Press release

Neo and Challenger Bank Market - 2026: Recent Developments, Key Strategies, Growth Analysis and Forecast

The global market is, growing at a CAGR of 50.6% during the period 2017 - 2020. Neo and challenger bank market trends are expected to be progressive in coming years. China is expected to witness the highest growth rate during the forecast period, owing to the large pool of underbanked consumers and surge in online and mobile banking users.The growth of the neo and challenger bank market is driven by factors such as favorable government regulations, convenience offered to consumers, and higher interest rates than traditional banks. However, acquisition of customers and profitability pose challenges to the market growth. Furthermore, increase in penetration of smartphones and internet in the emerging economies is expected to offer immense opportunities for the market growth in the near future.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/1798

Digital challenger banks are simplifying the financial world, creating a customer centric approach to services, and transforming the way banking is viewed by the public and the market. In return, they endeavor to deliver larger returns on equity as compared to those offered by prominent traditional banks. They strive to offer greater flexibility when it comes to lending through streamlined operations and costs." states Sheetanshu Upadhyay, BFSI Research at Allied Market Research.

The neo and challenger bank market is segmented based on the type of bank into neo and challenger banks. Among these, the neo banks segment accounts for the largest customer base in 2016, owing to the prominence of these banks in U.S. and the ease in acquisition of customers. This segment is expected to grow at a notable CAGR of 49.7% during the forecast period. The challenger banks segment is expected to grow at a CAGR of 52.6% in terms of customer base because of the proliferation of these banks in regions such as UK, Germany, and China. This is attributed to favorable regulations and substantial investments for these startups. Furthermore, increase in launch of digital subsidiaries by traditional banks and a large customer base available with them are expected to promote the growth of the market.

The U.S. accounts for approximately four-fifths share of the global neo bank market in terms of customer base in 2016, and is anticipated to maintain its dominant position throughout the forecast period. Substantial fintech investments amounting to $2.1 billion and $5.5 billion, respectively, have been made in New York and California in 2015, which reflect the market potential. The large SME market in the U.S. is relatively open to innovative solutions, which provide opportunities for challengers to innovate products and services.

The U.S. market is followed by the UK, which also has an impressive customer base, owing to favorable regulations and substantial investments funding such fintech startups. Challenger banks in the UK offer an alternative to banking arrangements for customers to differentiate themselves in terms of value services and improved service quality. Amendments in regulations and deregulation in the banking sector have facilitated the entry of challenger banks in the country. The growth of these banks in the country is on account of the reduced initial capital requirement.

The Chinese market has witnessed the entry of MYBank and WeBank post approval from China Banking Regulatory Commission (CBRC). Baidu, a challenger bank, has partnered with CITIC Bank International to launch its own online bank. The total number of SMEs in China is pegged at 42 million in 2013. The digital challenger banks intend to offer promising technologies and scale up their processes to cater to the underprivileged SME market. As per industry sources, Chinas mobile banking users increased by 50% in 2014, which reflects the untapped potential in the country.

Enquire For Discount: https://www.alliedmarketresearch.com/purchase-enquiry/1798

The neo and challenger bank market analysis is provided in the report with respect to the current trends and future estimations in the following countries, namely U.S., UK, Germany, China, and Australia.

The leading players profiled in the report include Atom Bank Plc, Movencorp Inc., Simple Finance Technology Corporation (acquired by BBVA), Fidor Bank AG (acquired by BPCE Group), N26, Pockit Limited, UBank Limited, Monzo Bank Limited, MyBank (Alibaba Group), and WeBank (Tencent Holdings Limited).

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022, +1-503-446-1141

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market - 2026: Recent Developments, Key Strategies, Growth Analysis and Forecast here

News-ID: 1928670 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

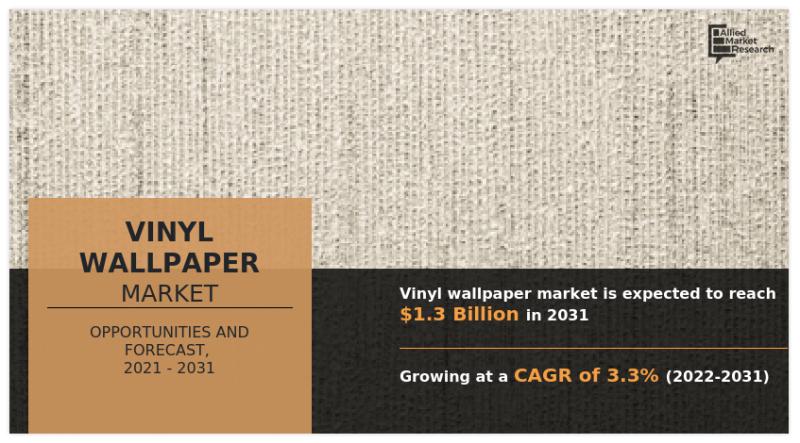

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

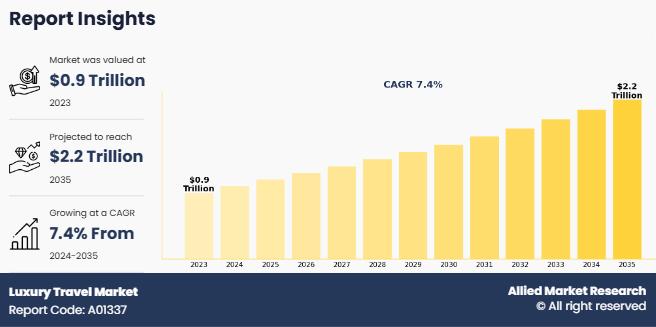

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…