Press release

Armenia Banking Market Anticipated to Garner $996 Million By 2026 at a CAGR of 8.5% | Top Impacting Factors - 2026

According to a new report published by Allied Market Research, titled, "Armenia Banking Market by Sector (Retail Banking, Corporate Banking, and Investment Banking) and Type (Closed Joint-Stock Company [CJSC] and Open Joint-Stock Company [OJSC]): Opportunity Analysis and Industry Forecast, 2019-2026", the Armenia banking market size was valued at $519 million in 2018, and is projected to reach $996 million by 2026, growing at a CAGR of 8.5% from 2019 to 2026.A bank is a financial institution licensed to accepting and safeguarding money owned by the public and creates credit in the market. It provides various products and services such as wealth management, credit and cash management, currency exchange, other financial transactions, and services in the industry.

Access Full Summary @ https://www.alliedmarketresearch.com/armenia-banking-market

The banking systems are highly regulated in most of the countries, responsible for ensuring financial stability and protecting depositors' funds, regulate exchange rates to control inflation, and other such allied activities in the banking sector. It operates into corporate banking, retail banking, investment banking, wholesale banking, and other such banking segments globally.

The Armenian banking sector is regulated by Central Bank of Armenia (CBA), which is responsible for the protection of consumer rights and market conduct in the financial system of the country. It has 17 commercial banks operating in the Republic of Armenia, and all commercial banks are currently participating in exchange trading of Armenia. The banking system is the biggest part of the financial market in the country and is highly dominated by banks that account for 88% of the total assets of the system.

Rise in adoption and implementation of digital banking technologies in the international financial system is one of the major factors that fuels the growth of the Armenian banking sector in the market. Moreover, continuous growth of small- and medium-sized enterprises (SMEs) in Armenia leads to large-scale financing and lending in comparison with other countries, which in turn boosts the growth of the banking sector in the country. However, the financial sector is characterized by high dollarization at around 60%, which is one of the highest in the region. This leads to large scale foreign exchange and refinancing risks; thereby, hampering the growth of Armenia banking industry.

Get Up to 30% Discount - Hurry Up!

Make Purchase Enquiry @ https://www.alliedmarketresearch.com/purchase-enquiry/6274

On the contrary, the country is set to introduce Basel III, providing an opportunity for banks to maintain capital buffers to cover bank losses during financial instability, and execute their existing offerings in the market. In addition, the liquidity rates of the banking system continue to stay high, providing an opportunity for banks to serve customers at the expense of liquidity means in the country.

Based on sector, the market is divided into retail banking, corporate banking, and investment banking. The corporate banking segment accounted for the largest revenue in 2018 and expected to maintain its dominant position throughout the Armenia banking market analysis period. Owing to the fact that the corporate sector is widely represented in Armenia and all 17 banks in the country with 60% of coverage are focused mainly on SMEs, which are categorized under corporate sector of banking system. The SMEs in the country has increased tremendously, and the level of financing and lending from banks for SMEs is quite high; thereby, thereby boosting the Armenia banking market growth in the country.

By type, the market is segmented into closed joint-stock company (CJSC) and open joint-stock company (OJSC). The closed joint-stock company (CJSC) segment accounted for the highest Armenia banking market share in 2018 and is anticipated to maintain this trend during the forecast period. The banking system in the country is privately owned with no government share and is expected to continue to attract new shareholders in the market. In addition, Armenian banking sector is the biggest part of the financial market in the country. The banks are largely categorized under closed joint-stock company (CJSC) type in the country.

Download Sample Report (Get Full Insights in PDF - 90 Pages) @ https://www.alliedmarketresearch.com/request-sample/6274

Key Findings of the Study:

1. The corporate banking segment is expected to be the fastest growing segment during the forecast period, in terms of value.

2. In terms of revenue, the closed joint-stock company (OJSC) segment accounted for the highest revenue in the Armenia banking market in 2018.

The key players operating in the Armenia banking market include Ameriabank CJSC, ARARATBANK OJSC, ArmSwissBank CJSC, Converse Bank CJSC, HSBC Armenia, ID Bank, ACBA-CREDIT AGRICOLE BANK CJSC, ArmBusinessBank CJSC, Ardshinbank CJSC, and Inecobank CJSC. Other players operating in the market are UniBank OJSC, VTB Bank Armenia CJSC, Artsakhbank CJSC, Evocabank CJSC, and Mellat Bank CJSC.

Chapter 1: Introduction

Chapter 2: Executive Summary

Chapter 3: Market Overview

Chapter 4: Armenia Banking Market, By Sector

Chapter 5: Armenia Banking Market, By Type

Chapter 6: Company Profiles

Buy Now @ https://www.alliedmarketresearch.com/checkout-final/bb0ec261d28723c12140d363d41378cf

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free (USA/Canada):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Armenia Banking Market Anticipated to Garner $996 Million By 2026 at a CAGR of 8.5% | Top Impacting Factors - 2026 here

News-ID: 2004356 • Views: …

More Releases from Allied Market Research

Eucalyptus Oil Market to Grow $252.0 Million By 2030, at 6.6% CAGR | Key Market …

Eucalyptus oil market garnered $135.5 million in 2020, and is slated to gain $252.0 million by 2030, registering a CAGR of 6.6% from 2021 to 2030.

