrative aspects of a loan from the time the proceeds are dispersed to the borrower until the loan is paid off. The Loan Services includes sending monthly payment statements, collecting monthly payments, maintaining records of payments and balances, collecting and paying taxes and insurance, remitting funds to the note holder, and following up any delinquencies. The Loan Services can be carried out by the bank or financial institution that issued the loans, a non-bank entity specializing in Loan Services or a third-party vendor for the lending institution. Loan Services may also refer to the borrower's obligation to make timely payments of principal and interest on a loan as a way to maintain creditworthiness with lenders and credit-rating agencies.

Available Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/236820 .

Significant points in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion. The Loan Services Market is segmented based on Product, source, application and Regions. On the basis of product, the market is sub-segmented.

Regionally, North America and Europe holds major share in Global Loan Services Market. Moreover, Asia-Pacific is expected to record higher growth rate in Loan Services market during the forecast year.

Top Major Key Players in the Global Loan Services Market:

1 FICS

2 Fiserv

3 Mortgage Builder

4 Nortridge Software

5 Shaw Systems Associates and More.................

Purchase this report online with 90 Pages, List of Tables & Figures and in-depth Table of Contents on "Global Loan Services Market Report 2020" @ https://www.businessindustryreports.com/buy-now/236820/single .

Product Type Segmentation

1 Conventional Loans

2 Conforming Loans

3 FHA Loans

4 Private Money Loans

5 Hard Money Loans

Industry Segmentation

1 Homeowner

2 Local Bank

3 Company

International Business News:

Fiserv (April 07, 2020) - Businesses Can Keep Customer's Personal Information Personal with New Solution from Fiserv - Businesses can better secure customer data with a new solution from Fiserv, Inc., a leading global provider of payments and financial services technology solutions. TransArmor Personal Data Protection from Fiserv, which incorporates industry-leading data security technology from Protegrity, helps businesses secure consumers' personal data.

With TransArmor Personal Data Protection, businesses are able to encrypt and tokenize personal information that consumers provide to businesses during routine interactions, such as creating a customer account, enrolling in a promotion, or disclosing basic shipping information. For the first time, when used alongside TransArmor Data Protection, Fiserv merchants will be able to tokenize and encrypt all payment card data and personal information throughout the entire customer and transaction lifecycle.

"As businesses build more effective consumer engagement strategies leveraging additional consumer data, it is incumbent on all businesses to secure personal data their customers entrust them with," said Krista Tedder, Director of Payments, Javelin Strategy & Research. "By tokenizing personal data in motion and at rest, personal data becomes useless to criminals when it is accessed, preserving the trust of the consumer relationship."

To meet PCI requirements, merchants must protect payment card data at the point of sale. However, personal information like a customer's name, home address, email, phone number, account number or password have not typically received the same level of protection. This personal information is in high demand on the dark web, and has been the target of high-profile data breaches.

Grab Your Report at an Impressive Discount @ https://www.businessindustryreports.com/check-discount/236820 .

Major Points in Table of Contents:

Global Loan Services Market Report 2020

1 Loan Services Product Definition

2 Global Loan Services Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Loan Services Shipments

2.2 Global Manufacturer Loan Services Business Revenue

2.3 Global Loan Services Market Overview

3 Manufacturer Loan Services Business Introduction

3.1 FICS Loan Services Business Introduction

3.2 Fiserv Loan Services Business Introduction

3.3 Mortgage Builder Loan Services Business Introduction

3.4 Nortridge Software Loan Services Business Introduction

3.5 Shaw Systems Associates Loan Services Business Introduction

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined - we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune - India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Services Market 2020: Soaring Demand Assures Motivated Revenue Share by 2025 | Analysis by FICS, Fiserv, Mortgage Builder, Nortridge Software, Shaw Systems Associates here

News-ID: 2014261 • Views: …

More Releases from Business Industry Reports

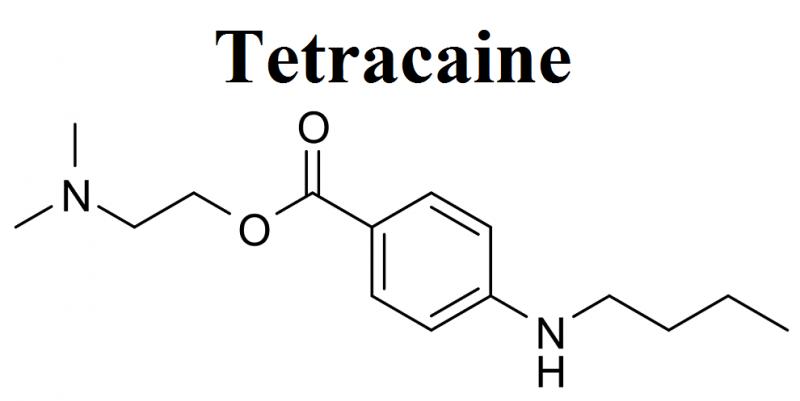

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

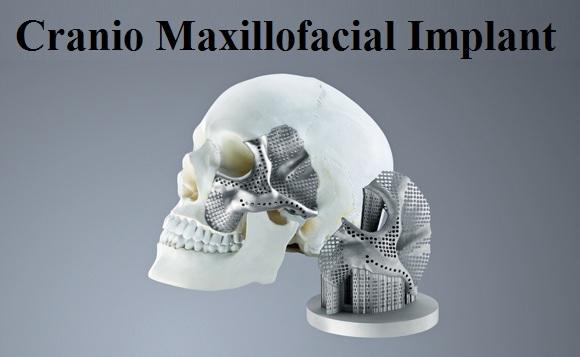

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…