Press release

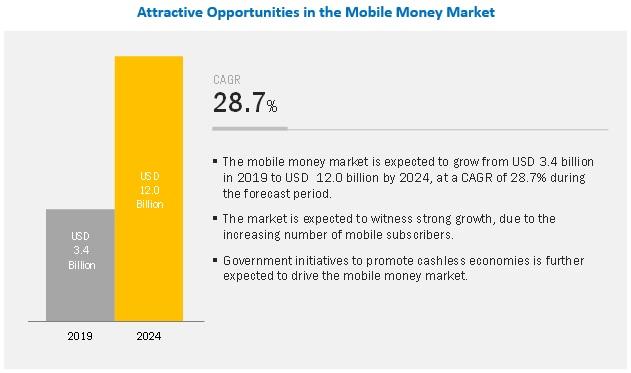

Mobile Money Market projected to gain $12.0 billion by 2024

According to a new market research report "Mobile Money Market by Transaction mode (Point of Sale, Mobile Apps, QR codes, Internet Payments, SMS, STK/USSD Payments, Direct Carrier Billing, Mobile Banking), Nature of Payment, Application, Type of Payments, Region - Global Forecast to 2024", published by MarketsandMarkets(TM), the Mobile Money Market to grow from USD 3.4 billion in 2019 to USD 12.0 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 28.7% during the forecast period.Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=577

Major factors expected to drive the growth of the Mobile Money Market include the rise in the number of mobile subscribers, government initiatives to promote cashless economies, and growth of businesses with digital payment-based business models.

Browse in-depth TOC on "Mobile Money Market"

103- Tables

30- Figures

153 Pages

By transaction mode, mobile apps segment to grow at the highest rate during the forecast period

By transaction mode, the mobile apps segment is expected to grow at the highest CAGR during the forecast period. Several applications offer payment services, such as Apple Pay, Google Pay, and PayPal. Some of these applications provide mobile wallet services too. Mobile applications considered under this segment include digital/mobile wallets and Unified Payment Interface (UPI) payment apps. With the proliferation of strong internet coverage in developed and some developing countries, the adoption of mobile money application has increased significantly. Mobile-based payment app interfaces are designed to facilitate easy payment using mobile phones. It is a software intended mainly for smartphones and tablet computers. All the functions of mobile money, such as sending, receiving, and withdrawing money along with other such options can easily be accessed through these apps.

By type of payment, the proximity payments segment to grow at highest CAGR during the forecast period

By type of payment, the proximity payments segment to grow a higher CAGR during the forecast period. These payments are carried out using mobile phones and Point of Sales (POS) device. Currently, several companies offer applications that enable proximity payments. It is referred to as in-store payments in case of retail store or in-location payments with regards to payment through a merchant's POS terminal. Proximity payments are specifically enabled for short distances and work when both the payer and payee are present in the same location. The proximity payment type is strikingly different from remote payment as it involves the presence of payment card details from one's own bank account and does not require any tie-up with a payment processor to facilitate transactions. Increasing adoption of mobile payment technologies by brick and mortar-based businesses further drives the demand for proximity payments.

Browse Full Report @ https://www.marketsandmarkets.com/Market-Reports/mobile-remittance-money-mcommerce-market-577.html

Middle East and Africa to account for the largest market size during the forecast period

The MEA market is termed as a transforming market; it is expected to have the largest market size in 2018 with Africa showing the highest adoption of mobile money services and mobile subscriptions in the region are growing rapidly. According to the World Bank data, there were 122 mobile subscriptions for every 100 individuals in Saudi Arabia, 211 in the United Arab Emirates (UAE), and 127 in Israel, in 2017. The growth of the Mobile Money Market in the MEA is further driven by increased investments in payment technologies made by governments of countries, such as Qatar, South Africa, and the UAE. This region has a presence of creditable Mobile Network Operators (MNOs), banks, and payment processing agents, which encourage the use of mobile money services. For instance, in February 2019, MTN and Ericsson signed a 5-year contract extension for the distribution of new products and the provision of mobile money services in 13 countries across the MEA region. Ericsson aims to deploy the Ericsson Wallet Platform in new markets to serve MTN's customers.

Speak to Research Expert @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=577

Key and emerging market players in Mobile Money Market include Vodafone (UK), Google (US), Orange (France), FIS (US), Paypal (US), Mastercard (US), Fiserve (US), Airtel (India), Gemalto (Netherlands), Alipay (China), MTN (South Africa), PAYTM (India) Samsung (South Korea), VISA (US), Tencent (China), Global Payments (US), Square (US), Amazon (US), Apple (US), Western Union Holdings (US), Comviva (India), and T- Mobile (US). These players have adopted various strategies to grow in the Mobile Money Market.

Contact:

Mr. Shelly Singh

MarketsandMarkets(TM) INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

MnM Blog: https://mnmblog.org

Content Source: https://www.marketsandmarkets.com/PressReleases/mobile-money.asp

About MarketsandMarkets(TM)

MarketsandMarkets(TM) provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets(TM) for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets(TM) are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets(TM) now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, and strategic players) annually in high growth emerging segments. MarketsandMarkets(TM) is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Money Market projected to gain $12.0 billion by 2024 here

News-ID: 1931189 • Views: …

More Releases from MarketsandMarkets(TM)

