Press release

SME Insurance Market Drivers, Trends, Opportunities and Forecast 2025| AIA, AIG, AXA

QY Research has recently published a research report titled, "Global SME Insurance Market Research Report 2020".assessing various factors impacting its trajectory. Analysts have used primary and secondary research methodologies to determine the path of the market. The data includes historic and forecast values for a well-rounded understanding. The global SME Insurance market is expected to augment in the forecast period owing to various drivers and opportunities that lie in the ever-growing market. This report includes assessment of various drivers, government policies, technological innovations, upcoming technologies, opportunities, market risks, restrains, market barriers, challenges, trends, competitive landscape, and segments.For more details, Get a Sample Copy of this Report (Including Full TOC, Table & Figures) @ https://www.qyresearch.com/sample-form/form/1057072/global-sme-insurance-market

Global SME Insurance Market: Competitive Landscape

Competitive landscape of a report determines the overall scenario of the market focusing on key players and their strategic moves. Readers can get an insight of how various key players are performing in the market and the scope for emerging players.

Key players profiled in the report on the global SME Insurance Market are: AIA, AIG, AXA, Tokio Marine, Sompo, Allianz, CPIC, Samsung Life Insurance, PingAn, Chubb, Great Eastern, China Life, PICC, Muang Thai, Hong Leong,

Global SME Insurance Market: Drivers and Restraints

This section of the report assess various drivers, opportunities, and restrains that lie in the market. These drivers and restraints are determined by various factors such as region, key players, innovations, and others. The report will help readers determine the key drivers and solutions for restraints. It also highlights the possible opportunities. The drivers and restraints are identified by current trends and historic milestones achieved by the market. The chapter on drivers and restraints also offers an evaluation of the investments made in production innovation through the years. The changes in environmental perspective have also been factored in to understand their impact on the growth of the global SME Insurance market.

Analysts have also highlighted the potential restraints present in the global SME Insurance market. With the help of market experts the report points out what changes companies can make to overcome these hurdles over the forecast years.

Global SME Insurance Market: Segment Analysis

The market has various segments such as applications, end users, and products. These help in determining the growth of a particular segment of a market. The readers can assess why a certain segment is performing better than the other and then make strategic investments. The type segment includes sales value for the forecast period of 2014 to 2025. The application segment includes sales by volume and consumption for the forecast period of 2014 to 2025.

Global SME Insurance Market by Type:

Property Insurance

Public Liability Insurance

Business Interruption Insurance

Workers Compensation Insurance

Goods in Transit Insurance

Global SME Insurance Market by Application:

Bancassurance

Digital & Direct Channels

Brokers

Agency

Get Customized Report in your Inbox within 24 hours @ https://www.qyresearch.com/customize-request/form/1057072/global-sme-insurance-market

Strategic Points Covered in TOC:

Chapter 1: Introduction, market driving force product scope, market risk, market overview, and market opportunities of the global SME Insurance market

Chapter 2: Evaluating the leading manufacturers of the global SME Insurance market which consists of its revenue, sales, and price of the products

Chapter 3: Displaying the competitive nature among key manufacturers, with market share, revenue, and sales

Chapter 4: Presenting global SME Insurance market by regions, market share and with revenue and sales for the projected period

Chapter 5, 6, 7, 8 and 9: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries in these various regions

Contact US:

QY Research, INC.

17890 Castleton, Suite 218,

Los Angeles, CA - 91748

USA: +1 626 428 8800

India: +91 9766 478 224

Emails - enquiry@qyresearch.com

Web - www.qyresearch.com

About Us:

We established as a research firm in 2007 and have since grown into a trusted brand amongst many industries. Over the years, we have consistently worked toward delivering high-quality customized solutions for wide range of clients ranging from ICT to healthcare industries. With over 50,000 satisfied clients, spread over 80 countries, we have sincerely strived to deliver the best analytics through exhaustive research methodologies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release SME Insurance Market Drivers, Trends, Opportunities and Forecast 2025| AIA, AIG, AXA here

