Press release

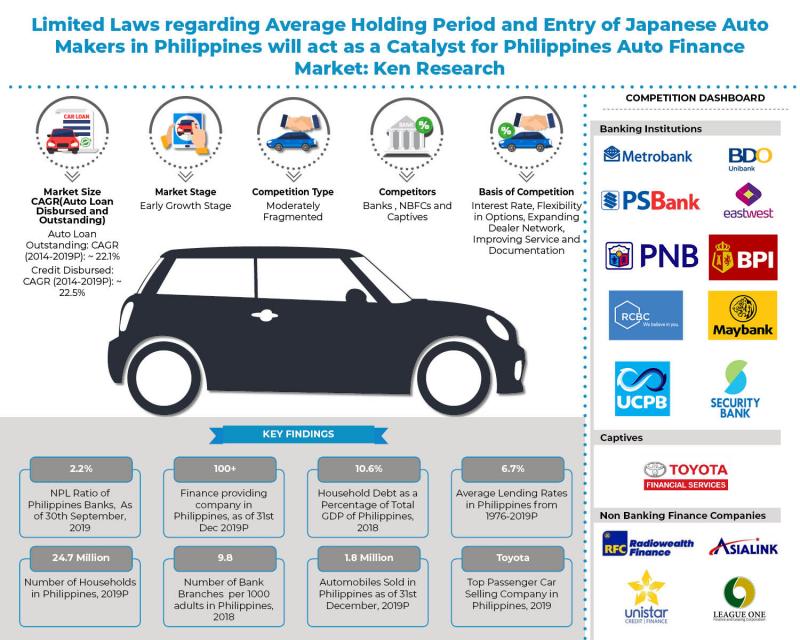

Philippines Auto Loan Outstanding is Expected to Reach around PHP 1,026.6 Billion by 2024: Ken Research

o Nissan has expanded its Nissan Finance program to enable more customers in the Philippines to own a Nissan vehicle. In partnership with East West Banking Corporation (EastWest), the sales finance program provides wholesale and retail financing options and loan facility products exclusively for Nissan customers in the Philippines.o Entry of Japanese Automakers in the Philippines Automotive Industry is set to act as a catalyst for the growth of sales in the Industry.

o Public sector external debt increased in the third Quarter of 2019 to USD 42.3 billion from USD 40.2 billion in the Second quarter. About USD 35.2 billion (83.3 percent) of public sector obligations were House Hold borrowings while the remaining USD 7.0 billion pertained to other government agencies' loans, according to central bank data

o Strong Relations and Various Mergers and Acquisition further strengthen the Banks and NBFC's in the Philippines Auto Finance Industry, while simultaneously creating entry opportunities for Captive finance players.

Growth Opportunity in Philippines EV market: The Electric Vehicle Association of the Philippines (EVAP) aspires for the establishment of a national development program for electric vehicles that is anchored on the existing Motor Vehicle Development Program for the automotive industry. This is to be implemented in four (4) phases of within a ten-year-period. The first phase (2013) is the launch of the program, including technology upgrading needed by the industry; the second phase (2014 to 2015) involves the buildup of the local market and enhancement of its production capacity; the third phase (2016 to 2018) will be for local and export market expansion, together with horizontal and vertical integration with the local automotive industry; and the fourth phase (2019 to 2023) will be the full integration, regional and global, developmental evolution in technological advancement and market size up.

Changing Nature of Ownership: Consumers in Philippines are increasingly moving forward to accommodate newer models of mobility and prefer partial ownership of vehicles instead of full ownership. Hence this will help in promotion of leasing activities.

Rationale for Changes in Auto Loan Outstanding for Non-Bank Institutions: The share of multi finance companies has been projected to incline over the coming years. Compared to banks, multi-finance companies generate better returns. Generally, major multi-finance player's record higher returns on equity and returns on assets as the benefits of higher asset yields outweigh the negatives of higher cost of funds, operating costs, and credit costs. The higher asset yield is due to the ability to tap the under-banked and unbanked market, an advantage that banks lack. Another reason why non-bank institutions are predicted to incline is because of the customized and innovative credit products they provide. These products are more appealing to masses and banks cannot provide such products because of the size of operations and standardization involved with the size. The number of non-bank units has been predicted to incline due to which their share will increase over the coming five years.

