Press release

Global Insurance Broker and Agents Market Will Grow USD 74,387 Million By 2027

Facts and Factors Market Research has published a new report titled "Insurance Broker and Agents Market By Type of Insurance Coverage (Life Insurance, Reinsurance, and General Insurance), By Type (Insurance Brokers and Insurance Agents), and By End-Users (Corporate and Individual): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 - 2027". According to the report, the global insurance broker and agents market was valued at approximately USD 52,414 million in 2018 and is expected to reach a value of around USD 74,387 million by 2027, at a CAGR of around 2.3% between 2019 and 2027.Request to Access Free Sample @ http://bit.ly/3aSEFS6

(The sample pages of this report is immediately accessible on demand).

This Free report sample includes:

The report covers present status and future prospects.

The report analyses market trends, size, and forecast in different geographically.

The report provides market competition overview among the Top companies.

The report provides a complete analysis of the current and emerging market trends and opportunities.

Example pages from the report.

FnF research methodology.

Insurance broker and agents sell insurance policies and annuities to the people. The brokers work on behalf of clients while agents work on behalf of insurance firms. They earn a commission on the percentage of policies sold. Risk management consulting & services like insurance administration are also included in the portfolio of insurance agents and brokers. The key responsibilities include reinsurance brokerage and administration, property insurance, casualty insurance policy, health & medical insurance, risk-management consulting, and life & accident insurance, and annuity brokerage. General insurance products include general insurance, life insurance, and much more.

Escalating awareness related to investments will boost the market growth

The rise in the awareness pertaining to funding activities and a huge number of online channels as well as the introduction of new schemes will drive the growth of insurance broker and agents industry over the forecast timeline. Apart from this, a rise in the cases of road collisions & natural calamities has generated awareness among the people about the significance of the insurance coverage. This, in turn, is predicted to steer the expansion of the insurance broker and agents industry during the forecast period.

Make An Inquiry About This Report @ http://bit.ly/33fzpoN

(You may enquire a report quote OR available discount offers to our sales team before purchase.)

Furthermore, the transition from higher cost centers to lower-cost centers is predicted to steer the expansion of the insurance broker and agents industry over the forecast period. Moreover, increase in the interest rates, stable economic growth in certain parts of the globe, and rise in the disposable income that is used for investment will prompt the growth of the insurance broker and agents industry over the forecast timeline. Nonetheless, growing cases of cybercrime in the insurance sector can pose a threat to the expansion of the market over the forecast timeline.

Life insurance to dominate the type of insurance coverage segment

The growth of the segment is due to a large number of persons purchasing life insurance coverage. Apart from this life insurance protects the individuals, families, and businesses from life risks as well as retirement risks. Furthermore, a prominent rise in the number of collisions will further drive the segmental growth.

Explore Complete TOC/ Ask for Customization @ http://bit.ly/2IKYSgo

(This report can be customized to meet the client's requirements. Please connect with our sales team, to customize your report according to research needs).

Insurance agents to contribute majorly towards the type segment

The growth of the segment is attributed to the rising acceptance of insurances individually over the group insurances. The segment is projected to record the CAGR of nearly 4.1% over the forecast period.

Medical segment to lead the end-user landscape over the forecast period

The segment is projected to accrue massive gains over the forecast timeline subject to the massive need to constantly comply with the rapidly altering regulatory framework.

North America to dominate the overall regional landscape during the period from 2019 to 2027

The growth of the regional market is due to the growing demand for P&C insurance in countries like the U.S. in North America.

Some of the key players involved in the market include Marsh & McLennan Cos Inc., Aon PLC, Brown & Brown Inc., Willis Towers Watson PLC, and Arthur J Gallagher & Co.

This report segments the insurance broker and agents market as follows:

Global Insurance Broker and Agents Market: By Type of Insurance Coverage Segment Analysis

Life Insurance

Reinsurance

General Insurance

Global Insurance Broker and Agents Market: By Type Segment Analysis

Insurance Brokers

Insurance Agents

Captive

Independent

Global Insurance Broker and Agents Market: By End-Users Segment Analysis

Corporate

Construction and Engineering

Energy

Medical

Fertilizers & Chemicals

Marine

IT and ITES

BFSI

Others

Individual

Global Insurance Broker and Agents Market: Regional Segment Analysis

North America

U.S.

Europe

UK

France

Germany

Asia Pacific

China

Japan

India

Latin America

Brazil

Middle East and Africa

Contact Us:

Facts & Factors

Global Headquarters

Level 8, International Finance Center, Tower 2,

8 Century Avenue, Shanghai,

Postal - 200120, China

Tel: +86 21 80360450

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client's/customer's conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Broker and Agents Market Will Grow USD 74,387 Million By 2027 here

News-ID: 1966069 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

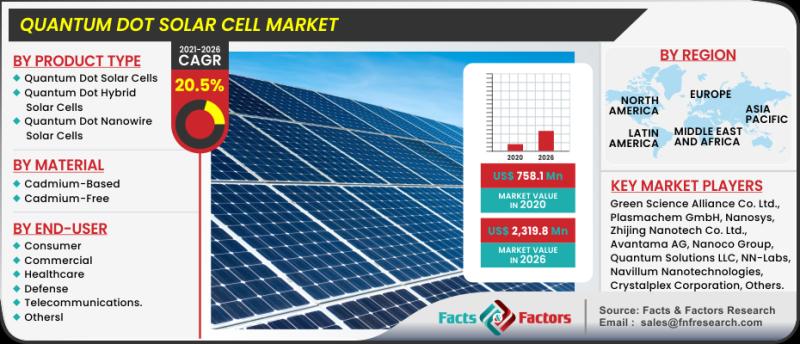

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…