Press release

Credit Management Software Market to amass Appreciable Gains by 2026

The "Global Credit Management Software Market Expected to Reach USD 2,550.00 Million by the end of 2025", report intends to offer a resourceful means to assess the Credit Management Software Market and entails the all-inclusive analysis and upfront statistics with regards to the market. This new report is committed fulfilling the requirements of the clients by giving them thorough insights into the market. The Credit Management Software Market report, titled Credit Management Software Market, is expansive research reliant on Credit Management Software Market, which inspects the raised structure of the present Credit Management Software Market all around the globe. Arranged by the adequate methodical framework, for instance, SWOT examination, the Credit Management Software Market report exhibits a total evaluation of the significant players of the Credit Management Software Market. Also, it encompasses the key leading market players across the globe with insights such as product pictures & specifications, market share, company profiles, sales, and contact details.After a thorough study on the global Credit Management Software Market profit and loss, the Credit Management Software Market detailed out the supply-demand, business escalation, government measures, commercial strategy, and various policies very genuinely. The research report has geographical segmentation based on regional market growth and development scaled down precisely. The market report also has details regarding the supply-demand, market growth and development factors, industrial profit and loss, economic grade, and certain strategic policies all mentioned. For more details on the Credit Management Software Market, all one has to do is to access the Credit Management Software Market portal and gather the necessary information.

Download Free PDF Research Report Brochure @ https://www.zionmarketresearch.com/requestbrochure/credit-management-software-market

Strategic Points Covered in TOC:

Chapter 1: Introduction, Credit Management Software Market driving force product scope, market risk, market overview, and market opportunities of the global Scanning Laser Rangefinders market

Chapter 2: Evaluating the leading manufacturers of the global Credit Management Software Market which consists of its revenue, sales, and price of the products

Chapter 3: Displaying the competitive nature among key manufacturers, with market share, revenue, and sales

Chapter 4: Presenting global Credit Management Software Market by regions, market share and with revenue and sales for the projected period

Chapter 5, 6, 7, 8 and 9: To evaluate the market by segments, by countries and by manufacturers with revenue share and sales by key countries in these various regions

The Credit Management Software Market is widely partitioned reliant on the predictable updates in the enhancement of parameters, for example, quality, trustworthiness, end customer solicitations, applications, and others. The Credit Management Software Market report contains general successful parameters, confinements, and besides has in detail illumination of the noteworthy data close by the present and future examples that may concern the advancement. The comprehensive Credit Management Software Market report elucidates within and outside representation of current advancements, parameters, and establishments.

Get Sample Report for More Details @ https://www.zionmarketresearch.com/sample/credit-management-software-market

Moreover, the Credit Management Software Market report provides even handed, objective estimation and analysis of prospects in the Credit Management Software Market with systematic market study report containing several other market-allied vital factors. Our qualified industry analysts evaluate the cost, market share, growth opportunities, technologies, market sizing, supply chains, applications, export & import, companies, and so on, with the sole effort of assisting our clients to make well-read business decisions.

The report majorly enlightens the key growth and limiting factors which majorly targets at the center of the market affecting the growth and its development in either positive or negative extent. The report also specifies the impact of regulations and policies implemented by the administration over the current growth and upcoming opportunities that may lead to the market development escalation. The global Credit Management Software Market report offers a superior vision of the global market, which will help clients to manage the business precisely with better growth and expansion compared to its contenders in the market.

The report gathers the essential information including the new strategies for growth of the industry and the potential players of the global Credit Management Software Market. It enlists the topmost industry player dominating the global Credit Management Software Market along with their contribution to the global market. The report also demonstrates the data in the form of graphs, tables, and figures along with the contacts details and sales of key market players in the global Credit Management Software Market.

TOC of this Report@ https://www.zionmarketresearch.com/toc/credit-management-software-market#utm_source=komal%2Fopenpr&utm_medium=26feb

Reasons to Buy this Report

o Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the Credit Management Software Market.

o Highlights key business priorities in order to assist companies to realign their business strategies.

o The key findings and recommendations highlight crucial progressive industry trends in the global Credit Management Software Market, thereby allowing players across the value chain to develop effective long-term strategies.

o Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

o Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

o Enhance the decision-making process by understanding the strategies that underpin security interest with respect to client products, segmentation, pricing and distribution

Lastly, with a team of vivacious industry professionals, we offer our clients with high-value market research that, in turn, would aid them to decipher new market avenues together with new strategies to take hold of the market share.

