Press release

Fraud Detection and Prevention Market Regional Revenue, Trends, Opportunities and Future Prospects

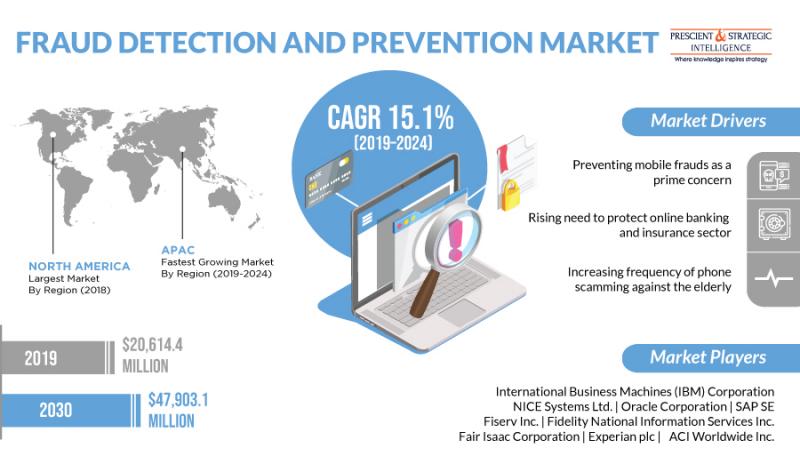

The global fraud detection and prevention market is driven by the usage of artificial intelligence (AI) and machine learning (ML) for curbing fraudulent activities, primarily mobile frauds, and those in the banking, financial services, and insurance (BFSI) sector. The market was valued at $20,614.4 million in 2018, and is predicted to advance at a CAGR of 15.1% during the forecast period (2019-2024). The key elements in the process are to identify the fraud risk, assess the likelihood of the risks, and take measures before any significant damage is done.Under the application segment, the fraud detection and prevention market is categorized into identity theft, payment frauds, money laundering, and others. Among these, the payment frauds category dominated the market in 2018, and it is expected to continue on this path during the forecast period. This is mainly due to the increase in the volume of electronic payments, which is resulting in a rise in the fraudulent activities in the payment sector. A key driver for the market is itself the rising need to protect web-based payment transactions.

Get the Sample Copy of this Report @ https://www.psmarketresearch.com/market-analysis/fraud-detection-and-prevention-market/report-sample

The need for protecting online financial platforms from fraudulent activities and inherent risks is mainly due to the rapid digitalization. Payment frauds are mostly unauthorized transactions processed by a cyber-criminal. It is challenging to eliminate the threat in the e-commerce domain; however, updating the software and network security systems can help in this regard. The fraud detection and prevention market is burgeoning on account of the rising electronic payment rate across the globe. Thus, with the need to curb web-based payment frauds, this application category is expected to dominate the market during the forecast period.

On the basis of enterprise size, the fraud detection and prevention market is bifurcated into large enterprises and small and medium enterprises (SMEs). Among the two, the large enterprises bifurcation held the larger market share in 2018, and it is also expected to dominate it in the forecast period. Large enterprises are quickly adopting such software to protect their massive business data and information from any misconduct. Additionally, they have higher budgets, which gives them more purchasing power.

Make Enquiry Before Purchase @ https://www.psmarketresearch.com/send-enquiry?enquiry-url=fraud-detection-and-prevention-market

The fraud detection and prevention market is divided, based on platform, into web-based and mobile-based. The demand for mobile-based software was higher in the market in 2018, and this division is expected to progress faster in the forecast period. The main driver for the growth of this division is the concerns toward mobile frauds. Perpetrators are targeting mobile users by hacking, taking over account details, making unauthorized transactions, and stealing their identity. The constantly evolving fraudulent activities impact mobile transactions heavily; hence, the demand for fraud detection and prevention solutions is flourishing.

About P&S Intelligence

P&S Intelligence is a provider of market research and consulting services catering to the market information needs of burgeoning industries across the world. Providing the plinth of market intelligence, P&S as an enterprising research and consulting company, believes in providing thorough landscape analyses on the ever-changing market scenario, to empower companies to make informed decisions and base their business strategies with astuteness.

Contact:

P&S Intelligence

International: +1-347-960-6455

Email: enquiry@psmarketresearch.com

Web: https://www.psmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market Regional Revenue, Trends, Opportunities and Future Prospects here

News-ID: 1947393 • Views: …

More Releases from P&S Intelligence

Modular Automation Market Poised for Robust Growth Amid Industry 4.0 Transformat …

According to the latest market research study published by P&S Intelligence, the global modular automation market is on an impressive growth trajectory, expected to generate USD 6.3 billion in 2024 and expand at a CAGR of 8.7% to reach USD 12.1 billion by 2032. This surge is driven by rising demand for flexible, cost-efficient manufacturing solutions and the accelerating integration of Industry 4.0 technologies.

