Press release

Banking Compliance Solutions Market To 2019 - 2027 Key Business Opportunities Along With Potential Challenges

Compliance refers to adhering to standard rules and regulation of an organization and hence, various compliance solutions are used across different industries. Presently, banking organizations require a robust and effective compliance management solutions keep pace with changing laws, regulations, standards, and internal policies. Banking compliance software solutions deliver key features to monitor appropriate rules & regulations and other requirements. Additionally, banking compliance solutions run risk assessments, organize compliance documentations, audit and demonstrate proof of compliance through robust reporting.Browse Report Details: https://www.transparencymarketresearch.com/banking-compliance-solutions-market.html

Banking is a sensitive industry where compliance solutions are a must; therefore, organizations are using various compliance software solutions to protect clients and customers data from hackers. Cloud-based information governance infrastructure has provided various benefits for the banking industry such as low cost, requirement for minimal technological infrastructure, fast processing of data, automatic and continuous upgrade, and remote access of cloud-based data across the organization. Cloud-based governance infrastructure helps the banking industry to deploy policies quickly across applications and systems.

Furthermore, information which is collected automatically through the systems is used for making better business decisions. Banking compliance solutions provide various features such as compliance and risk reporting for all levels, automated audit tracking of all compliance changes, and regulatory library with links to the online sources. This solution provides a seamless integration with governance risk compliance (GRC) modules and continuous status tracking through user and management dashboards. However, integration of rules and policies with the software product modules are some challenges faced by the banking compliance solution providers.

Planning To Lay Down Future Strategy? Request Sample https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=64727

Governments are enforcing various rules and regulations on the banking industry due to increasing number of unfair practices. This, in turn, is fueling the demand for banking compliance solutions. Rise in volume and variety of data is creating the need for banking compliance solutions. Players in the market can provide secure solutions, improve productivity and efficiency to customers, and increase portfolio risk solutions to garner larger share.

Increasing adoption of advanced technologies in the banking industry such as machine learning, artificial intelligence (AI), big data, and blockchain are expected to create opportunities in the banking compliance solutions market. However, data breaches and cyber-attacks are increasing with the use of cloud-based technology. This, is a major factor that is likely to restrain the banking compliance solutions market during the forecast period. Additionally, increasing data integration concern is reducing the adoption of banking compliance solutions.

For Exclusive Market Insights From Experts? Request A Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=B&rep_id=64727

Based on enterprise size, the banking compliance solutions market can be categorized into small, medium, and large. In terms of end-user, the banking compliance solutions market can be classified into banking and non-banking. The banking can be sub-segmented into retail, wholesale/corporate banking, investment, and private. The non-banking segment can be classified into insurance, stock exchanges, financial agencies, and asset management firms. Based on region, the global banking compliance solutions market can be split into North America, South America, Europe, Asia Pacific, and Middle East & Africa.

Key players operating in the banking compliance solutions market include LogicManager, Inc., MEGA International, NAVEX Global, Inc., Protiviti Inc, Rsam, SAI Global Pty Limited, SAP SE, SAS Institute Inc, Oracle, Software AG, and IBM Corporation.

Contact:

90 State Street, Suite 700

Albany, NY 12207

Tel: +1-518-618-1030

USA - Canada

About Us:

Transparency Market Research (TMR) is a market intelligence company, providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision makers. TMR's experienced team of Analysts, Researchers, and Consultants, use proprietary data sources and various tools and techniques to gather, and analyze information. Our business offerings represent the latest and the most reliable information indispensable for businesses to sustain a competitive edge.

Each TMR syndicated research report covers a different sector - such as pharmaceuticals, chemicals, energy, food & beverages, semiconductors, med-devices, consumer goods and technology. These reports provide in-depth analysis and deep segmentation to possible micro levels. With wider scope and stratified research methodology, TMR's syndicated reports thrive to provide clients to serve their overall research requirement.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking Compliance Solutions Market To 2019 - 2027 Key Business Opportunities Along With Potential Challenges here

News-ID: 1917944 • Views: …

More Releases from Transparency Market Research

Coffee Machine Market to Reach US$ 25.0 Billion by 2036, Driven by At-Home Premi …

The global coffee machine market was valued at US$ 14.1 Billion in 2025 and is projected to reach US$ 25.0 Billion by 2036, expanding at a CAGR of 5.4% from 2026 to 2036. Market growth is being driven by rising global coffee consumption, increasing demand for premium and specialty coffee at home, busy urban lifestyles, rapid product innovation, smart connectivity features, strong e-commerce penetration, expanding middle-class incomes, compact kitchen trends,…