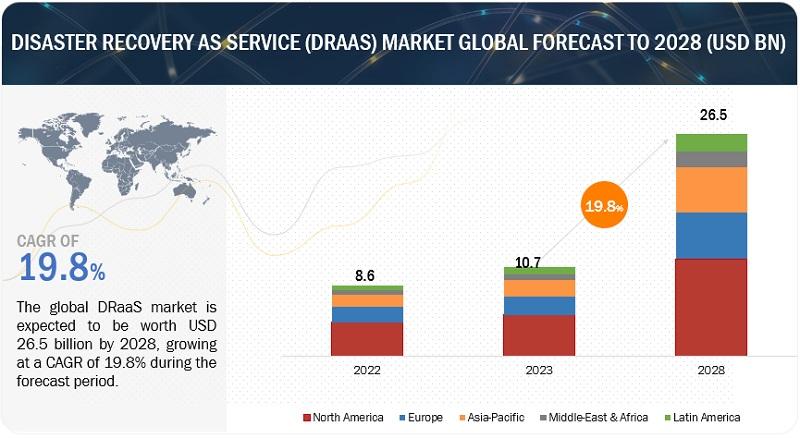

Disaster Recovery as a Service (DRaaS) Market Trends, Drivers, Strategies, Appli …

According to a research report "Disaster Recovery as a Service (DRaaS) Market by Service Type (Backup & Restore, Real-Time Replication, Data Protection), Deployment Mode (Public Cloud, Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the DRaaS market size is expected to grow from USD 10.7 billion in 2023 to USD 26.5 billion by 2028 at a compound annual growth rate (CAGR) of 19.8%…

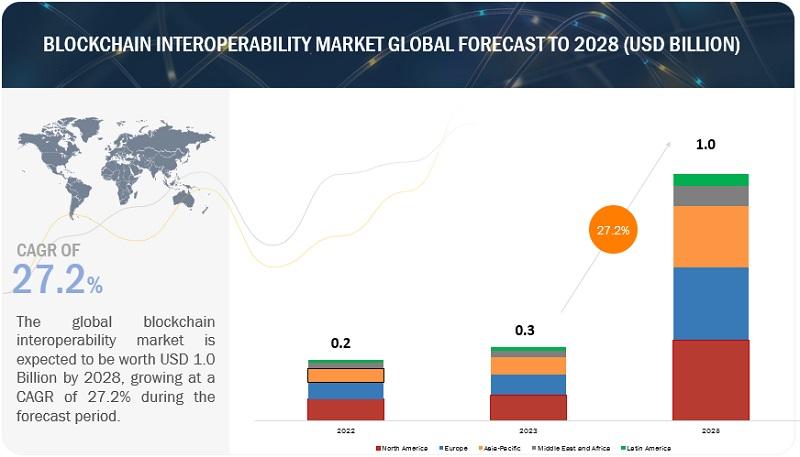

Blockchain Interoperability Market Size to Witness a Pronounce Growth by 2028

According to a research report "Blockchain Interoperability Market by Solution (Cross-chain Bridging, Cross-chain APIs, Federated or Consortium Interoperability), Application (dApps, Digital Assets/NFTs, Cross-chain Trading & Exchange), Vertical and Region - Global Forecast to 2028" published by MarketsandMarkets, the global blockchain interoperability market size is projected to grow from USD 0.3 billion in 2023 to USD 1.0 billion by 2028 at a CAGR of 27.2% during the forecast period.

Download PDF Brochure…

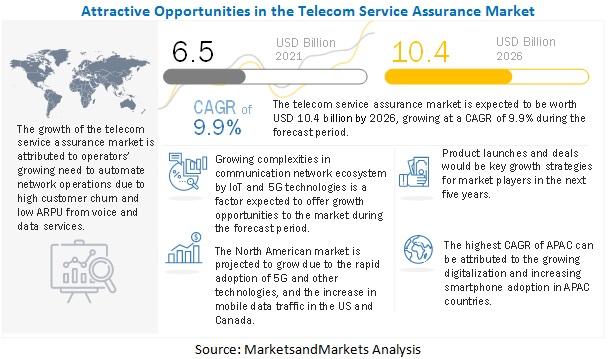

Telecom Service Assurance Market Growth, Opportunities Business Scenario, Share, …

According to a research report "Telecom Service Assurance Market Trends by Component (Solutions (Fault and Event Management, Performance Management, and Quality and Service Management) and Services), Operator Type, Deployment Type, Organization Size, and Region - Global Forecast to 2026" published by MarketsandMarkets, the global Telecom service assurance Market size to grow from USD 6.5 billion in 2021 to USD 10.4 billion by 2026, at a Compound Annual Growth Rate (CAGR)…

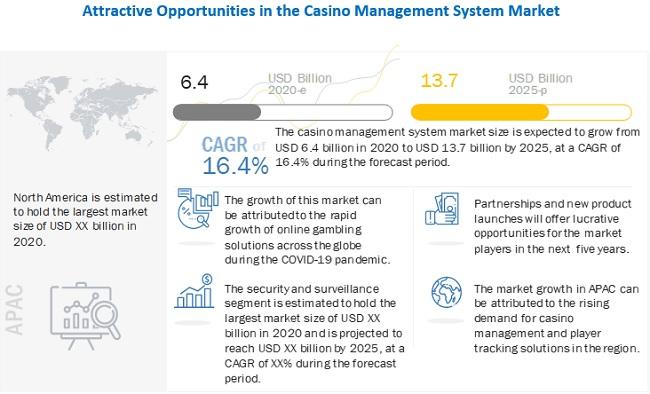

Casino Management Systems Market predicted to obtain $13.7 billion by 2025

According to a new market research report "Casino Management Systems Market by Component (Solutions and Services), Application (Accounting, Security and Surveillance, Player Tracking, Hotel and Hospitality, Analytics, and Digital Content Management), End User, and Region - Global Forecast to 2025" published by MarketsandMarkets™, the market size projected to grow from USD 6.4 billion in 2020 to USD 13.7 billion by 2025, at a Compound Annual Growth Rate (CAGR) of 16.4%…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…