Antiseptic and anti-fungal capabilities are two of the most important features of Eucalyptus essential oil. The mosquito repellant properties of eucalyptus essential oil are well-known. The extraction of eucalyptus essential oil has a potent synergistic impact that can be linked to the greatest level of…

Biopesticides Market is Anticipated to Develop Altogether at Strong CAGR -Allied …

Biopesticides market was valued at $7.0 billion in 2020, and is estimated to reach $33.6 billion by 2031, growing at a CAGR of 13.9% from 2022 to 2031.

Increase in R&D expenditure and upcoming breakthroughs in biopesticide manufacturing technology are expected to generate attractive biopesticides market growth prospects.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/538

Extensive use of various types of microbial biopesticides to enhance the quality of the crop & land, increase yield & productivity,…

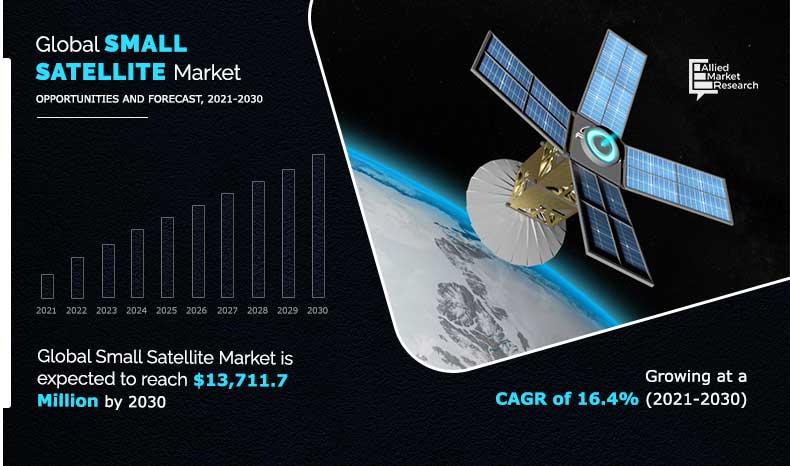

Small Satellite Market is set to witness a growth rate of 16.4% in the next 10 y …

The small satellite industry was estimated at $3.25 billion in 2020, and is anticipated to hit $13.71 billion by 2030, registering with a CAGR of 16.4% from 2021 to 2030.

Small satellites are being used by defense organizations to deploy spy solutions for tracking and monitoring enemy and terrorist activities worldwide. By type, the small satellite market is categorized into minisatellite, microsatellite, nanosatellite, and others. The minisatellite segment accounted for the…

Frozen Food Packaging Market Size, Share, Emerging Trends, Growth and Forecast t …

Frozen food packaging market was valued at $38,826.20 million in 2020, and is estimated to reach $63,980.50 million by 2031, growing at a CAGR of 5.03% from 2022 to 2031.

Rise in consumption of frozen ready meals and packaging as a tool for product differentiation are factors that drive the growth of the frozen food packaging market globally. However, stringent government regulations towards frozen food packaging impede the market growth.

Download Sample…

More Releases for Armenia

M&A Activity in Armenia Banking Market to Set New Growth Cycle

Advance Market Analytics added research publication document on Worldwide Armenia Banking Market breaking major business segments and highlighting wider level geographies to get deep dive analysis on market data. The study is a perfect balance bridging both qualitative and quantitative information of Worldwide Armenia Banking market. The study provides valuable market size data for historical (Volume** & Value) from 2019 to 2023 which is estimated and forecasted till 2032*. Some…

RAVCARE Accepted into Armenia Startup Academy Pre-accelerator Program

RAVCARE, an innovative startup dedicated to revolutionizing the healthcare technology space, is pleased to announce its acceptance into the prestigious Armenia Startup Academy Pre-accelerator program. This program will provide RAVCARE with vital resources, mentorship, and networking opportunities aimed at accelerating its growth trajectory and enhancing its market capabilities.

The Armenia Startup Academy is renowned for its commitment to empowering early-stage startups through tailored training modules, mentorship with industry experts, and access…

Armenia Real Estate Market Size, Industry Share, Forecast 2026

According to a new report published by Allied Market Research, titled, "Armenia Real Estate Market by Property and Business: Global Opportunity Analysis and Industry Forecast, 2019-2026," the Armenia real estate market size was valued at $880.4 million in 2018, and is projected to reach $1,249.3 million by 2026, growing at a CAGR of 4.3%. The sales segment accounted for more than half of Armenia real estate market share in 2018…

Armenia Real Estate Market by Property, and Business, 2030

Armenia is an ancient country located in the Caucasus region between Europe and Asia, and has been home to a rich and diverse culture since the dawn of civilization. The country has experienced a surge in foreign investment over the past decade and the real estate industry is no exception. With its stunning natural beauty and rapidly modernizing infrastructure, Armenia is becoming an increasingly attractive destination for real estate investors.

the…

Armenia Real Estate Market Expected to Reach $1,249.3 Million by 2026

According to a new report published by Allied Market Research, titled, "Armenia Real Estate Market by Property and Business: Global Opportunity Analysis and Industry Forecast, 2019-2026," the Armenia real estate market size was valued at $880.4 million in 2018, and is projected to reach $1,249.3 million by 2026, growing at a CAGR of 4.3%. The sales segment accounted for more than half of Armenia real estate market share in 2018…

Armenia Banking Market 2026 Competitive Landscape | Outlook with Ameriabank CJSC …

The Armenia banking market was valued at $519 million in 2018, and is expected to reach $996 million by 2026, registering a CAGR of 8.5% from 2019-2026. A bank is a financial institution licensed to accept deposits from the public and create credit in the market. The banking system operates into corporate banking, retail banking, investment banking, wholesale banking, and other such banking segments globally. It provides various products and…