Press release

Digital Banking Market Views: Taking A Nimble Approach to 2020 | Garanti, BBVA, DBS, OCBC

A new market study is released on Digital Banking - Thematic Market with data Tables for historical and forecast years represented with Chats & Graphs spread through 41 Pages with easy to understand detailed analysis. The study highlights detailed assessment of the Market and display market sizing trend by revenue & volume (if applicable), current growth factors, expert opinions, facts, and industry validated market development data. The research study provides estimates for Digital Banking - Thematic Forecast till 2025*. Some are the players that are considered in the coverage of this study are Garanti, BBVA, DBS, OCBC, Buddy Bank, Bank Mobile, Chime, Monzo, mBank, ImaginBank, HelloBank, WEBank, MYBank, KakaoBank, Tinkoff Bank, Widiba.Industries and markets are ever-evolving; navigate these changes with ongoing research conducted by HTF MI; Address the latest insights released on Digital Banking - Thematic Market.

Browse now for Full Report Index or a Sample Copy @: https://www.htfmarketreport.com/sample-report/2532317-digital-banking-thematic-research

Summary:

Most incumbent banks digital transformation efforts (whether they are piecemeal or end-to-end) are optimized for a world that no longer exists: the vertically integrated value chain, where change is slow, competition is limited, and incumbents are protected by regulation and channels (branch networks). In this world, doing what banks have always done, only better - faster, cheaper, etc. - drives business results. In the digitally disaggregated value chain, banking opens up, and industry lines blur. Everything that banking is begins to change.

Scope:

- The vast majority of bank customers are unwilling to use a digital-only bank as their main current/checking account. However, those customers that described themselves as very willing are typically banks' "better" customers (higher income, likely to hold more products, heavy digital users, etc.).

- New digital banks structure fees so they win when customers win (e.g. a small product commission when finding a customer the best mortgage for their needs or the best rate on a credit card). Incumbent banks often earn most when customers benefit least creating enormous structural disincentives to customer centricity.

Enquire for making customized Report @ https://www.htfmarketreport.com/enquiry-before-buy/2532317-digital-banking-thematic-research

To comprehend Digital Banking - Thematic market dynamics in the global market, the worldwide Digital Banking - Thematic market is analyzed across major geographical regions. HTF Market Intelligence also provides customized specific regional and country-level reports, see below break-ups.

o North America: United States, Canada, and Mexico.

o South & Central America: Argentina, ,Chile, LATAM, and Brazil.

o Middle East & Africa: Saudi Arabia, UAE, Israel, Turkey, Egypt and South Africa.

o Europe: UK, France, Italy, Germany, Spain, BeNeLux, and Russia.

o Asia-Pacific: India, China, Japan, South Korea, Indonesia, Thailand, Singapore, and Australia.

2-Page company profiles for 10+ leading players is included with 3 years financial history to illustrate the recent performance of the market. Latest and updated discussion for 2019 major macro and micro elements influencing market and impacting the sector are also provided with a thought-provoking qualitative remarks on future opportunities and likely threats. The study is a mix of both statistically relevant quantitative data from the industry, coupled with insightful qualitative comment and analysis from Industry experts and consultants.

Reasons to buy:

- Understand consumer adoption globally of different digital banking touchpoints

- Identify technology, regulatory and consumer trends driving digital transformation at incumbent banks and progress with those initiatives at leading banks

- Receive detailed insights regarding new entrants, their business models and their key sources of competitive advantage

- Learn how incumbent banks can move beyond core products to build deeper engagement with customers and identify new revenue opportunities

To ascertain a deeper view of Market Size, competitive landscape is provided i.e. Comparative Market Share Revenue Analysis (Million USD) by Players (2017-2018) & Segment Market Share (%) by Players (2017-2018) and further a qualitative analysis of all players is made to understand market concentration rate.

