Press release

Shadow Banking Market Is Thriving Worldwide with Citibank, Barclays, HSBC, Credit Suisse

Global Shadow Banking Market Size, Status and Forecast 2025 is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Shadow Banking Market. Some of the key players profiled in the study are Bank of America Merrill Lynch, Barclays, HSBC, Credit Suisse, Citibank, Deutsche Bank, Goldman Sachs & Morgan Stanley.You can get free access to samples from the report here: https://www.htfmarketreport.com/sample-report/1148886-global-shadow-banking-market-3

Shadow Banking Market Overview:

If you are involved in the Shadow Banking industry or intend to be, then this study will provide you comprehensive outlook. It's vital you keep your market knowledge up to date segmented by Banks, Finance & Other,, Type I, Type II and major players. If you want to classify different company according to your targeted objective or geography we can provide customization according to your requirement.

Shadow Banking Market: Demand Analysis & Opportunity Outlook 2025

Shadow Banking research study is to define market sizes of various segments & countries by past years and to forecast the values by next 5 years. The report is assembled to comprise each qualitative and quantitative elements of the industry facts including: market share, market size (value and volume 2014-19, and forecast to 2025) which admire each countries concerned in the competitive examination. Further, the study additionally caters the in-depth statistics about the crucial elements which includes drivers & restraining factors that defines future growth outlook of the market.

Important years considered in the study are:

Historical year - 2014-2019 ; Base year - 2019; Forecast period** - 2020 to 2025 [** unless otherwise stated]

The segments and sub-section of Shadow Banking market are shown below:

The Study is segmented by following Product Type: Type I, Type II

Major applications/end-users industry are as follows: Banks, Finance & Other

Some of the key players/Manufacturers involved in the Market are - Bank of America Merrill Lynch, Barclays, HSBC, Credit Suisse, Citibank, Deutsche Bank, Goldman Sachs & Morgan Stanley

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1148886-global-shadow-banking-market-3

If opting for the Global version of Shadow Banking Market analysis is provided for major regions as follows:

o North America (USA, Canada and Mexico)

o Europe (Germany, France, the United Kingdom, Netherlands, Russia , Italy and Rest of Europe)

o Asia-Pacific (China, Japan, Australia, New Zealand, South Korea, India and Southeast Asia)

o South America (Brazil, Argentina, Colombia, rest of countries etc.)

o Middle East and Africa (Saudi Arabia, United Arab Emirates, Israel, Egypt, Nigeria and South Africa)

Buy this research report @ https://www.htfmarketreport.com/buy-now?format=1&report=1148886

Key Answers Captured in Study are

Which geography would have better demand for product/services?

What strategies of big players help them acquire share in regional market?

Countries that may see the steep rise in CAGR & year-on-year (Y-O-Y) growth?

How feasible is market for long term investment?

What opportunity the country would offer for existing and new players in the Shadow Banking market?

Risk side analysis involved with suppliers in specific geography?

What influencing factors driving the demand of Shadow Banking near future?

What is the impact analysis of various factors in the Global Shadow Banking market growth?

What are the recent trends in the regional market and how successful they are?

Read Detailed Index of full Research Study at @ https://www.htfmarketreport.com/reports/1148886-global-shadow-banking-market-3

There are 15 Chapters to display the Global Shadow Banking market.

Chapter 1, About Executive Summary to describe Definition, Specifications and Classification of Global Shadow Banking market, Applications [Banks, Finance & Other], Market Segment by Types Type I, Type II;

Chapter 2, objective of the study.

Chapter 3, to display Research methodology and techniques.

Chapter 4 and 5, to show the Shadow Banking Market Analysis, segmentation analysis, characteristics;

Chapter 6 and 7, to show Five forces (bargaining Power of buyers/suppliers), Threats to new entrants and market condition;

Chapter 8 and 9, to show analysis by regional segmentation[United States, Europe, China, Japan, Southeast Asia & India ], comparison, leading countries and opportunities; Regional Marketing Type Analysis, Supply Chain Analysis

Chapter 10, to identify major decision framework accumulated through Industry experts and strategic decision makers;

Chapter 11 and 12, Global Shadow Banking Market Trend Analysis, Drivers, Challenges by consumer behavior, Marketing Channels

Chapter 13 and 14, about vendor landscape (classification and Market Ranking)

Chapter 15, deals with Global Shadow Banking Market sales channel, distributors, Research Findings and Conclusion, appendix and data source.

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Europe or Asia or Oceania [Australia and New Zealand].

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA - 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the "Accurate Forecast" in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their "Goals & Objectives".

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Shadow Banking Market Is Thriving Worldwide with Citibank, Barclays, HSBC, Credit Suisse here

News-ID: 1937129 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

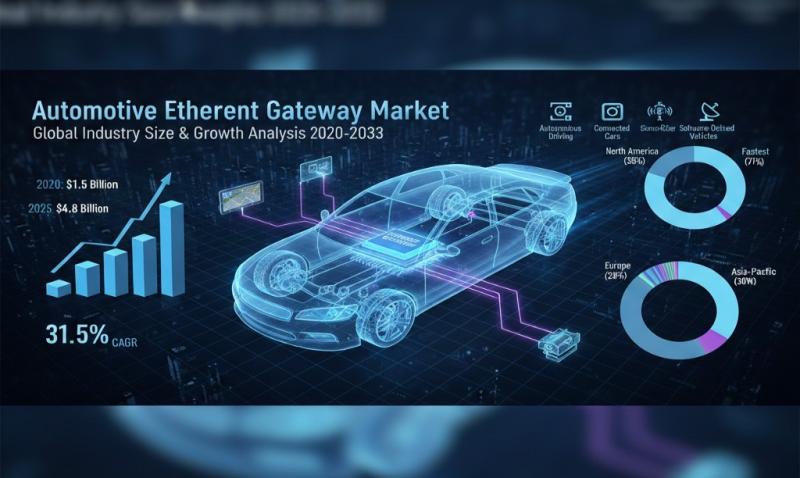

Automotive Ethernet Gateway Market - Global Industry Size & Growth Analysis 2020 …

The latest study released on the Global Automotive Ethernet Gateway Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Automotive Ethernet Gateway study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

Aluminum Coils Market - Global Industry Size & Growth Analysis 2020-2033

The latest study released on the Global Aluminum Coils Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Aluminum Coils study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

Hot Honey Drizzle Market Hits New High | Major Giants Nature Nate's, The Honey P …

The latest study released on the Global Hot Honey Drizzle Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Hot Honey Drizzle study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

AI Document Generator Market May See a Big Move | Major Giants Google (USA), SAP …

The latest study released on the Global AI Document Generator Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The AI Document Generator study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…