Press release

Cyber Insurance Market In-Depth Global Industry Analysis 2020 By Leading Growth Drivers, Emerging Audience, Segments, Industry Sales, Profits and Regional Analysis Till 2030

TheBusinessResearchCompany.com offers "Cyber Insurance Market By Insurance (Standalone, Packaged And Personal), By End Use (IT Services, Media), Distribution (Tied Agents And Branches, Direct And Other Channels, Bancassurance), By End Use And Market Competitors - Global Forecast To 2030" from its research store.The cyber insurance market consists of sales of cyber insurance products and related services by entities (organizations, sole traders and partnerships) that are involved in underwriting (assuming the risk and assigning premiums) annuities and cyber insurance policies.

Cyber insurance providers invest premiums to build up a portfolio of financial assets to be used against future claims. Direct insurance providers are entities that are engaged in primary underwriting and assuming the risk of annuities and insurance policies.

Going forward, stringent regulatory environments such as full compliance with GDPR, increased evaluation of cyber threats during mergers and acquisitions, increasing awareness of cyber threats, and growing adoption of internet-based business models will drive the growth. Factors that could hinder the growth of the cyber insurance market in the future include a lack of actuarial data and proven cyber exposure models, pricing uncertainty around cyber insurance policies, and emerging new types of cyber exposures and risks.

Browse Complete Report @ https://www.thebusinessresearchcompany.com/report/cyber-insurance-market

Cyber Insurance Market Segmentation: -

By Type Of Distribution - The cyber insurance market can be segmented by type of distribution

1. Brokers

2. Tied Agents And Branches

3. Direct and other

4. Bancassurance

The brokers market was the largest segment of the cyber insurance market, accounting for 47.8% of the total in 2018. It was followed by tied agents and branches, direct and other, and bancassurance. Going forward, direct and other segment is expected to be the fastest growing segment in the cyber insurance market.

By Type Of Insurance- The cyber insurance market can be segmented by type of insurance

1. Standalone

2. Package

3. Personal

The standalone market was the largest segment of the cyber insurance market, accounting for 53.1% of the total in 2018. It was followed by package, and personal.

By Size Of Business - The cyber insurance market can be segmented by size of business

1. Mid

2. Large

3. Small

The mid-sized business market was the largest segment of the cyber insurance market, accounting for 65.0% of the total in 2018. It was followed by large, and small. Going forward, small sized business is expected to be the fastest growing segment in the cyber insurance market.

By Type Of Claim - The cyber insurance market can be segmented by type of claim are

Ransomware, Hacker, Business Email Compromise, Malware/Virus, Phishing, Others, Third Party, Rogue Employee, Legal Action, Paper Records, Programming Error, Staff Mistake, Lost/Stolen Laptop/Device

The ransomware market was the largest segment of the cyber insurance market, accounting for 32.7% of the total in 2018. It was followed by hacker, business email compromise, malware/virus, phishing, and others. Going forward, business email compromise segment is expected to be the fastest growing segment in the cyber insurance market.

Request For A Sample Copy Of This Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=2623&type=smp

By End-Use - The cyber insurance market can be segmented by end-use

1. Professional Services

2. Media

3. Healthcare

4. Others

5. Government Bodies (Public)

6. Financial Services

7. Retail And Wholesale

8. Education

9. Manufacturing

10. IT Services

The professional services market was the largest segment of the cyber insurance market, accounting for 17.2% of the total in 2018. It was followed by media, healthcare, others, government bodies (public), financial services, and others. Going forward, education segment is expected to be the fastest growing segment in the cyber insurance market.

By Geography - The cyber insurance market is segmented into

1. North America

2. Western Europe

3. Asia Pacific

4. Eastern Europe

5. South America

6. Middle East

7. Africa

North America was the largest region in the global cyber insurance market, accounting for 55.8% of the total in 2018. It was followed by Asia Pacific, Western Europe, and then the other regions. Going forward, the fastest-growing regions in the cyber insurance market will be South America and Eastern Europe.

Some of the major players involved in the cyber insurance market are Chubb Limited, AXA Group, American International Group, Inc., Beazley Insurance Co, Inc., The Travelers Companies, Inc., AXIS Capital Holdings Limited, BCS Financial Corporation, Liberty Mutual Group, Zurich Insurance Group Ltd., AIG Insurance Co China Ltd, Bajaj Allianz General Insurance, HDFC ERGO General Insurance Company Limited, Mitsui Sumitomo Insurance Group Holdings, Inc, AIU Insurance Company, Samsung Fire & Marine Insurance, Emergence Insurance Pty Ltd, Brooklyn Underwriting Pty Ltd, Allianz China General Insurance Company Ltd, Ping An Insurance, ICICI Lombard General Insurance Company Limited, SBI General Insurance, Tokio Marine & Nichido Fire Insurance Co., Ltd.

