Press release

Digital Banking platforms market Projections & Future Opportunities Recorded for the Period until 2025

Global digital banking platforms market to reach USD 6.7 billion by 2025. Global digital banking platforms market is valued at USD 2.9 billion in 2017 and is anticipated to grow with a healthy growth rate of more than 11% over the forecast period 2018-2025. Rising adoption of smartphones and tablets and increasing adoption of cloud-based platforms for higher scalability is promoting the growth of the market. Growing smartphones ownership across the globe is also driving the market growth. For instance, according to pew research center report in 2018, around 63% of total individuals in United States owns a smartphone and tablets. Moreover 69% of total individuals of Australia owns a tablets and smartphone. Thus, rising smartphone and tablets ownership is expected to fuel the market growthRequest To Download Sample of This Strategic Report: https://www.kennethresearch.com/sample-request-10078561

The report on global Digital Banking Platforms market includes Banking Type, Banking Mode and Deployment Type segments. Banking Type segment is further divided into Retail Banking and Corporate Banking, Banking Mode includes Online Banking and Online Banking and Deployment Type is further classified into On-Premises and Cloud. Retail banking segment is expected to be the largest contributor to the digital banking platforms market during the forecast period owing to the need to meet retail customers’ elevated expectations of personalization and align these expectations in line with the growing multiplication of channels.

The regional analysis of Global Digital Banking Platforms Market is considered for the key regions such as Asia Pacific, North America, Europe, Latin America and Rest of the World. North America is the leading market region for global Digital Banking Platforms market in terms of market revenue share. Factors such as emerging market players and growing demand for digital banking are promoting the growth of the market.

The leading market players mainly include-

Backbase

EdgeVerve Systems

Temenos

Finastra

TCS

Appway

NETinfo

Worldline

SAP

BNY Mellon

Oracle

Sopra

CREALOGIX

Fiserv

Intellect Design Arena

The objective of the study is to define market sizes of different segments & countries in recent years and to forecast the values to the coming eight years. The report is designed to incorporate both qualitative and quantitative aspects of the industry within each of the regions and countries involved in the study. Furthermore, the report also caters the detailed information about the crucial aspects such as driving factors & challenges which will define the future growth of the market. Additionally, the report shall also incorporate available opportunities in micro markets for stakeholders to invest along with the detailed analysis of competitive landscape and product offerings of key players. The detailed segments and sub-segment of the market are explained below:

By Banking Type:

Retail Banking

Corporate Banking

By Banking Mode:

Online Banking

Mobile Banking

By Deployment Type:

On-Premises

Cloud

By Regions:

North America

o U.S.

o Canada

Europe

o UK

o Germany

Asia Pacific

o China

o India

o Japan

Latin America

o Brazil

o Mexico

Rest of the World

Furthermore, years considered for the study are as follows:

Historical year – 2015, 2016

Base year – 2017

Forecast period – 2018 to 2025

Target Audience of the Global Digital Banking Platforms Market in Market Study:

Key Consulting Companies & Advisors

Large, medium-sized, and small enterprises

Venture capitalists

Value-Added Resellers (VARs)

Third-party knowledge providers

Investment bankers

Investors

Request To Download Sample of This Strategic Report: https://www.kennethresearch.com/sample-request-10078561

Contact Us

Kenneth Research

Email: Sales@kennethresearch.com

Phone: +1 313 462 0609

About Kenneth Research

Kenneth Research is a reselling agency providing market research solutions in different verticals such as Automotive and Transportation, Chemicals and Materials, Healthcare, Food & Beverage and Consumer Packaged Goods, Semiconductors, Electronics & ICT, Packaging, and Others. Our portfolio includes set of market research insights such as market sizing and market forecasting, market share analysis and key positioning of the players (manufacturers, deals and distributors, etc), understanding the competitive landscape and their business at a ground level and many more. Our research experts deliver the offerings efficiently and effectively within a stipulated time. The market study provided by Kenneth Research helps the Industry veterans/investors to think and to act wisely in their overall strategy formulation

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking platforms market Projections & Future Opportunities Recorded for the Period until 2025 here