Corporate Office

Zion Market Research

244 Fifth Avenue, Suite N202

New York, 10001, United States

Tel: +49-322 210 92714

USA/Canada Toll Free No.1-855-465-4651

About Us

Zion Market Research is an obligated company. We create futuristic, cutting edge, informative reports ranging from industry reports, company reports to country reports. We provide our clients not only with market statistics unveiled by avowed private publishers and public organizations but also with vogue and newest industry reports along with pre-eminent and niche company profiles. Our database of market research reports comprises a wide variety of reports from cardinal industries. Our database is been updated constantly in order to fulfill our clients with prompt and direct online access to our database. Keeping in mind the client's needs, we have included expert insights on global industries, products, and market trends in this database. Last but not the least, we make it our duty to ensure the success of clients connected to us--after all--if you do well, a little of the light shines on us.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Management Software Market to amass Appreciable Gains by 2026 here

News-ID: 1945944 • Views: …

More Releases from Zion Market Research

Halal Food Market to Reach USD 16.84 Billion by 2034, Expanding at 18.04% CAGR

The global halal food market, valued at USD 3.21 billion in 2024, is projected to reach USD 16.84 billion by 2034 at a robust CAGR of 18.04%. This extraordinary growth is fueled by a rapidly rising global Muslim population, increasing demand for certified halal-compliant food, expanding global halal trade networks, and the emergence of halal as a trusted, premium, ethical, and hygienic food label even for non-Muslim consumers.

Key Market Highlights

Metrics Insight

2024…

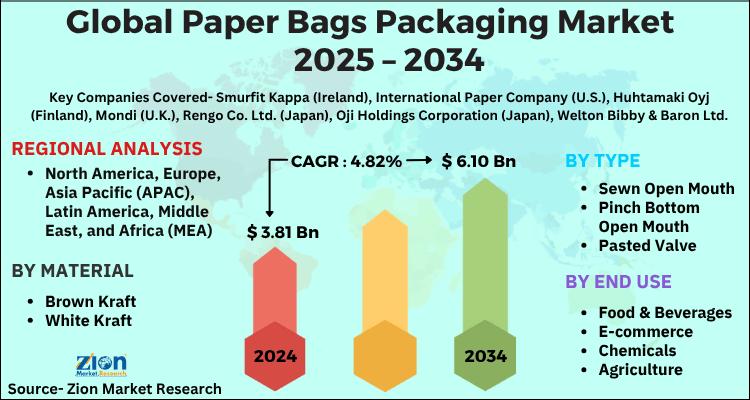

Paper Bags Packaging Market to Reach USD 6.10 Billion by 2034, Expanding at 4.82 …

The global paper bags packaging market, valued at USD 3.81 billion in 2024, is projected to reach USD 6.10 billion by 2034, growing at a 4.82% CAGR between 2025 and 2034. The market is gaining momentum on the back of sustainability mandates, stringent global regulations against single-use plastic, rising consumer environmental consciousness, and the rapid expansion of e-commerce and foodservice industries adopting recyclable packaging.

Key Market Highlights

Indicator Insight

2024 Market Value USD 3.81 Billion

2034…

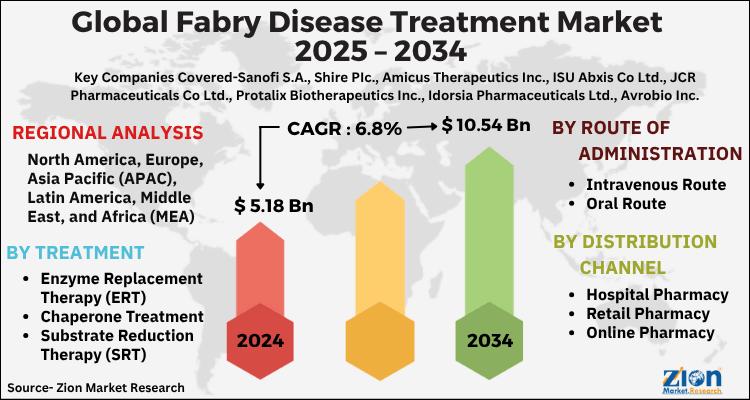

Fabry Disease Treatment Market to Reach USD 10.54 Billion by 2034, Expanding at …

The global Fabry disease treatment market, valued at USD 5.18 billion in 2024, is projected to reach USD 10.54 billion by 2034, growing at a 6.8% CAGR (2025-2034). Market momentum is driven by rising disease awareness and diagnosis, expanding enzyme replacement therapy (ERT) utilization, progress in chaperone and substrate reduction therapies (SRT), and an advancing pipeline in gene and next-generation ERTs. Persistent unmet need-stemming from organ involvement (renal, cardiac, cerebrovascular),…

Snow Sports Apparel Market to Reach USD 5.37 Billion by 2034, Expanding at 7.3% …

The global snow sports apparel market, valued at USD 2.65 billion in 2024, is projected to reach USD 5.37 billion by 2034, growing at a 7.3% CAGR (2025-2034). Growth is driven by the rising popularity of winter sports and outdoor recreation, fabric and garment-tech innovations (breathability, waterproofing, thermal regulation), and the accelerating role of e-commerce, social media, and athlete-led branding in discovery and conversion.

Strategic Market Insights & Key Performance Indicators

2024…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…