Analysts at Ken Research in their latest publication "Philippines Auto Finance Market Outlook to 2024- Growing Prominence of Captive Finance and Surge in Used Car Sales Supporting Disbursement for Auto Loans" https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/308534-93.html believe that the market demand is likely to follow a growth trend in the near future due to a forthcoming increase in used cars sales and a shift towards newer models of mobility such as car sharing and leasing, which will in turn help the economy grow as well. The market is anticipated to register a positive CAGR of 9.0% in terms of credit disbursed and 8.1% in terms of total loan outstanding during the forecasted period 2019P-2024F.

Key Segments Covered:-

By Type of Vehicle Financed

New Vehicles

Used Vehicles

Motorcycles

By Banks and Non Banks

Banks (Auto Loans and Motorcycle Loans)

Non Banks (Auto Loans and Motorcycle Loans)

By Type of Banking Institutions

Commercial and Universal Banks

Thrift Banks

By Nature of Vehicles

New Vehicles (Banks and Non Banks)

Used Vehicles (Banks and Non Banks)

By Type of Vehicle Sold

Passenger

Commercial

Motorcycles

By Tenure of Loans

New Vehicle (1 year, 2 Years, 3 Years, 4 years, 5 Years or More)

Used Vehicle (1 year, 2 Years, 3 Years or More)

By Registration of Vehicles

Key Target Audience

Existing Auto Finance Companies

Banks

OEM Dealerships

Captive Finance Companies

Credit Unions

Private Finance Companies

New Market Entrants

Government Organizations

Investors

Auto mobile Associations

Auto mobile OEMs

Time Period Captured in the Report:

Historical Period: 2014-2019P

Forecast Period: 2019P-2024F

Key Companies Covered:

Banks

MetroBank

BDO Bank

PS Bank

Eastwest Bank

The Philippine National Bank

Bank of the Philippine Islands

The Rizal Commercial Banking Corporation

Maybank Philippines

China Bank

United Coconut Planters Bank

Security Bank Corporation

Union Bank

Robinsons Bank

The Philippine Bank of Communications (PBCOM)

Land Bank of Philippines

Asia United Banking Corporation

Bank of Commerce

Development Bank of Philippines

Union Bank

UCPB Bank

Sterling Bank of Philippines

NBFCs

Radiowealth finance company (RFC)

Unistar Credit and Finance Corporation

Asia Link Finance Corporation Leauge

One Finance and leasing Corporation

DBP Leasing Corporation

First United Finance and Leasing Corporation

BPI Capital Corporation

Cebu International Finance Corporation

Orix Metro Leasing and Finance Corporation

Philippine Depository and Trust Corporation

LBP leasing and Financing Corporation

RCBC Leasing and Finance Corporation

Captives

Toyota Financial Services Philippines Limited

Key Topics Covered in the Report

Philippines Auto Finance Market Overview and Genesis

Philippines Auto Finance Market Ecosystem, 2019P

Value Chain Analysis of Philippines Auto Finance Market, 2019P

Philippines Finance Market Value Chain Analysis

Philippines Auto Finance Market Size, 2013-2019P

Philippines Auto Finance Market Segmentation, 20113-2019P

Major Trends and Development in Philippines Auto Finance Market

Regulatory Framework in the Philippines Auto Finance Market

Snapshot On Philippines Automotive Sales And Manufacturing Market, 2014-2019P

Ways to Finance Automotives in Philippines(Bank Finance or Multi Financing Companies, Personal Finance, Lease Financing)

Vendor Selection Process for Auto Finance Company in Philippines

Competitive Landscape containing Company & Product Profiles in the Philippines Auto Finance Market

Financial Penetration of various OEM Brands

Philippines Finance Market Future Outlook and Projections, 2019P-2024

Analyst Recommendations for the Philippines Auto Finance Market

For More Information On The Research Report, Refer To Below Link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/308534-93.html

Related Reports:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market-outlook/299310-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/qatar-auto-finance-market-outlook-to-2023/274062-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/us-vehicle-finance-market-outlook/252780-93.html

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Auto Loan Outstanding is Expected to Reach around PHP 1,026.6 Billion by 2024: Ken Research here

News-ID: 1922472 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…