News-ID: 1905926 • Views: …

More Releases from Kenneth Research

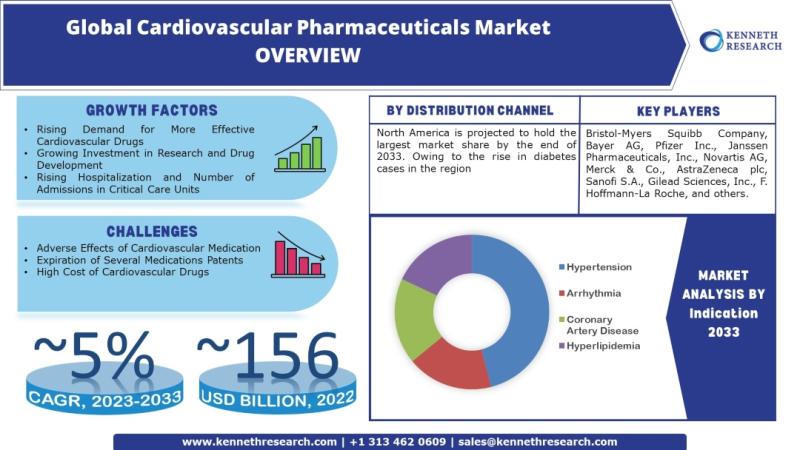

Global Cardiovascular Pharmaceuticals Market to be Propelled by Growing Investme …

Kenneth Research published a report titled "Cardiovascular Pharmaceuticals Market: Global Demand Analysis & Opportunity Outlook 2033" which delivers detailed overview of the global cardiovascular pharmaceuticals market in terms of market segmentation by drug class, distribution channel, indication and by region.

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, supply and demand risk, along with detailed discussion on current and future market trends that are associated with…

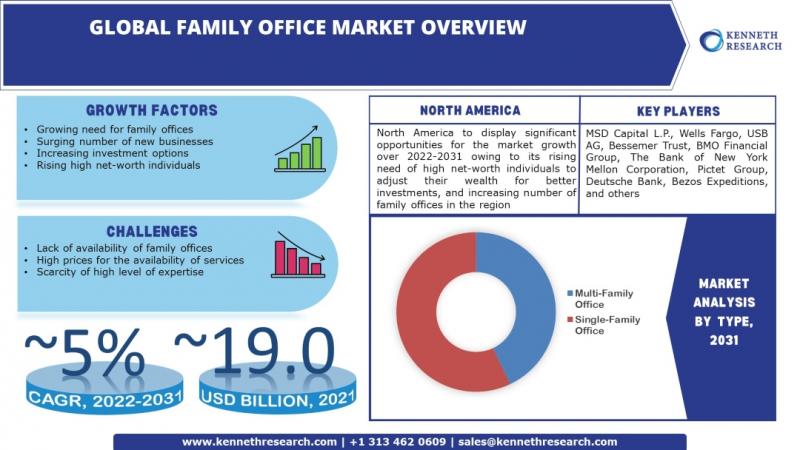

Global Family Office Market to be Propelled by Surging Number of New Businesses …

Kenneth Research published a report titled "Family Office Market: Global Demand Analysis & Opportunity Outlook 2031" which delivers detailed overview of the global family office market in terms of market segmentation by services, type, net worth managed, and by region.

Access Full Description: https://www.kennethresearch.com/report-details/family-office-market/10346745

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, supply and demand risk, along with detailed discussion on current and future market trends that…

Photomask Market Growth Analysis by Revenue, Size, Share, Scenario on Latest Tre …

Kenneth Research provides an extensive study by our analysts which offers forecast assessment by correlating the historical data with key market dynamics. The Photomask Market further includes trends and opportunities that are highlighted, along with the market valuation. The market is segmented by segments and portrays the industry overview along with elaborate description of the market for the forecast period 2020-2025. The report also constitutes future growth statistics which is…

Embedded Systems Market 2020 New Innovations Trends, Research, Global Share and …

Kenneth Research provides an extensive study by our analysts which offers forecast assessment by correlating the historical data with key market dynamics. The Embedded Systems Market further includes trends and opportunities that are highlighted, along with the market valuation. The market is segmented by segments and portrays the industry overview along with elaborate description of the market for the forecast period 2020-2025. The report also constitutes future growth statistics which…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…