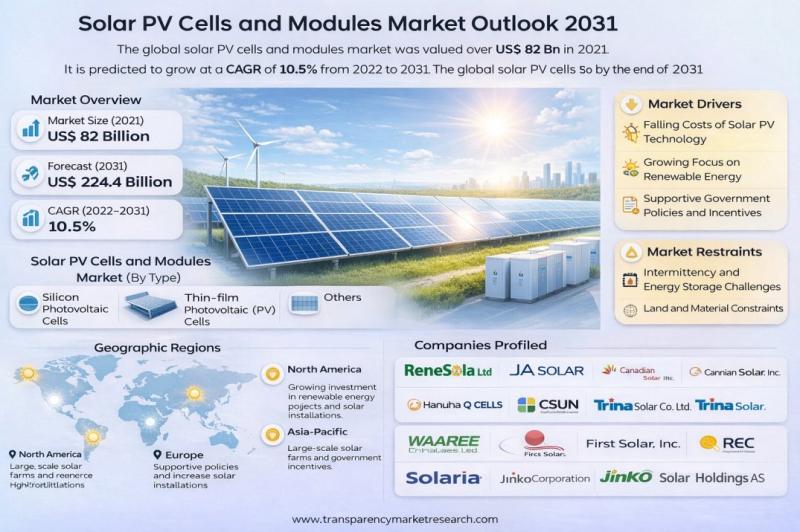

Solar PV Cells and Modules Market to Surpass US$ 224.4 Billion by 2031, Growing …

The global solar PV cells and modules market was valued at over US$ 82 Bn in 2021 and is projected to grow at a robust CAGR of 10.5% from 2022 to 2031. By the end of 2031, the market is expected to cross US$ 224.4 Bn, reflecting the accelerating global transition toward renewable energy sources and sustainable power generation.

Strong policy support, corporate net-zero commitments, and rapid technological advancements in photovoltaic…

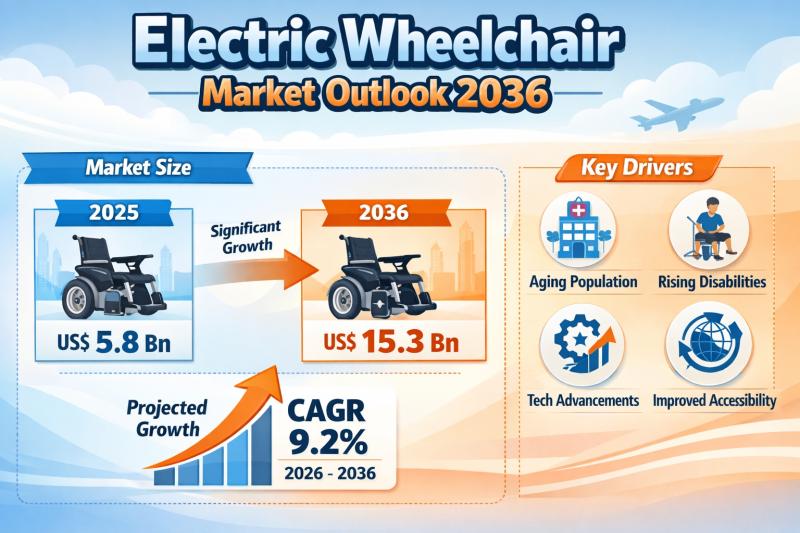

Electric Wheelchair Market Expanding at 9.2% CAGR Through 2036 - By Control Type …

The global electric wheelchair market continues to demonstrate strong and sustained growth, fueled by demographic transitions, technological innovation, and expanding healthcare access worldwide. Valued at US$ 5.8 billion in 2025, the market is projected to reach US$ 15.3 billion by 2036, expanding at a compound annual growth rate (CAGR) of 9.2% from 2026 to 2036.

Discover essential conclusions and data from our Report in this sample -

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=4198

This robust trajectory reflects rising…

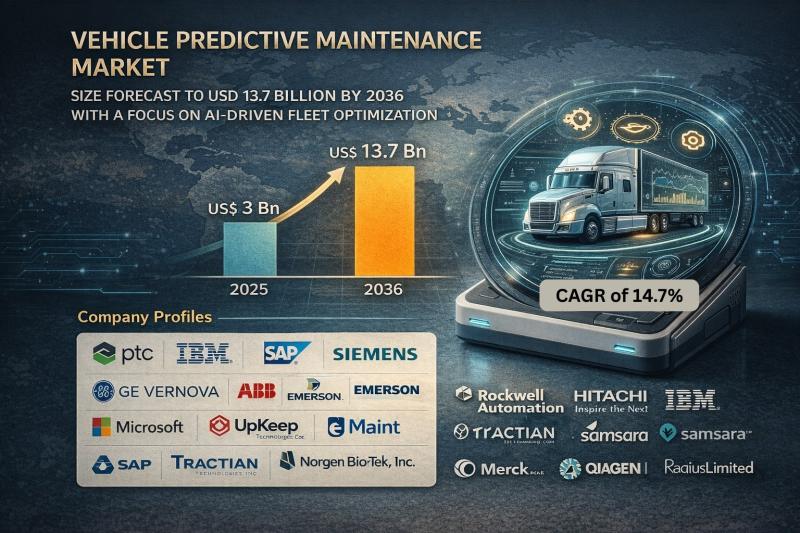

Vehicle Predictive Maintenance Market Size Forecast to USD 13.7 Billion by 2036 …

Vehicle Predictive Maintenance Market Outlook 2036

The global vehicle predictive maintenance market was valued at USD 3 Billion in 2025 and is projected to reach USD 13.7 Billion by 2036, expanding at a robust CAGR of 14.7% from 2026 to 2036. Market growth is driven by increasing adoption of connected vehicles, rising fleet digitalization, advancements in AI-driven analytics, and growing emphasis on minimizing vehicle downtime and maintenance costs.

👉 Get your sample…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…