Competitive Landscape & Analysis:

Major players of Digital Banking - Thematic Market are focusing highly on innovation in new technologies to improve production efficiency and re-arrange product lifecycle. Long-term growth opportunities for this sector are captured by ensuring ongoing process improvements of related players following NAICS standard by understanding their financial flexibility to invest in the optimal strategies. Company profile section of players such as Garanti, BBVA, DBS, OCBC, Buddy Bank, Bank Mobile, Chime, Monzo, mBank, ImaginBank, HelloBank, WEBank, MYBank, KakaoBank, Tinkoff Bank, Widiba includes vital information like legal name, website, headquarter, its market position, distribution and marketing channels, historical background and top 4 closest competitors by Market capitalization / turnover along with sales contact information. Each company / manufacturers revenue figures, growth rate, net profit and gross profit margin is provided in easy to understand tabular format for past 3 years and a separate section on market entropy covering recent development activities like mergers &acquisition, new product/service launch, funding activity etc.

Buy Full Copy Digital Banking - Thematic Report 2018 @ https://www.htfmarketreport.com/buy-now?format=1&report=2532317

In this study, the years considered to estimate the market size of Digital Banking - Thematic are as follows:

History Year: 2014-2018, Base Year: 2019, Forecast Year 2019 to 2025

Key Stakeholders / Target Audience Covered:

In order to better analyze value chain/ supply chain of the Industry, a lot of attention given to backward & forward Integration

- Digital Banking - Thematic Manufacturers

- Digital Banking - Thematic Distributors/Traders/Wholesalers

- Digital Banking - Thematic Sub-component Manufacturers

- Industry Association

- Downstream Vendors

Actual Numbers & In-Depth Analysis of Digital Banking - Thematic Market Size Estimation, Business opportunities, Available in Full Report.

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, LATAM, West Europe, MENA Countries, Southeast Asia or Asia Pacific.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA - 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the "Accurate Forecast" in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their "Goals & Objectives".

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market Views: Taking A Nimble Approach to 2020 | Garanti, BBVA, DBS, OCBC here

News-ID: 1967241 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

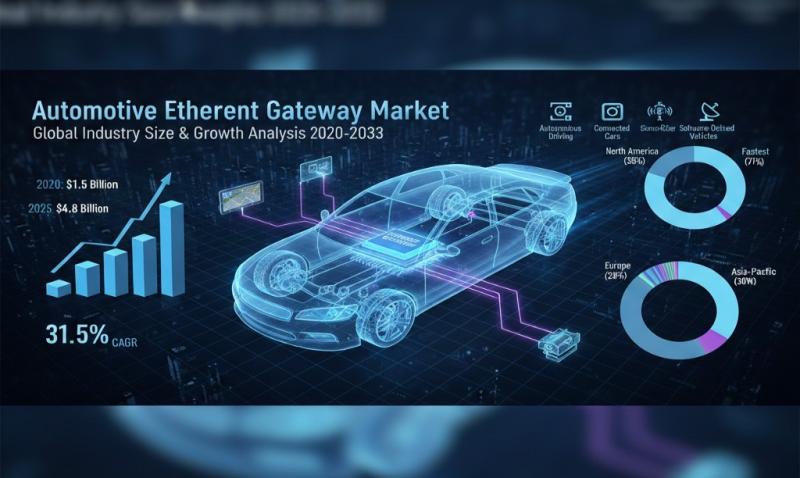

Automotive Ethernet Gateway Market - Global Industry Size & Growth Analysis 2020 …

The latest study released on the Global Automotive Ethernet Gateway Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Automotive Ethernet Gateway study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Aluminum Coils Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Aluminum Coils Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Aluminum Coils study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Hot Honey Drizzle Market Hits New High | Major Giants Nature Nate's, The Honey P …

The latest study released on the Global Hot Honey Drizzle Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Hot Honey Drizzle study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

AI Document Generator Market May See a Big Move | Major Giants Google (USA), SAP …

The latest study released on the Global AI Document Generator Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The AI Document Generator study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…