Press release

Is North America Usage Based Insurance Market Really a Strong Market to Invest in 2020? | Latest Study By Data Bridge Market Research

Data Bridge Market research has recently released expansive research report with titled "North America Usage-Based Insurance Market". †The report helps out the clients to tackle every strategic aspect including product development, product specification, exploring niche growth opportunities, application modelling, and new geographical markets. North America Usage-Based Insurance Market report has used numerical and statistical data brought together to produce this report is mostly denoted with the 100+ market data Tables, Pie Charts, graphs, tables and infographics which make this report more user-friendly. All the data and statistics encompassed in this North America Usage-Based Insurance business document are backed up by latest and proven tools and techniques such as SWOT analysis and Porter's Five Forces Analysis.North America Usage-Based Insurance Market 2020 Analysis and Precise Outlook: Revenue Analysis, Technological Adoption and Developments, Major Trends, and Market Overview

Leading Players operating in the North America Usage-Based Insurance Market are:

Key players are involved in mergers and acquisition to strengthen their market position. Owing to increasing competition frequent innovations are taking place in the market. Some of the companies operating the industry are:

Vodafone,

Allstate Insurance Company,

Octo Group,

TomTom International,

Allianz,

TrueMotion,

Cambridge Mobile Telematics

North America usage based insurance market is growing with healthy CAGR of 19.3% in the forecast period of 2019 to 2026.

Get FREE Sample Report + All Related Graphs & Charts Here@ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=north-america-usage-based-insurance-market&AM

The 2020 Annual North America Usage-Based Insurance Market offers:

=> 100+ charts exploring and analyzing the North America Usage-Based Insurance market from critical angles including retail forecasts, consumer demand, production and more

=> 10+ profiles of top North America Usage-Based Insurance producing states, with highlights of market conditions and retail trends

=> Regulatory outlook, best practices, and future considerations for manufacturers and industry players seeking to meet consumer demand

=> Benchmark wholesale prices, market position, plus prices for raw materials involved in North America Usage-Based Insurance type

Key Segmentation: North America Usage-Based Insurance Market

By Package type (pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), manage-how-you-drive (MHYD)), vehicle type (light-duty vehicle (LDV), heavy-duty vehicles (HDV)), Device offering (company provided, bring your own device (BYOD)), Technology (OBD-II, smartphone, embedded system, black box and others), Vehicle age (new vehicles, on-road vehicles), Electric and hybrid vehicle (hybrid electric vehicle (HEV), plug-in hybrid vehicle (PHEV), battery electric vehicle (BEV)), Country (U.S., Canada, Mexico)

Rapid Business Growth Factors

In addition, the market is growing at a fast pace and the report shows us that there are a couple of key factors behind that. The most important factor that's helping the market grow faster than usual is the tough competition.

Points Which Are Focused In the Report

The report offers market share appraisals for regional and global levels

Potential and niche segments/regions exhibiting promising growth

What are the challenges being faced by the new entrants

Future trends to elucidate imminent investment pockets.

This report provides pin-point analysis for changing competitive dynamics

Comprehensive analysis of the factors that drive and restrict the market growth is provided in the report

Major Industry Competitors:†North America Usage-Based Insurance Market

Some of the prominent participants operating in this market are Intelligent Mechatronic Systems Inc., TrueMotion, Cambridge Mobile Telematics, Insure The Box Limited, Progressive Casualty Insurance Company, Modus Group, LLC, Inseego Corp, Metromile Inc., The Floow Limited, Vodafone, Allstate Insurance Company, Octo Group, , TomTom International, Allianz, AXA Equitable Life Insurance Company, , Liberty Mutual Insurance, Verizon, Sierra Wireless, , Mapfre, Movitrack Viasat, Inc., ASSICURAZIONI GENERALI S.P.A., and UNIPOLSAI ASSICURAZIONI S.P.A.