Place a DIRECT PURCHASE ORDER of Entire 290+ pages report (Individual License at USD 4000.00 ) @ https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=2623

Contact Information:

The Business Research Company

https://www.thebusinessresearchcompany.com

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

About The Business Research Company:

The Business Research Company is a Business Intelligence Company which excels in company, market and consumer research. It has offices in the UK, the US and India and a network of trained researchers in 15 countries globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cyber Insurance Market In-Depth Global Industry Analysis 2020 By Leading Growth Drivers, Emerging Audience, Segments, Industry Sales, Profits and Regional Analysis Till 2030 here

News-ID: 1931244 • Views: …

More Releases from The Business Research Company

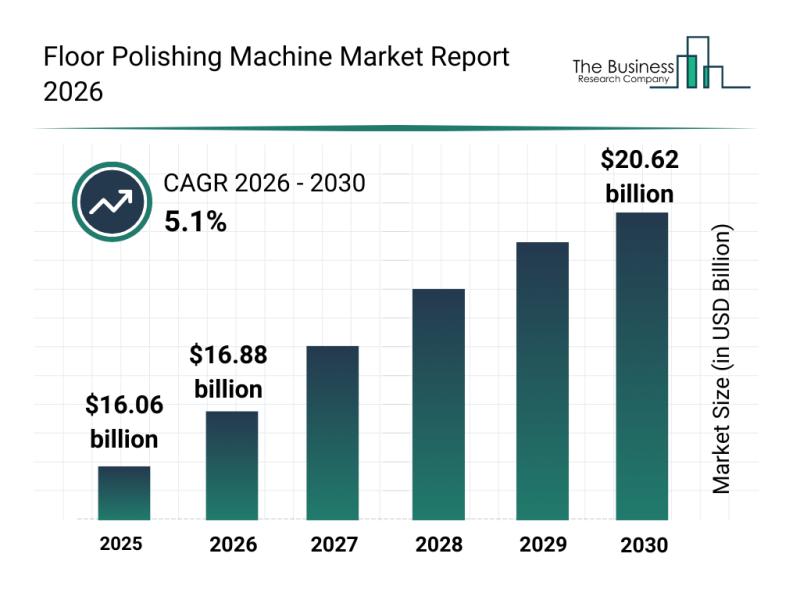

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Fl …

The floor polishing machine industry is on the verge of significant expansion as advancements in technology and growing demand from various sectors drive market momentum. This report will explore the current market valuation, key players, prominent trends, and notable segments shaping the future of floor polishing machinery.

Market Valuation Outlook for Floor Polishing Machines by 2030

The floor polishing machine market is poised for substantial growth in the coming years, expected…

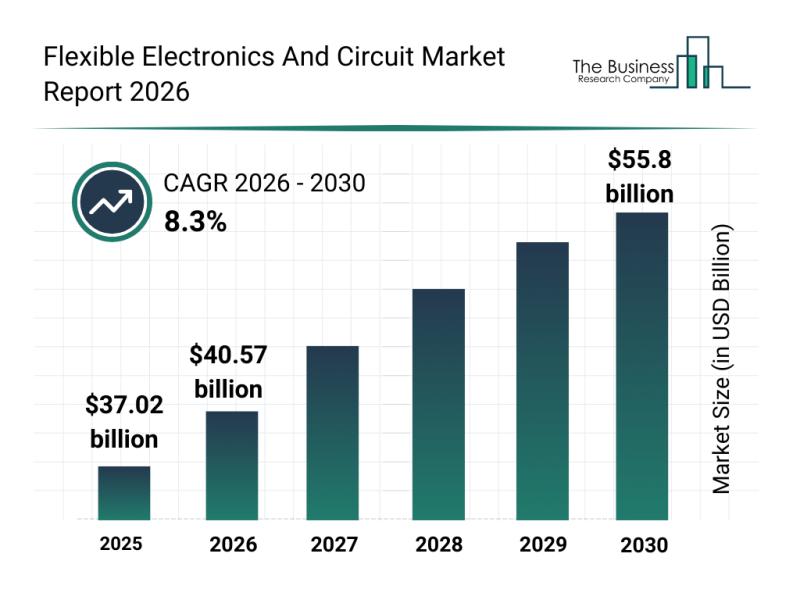

Competitive Landscape: Key Market Leaders and New Entrants in the Flexible Elect …

The flexible electronics and circuit sector is positioned for impressive expansion in the coming years, driven by rapid technological advancements and increasing applications across various industries. As innovation pushes the boundaries of what flexible technology can do, this market is set to experience significant growth and transformation.