As manufacturing landscapes evolve with rapid changes…

U.S. ESG Investments Market Set to Skyrocket: $16 Trillion by 2032

According to the latest market research study published by P&S Intelligence, the U.S. Environmental, Social, and Governance (ESG) investments market is experiencing a significant surge, with projections indicating an increase from $6.5 trillion in 2024 to an estimated $16.0 trillion by 2032. This represents a robust compound annual growth rate (CAGR) of 12.1% over the forecast period.

According to a comprehensive analysis by P&S Intelligence, the market's expansion is driven…

Facility Management in the U.K. Booms with 14.1% CAGR as Demand Soars Across Sec …

According to the latest market research study published by P&S Intelligence, the U.K. facility management market is poised for significant growth, with projected revenues reaching USD 2,743.3 million in 2024 and expected to soar to USD 6,038.4 million by 2030, reflecting a robust CAGR of 14.1% during the forecast period.

This expansion is fueled by a surge in demand across both public and private sectors. According to the RICS U.K.…

Point-of-Sale Software Market in the U.S. Set to Grow by 9.7% CAGR, Boosted by O …

According to the latest market research study published by P&S Intelligence, the U.S. point-of-sale (POS) software market, valued at USD 4.7 billion in 2024, is poised for significant growth over the coming years, with projections estimating it will reach USD 9.8 billion by 2032, expanding at a compound annual growth rate (CAGR) of 9.7%. This growth is attributed to rapid technological advancements, a surge in mobile and cloud-based POS systems,…

More Releases for BFSI

Evolving Market Trends In The Robotic Process Automation In BFSI Industry: Advan …

The Robotic Process Automation In BFSI Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Robotic Process Automation In BFSI Market Size During the Forecast Period?

In recent times, the market size for robotic process automation in bfsi has witnessed a significant surge.…

Evolving Market Trends In The Banking, Financial Services and Insurance (BFSI) S …

The Banking, Financial Services and Insurance (BFSI) Security Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Banking, Financial Services and Insurance (BFSI) Security Market Size During the Forecast Period?

The market size for security within the banking, financial services and insurance (BFSI)…

Key Trend Reshaping the AI in BFSI Market in 2025: Transforming The BFSI Sector …

What combination of drivers is leading to accelerated growth in the ai in bfsi market?

The anticipated surge in the AI in BFSI market may be traced back to the mounting use of AI in improving efficiency. Artificial intelligence (AI) comprises various technologies and algorithms that simulate human intelligence, including problem-solving, drawing insights from data, and making effective decisions. This growing usage of AI for enhancing efficiency could be attributed to…

Mumbai's BFSI Sector Gears Up for Transformation at the 24th Edition of BFSI IT …

Mumbai: The banking, financial services, and insurance (BFSI) sector in Mumbai is currently undergoing a profound transformation, fueled by rapid technological advancements and a significant increase in digital adoption. Emphasizing a strong commitment to digitalization, key stakeholders in Mumbai are championing initiatives akin to advancements in digital payments and the establishment of the Digital Banking Transformation Office. These efforts are propelling the BFSI landscape forward, fostering innovation and paving the…

Empowering BFSI Security: Safeguarding Futures Amid Evolving Threats, BFSI Secu …

Guarding the financial backbone against evolving cyber threats fuels the burgeoning, emergence of tailored solutions, biometrics, and IoT-based cybersecurity solutions significantly enhancing online banking Opportunities for the market.

The BFSI Security Market, valued at USD 61.6 billion in 2022, is poised to witness exponential growth, reaching USD 166.2 billion by 2030, reflecting a robust CAGR of 13.2%. This escalating trajectory is primarily attributed to the stringent regulatory environment governing the banking,…

IoT in BFSI Market : How the Business Will Grow in 2026?�Top Players in IoT in B …

The global internet of things (IoT) in banking, financial services, and insurance (BFSI) market is predicted to reach USD 116.27 billion by 2026, exhibiting a CAGR of 26.5% during the forecast period. The increasing investment of banks and financial institutions in IoT technologies will stimulate the growth of the market in the foreseeable future. According to the studies conducted by Tata consultancy services, financial institutions spend an average IoT budget…