Key Developments in the Market:

In September 2018, Allstate launched a product for life insurance which will pay on monthly basis rather than lump sum amount. This is consumer driven product which will help the company to cover more market share and to aware the people about life insurance.

In October 2018, The Floow launches FlowFleet for the insurer who deals in commercial line. This helped the insurance company to better manage the risk and to provide the optimal premium price to their customer in the high premium rising market.

In June 2018, Allstate launched pay per mile i.e. usage based insurance in New Jersey. This insurance gives more control to customer about their insurance premium and plans for using telematics services for better management in their insurance segment.

In March 2018, Octo Telematics entered into partnership with Renault finance company to provide data analytics and services to its customer globally. This will increase the global market share of the company.

Some extract from Table of Contents

Overview of North America Usage-Based Insurance Market

Usage-Based Insurance Size (Sales Volume) Comparison by Type

Usage-Based Insurance Size (Consumption) and Market Share Comparison by Application

Usage-Based Insurance Size (Value) Comparison by Region

Usage-Based Insurance Sales, Revenue and Growth Rate

Usage-Based Insurance Competitive Situation and Trends

Strategic proposal for estimating availability of core business segments

Players/Suppliers, Sales Area

Analyze competitors, including all important parameters of North America Usage-Based Insurance

Global North America Usage-Based Insurance Manufacturing Cost Analysis

The most recent innovative headway and supply chain pattern mapping

FREE Table Of Contents Is Available Here@ https://www.databridgemarketresearch.com/toc/?dbmr=north-america-usage-based-insurance-market&AM

Key Research Methodology Used By Data Bridge market Research

Why Is Data Triangulation Important In Qualitative Research?

This involves data mining, analysis of the impact of data variables on the market, and primary (industry expert) validation. Apart from this, other data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Top to Bottom Analysis and Vendor Share Analysis. Triangulation is one method used while reviewing, synthesizing and interpreting field data. Data triangulation has been advocated as a methodological technique not only to enhance the validity of the research findings but also to achieve 'completeness' and 'confirmation' of data using multiple methods

Contact:

Data Bridge Market Research

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email:†Corporatesales@databridgemarketresearch.com

About Data Bridge Market Research:

An absolute way to forecast what future holds is to comprehend the trend today!

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Data Bridge adepts in creating satisfied clients who reckon upon our services and rely on our hard work with certitude. We are content with our glorious 99.9 % client satisfying rate.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Is North America Usage Based Insurance Market Really a Strong Market to Invest in 2020? | Latest Study By Data Bridge Market Research here

News-ID: 1921517 • Views: ‚Ķ

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home DeŐĀcor Tr ‚Ķ

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

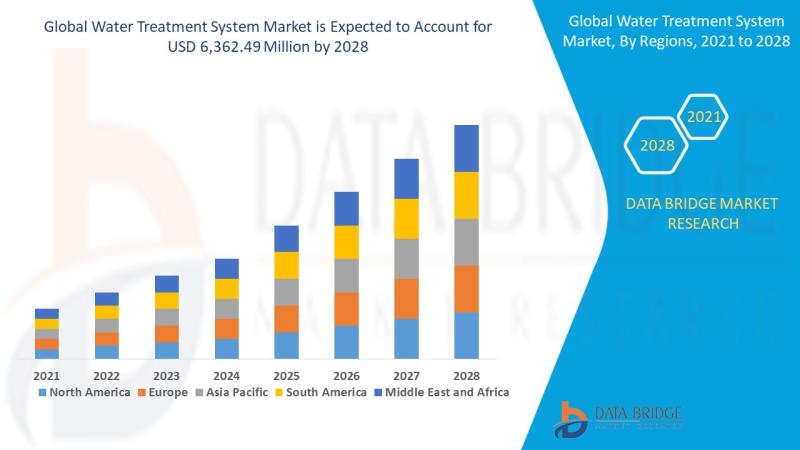

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…