Projected Market Valuation and Growth in Flexible Electronics and Circuit Market

The flexible electronics and circuit market is anticipated to reach a valuation of…

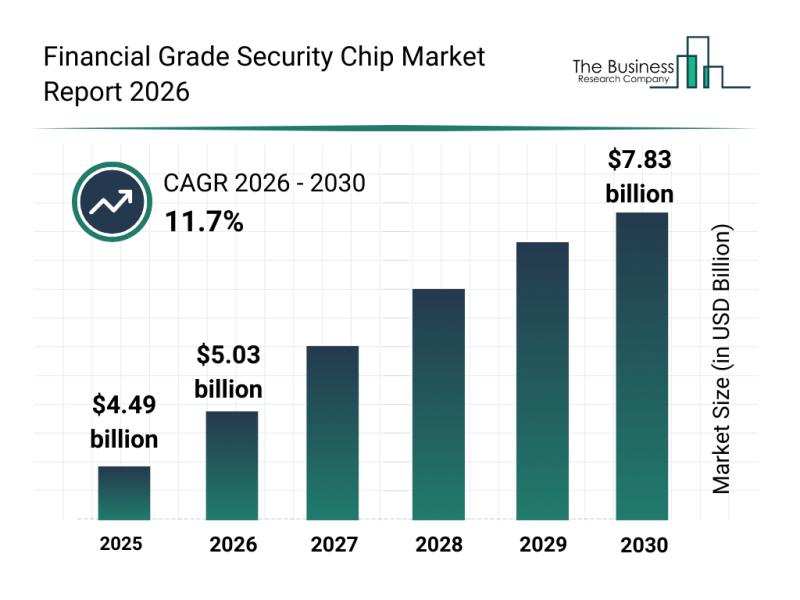

Financial Grade Security Chip Market Overview: Major Segments, Strategic Develop …

The financial grade security chip market is on a trajectory of significant expansion, driven by the increasing demand for robust digital security solutions in an evolving technological landscape. As digital transactions and connected devices become more prevalent, the market is set to experience substantial growth fueled by innovation and heightened security standards.

Financial Grade Security Chip Market Size and Long-Term Growth Outlook

The market for financial grade security chips is projected…

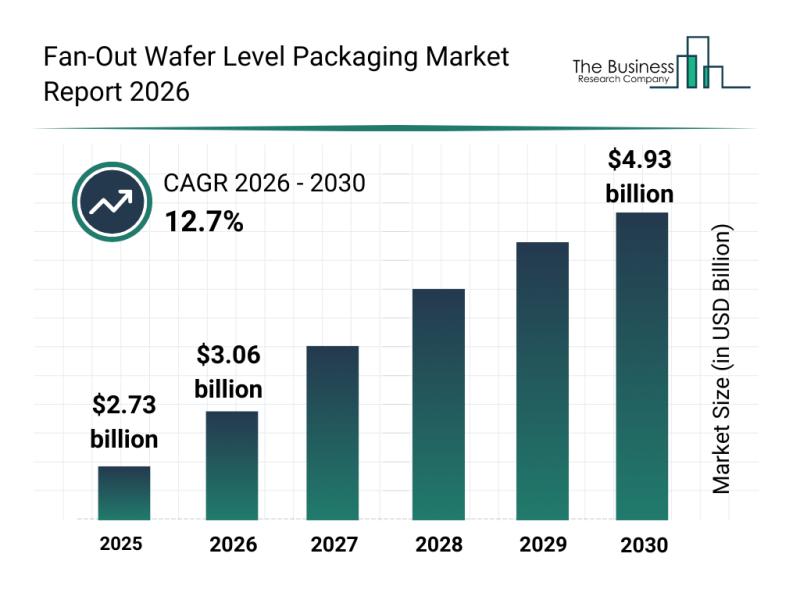

Analysis of Key Market Segments Influencing the Fan-Out Wafer Level Packaging Ma …

The fan-out wafer level packaging sector is set to experience significant expansion in the coming years, driven by growing demand across various high-tech industries. With advancements in semiconductor integration and increasing needs in automotive and communication technologies, this market is positioned for impressive growth and innovation. Here, we explore the market size projections, leading companies, key trends, and segment dynamics shaping the future of fan-out wafer level packaging.

Forecasted Market Size…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…