News-ID: 1954084 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

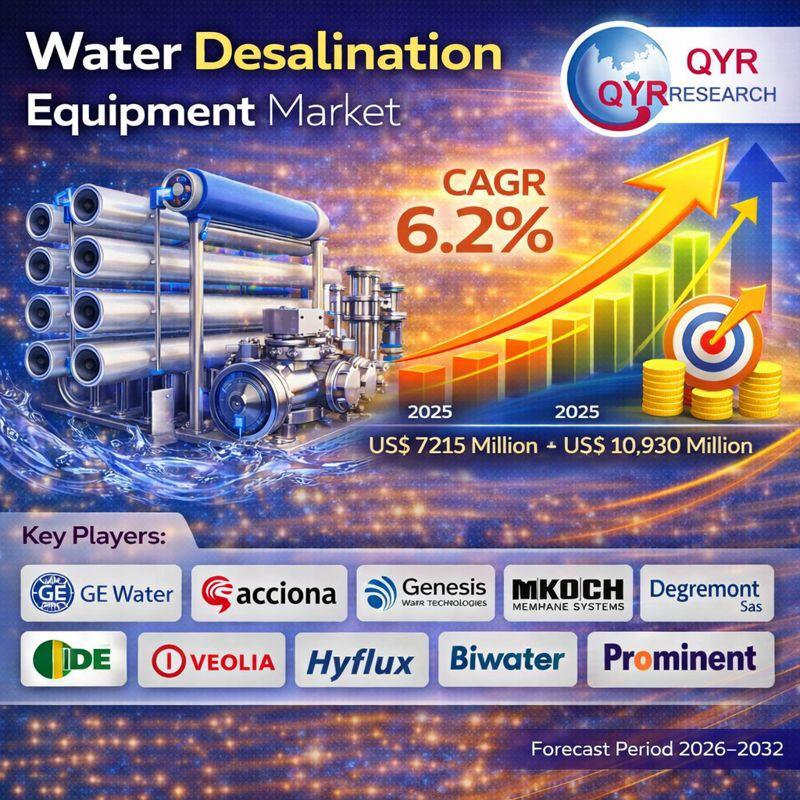

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

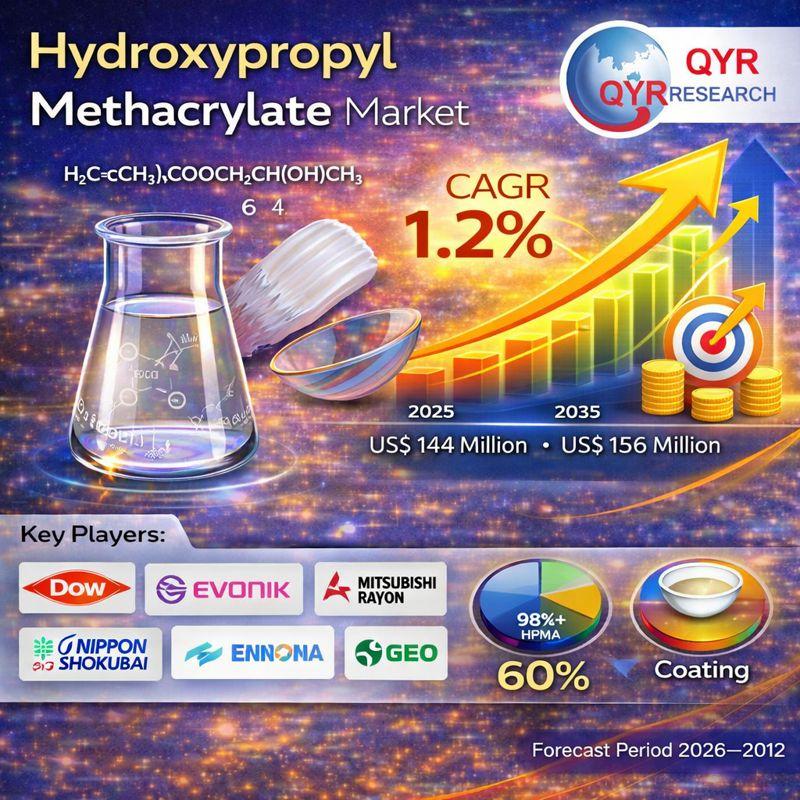

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…