Press release

Global Insurance Policy Administration Systems Software Market Size Predicted to Reach USD 11,022 Million By 2025

Facts and Factors Market Research has published a new report titled “Insurance Policy Administration Systems Software Market By Offerings (Standalone Software and Integrated Platform), By Deployment Mode (On-Premise and Cloud-Based), By Organization Size (Large Enterprises and Small & Medium-Sized Enterprises), and By End-User (Conventional Insurance Providers and Bancassurance Companies): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2025”. According to the report, the global Insurance Policy Administration Systems Software market was valued at approximately USD 8,143 million in 2018 and is expected to reach a value of around USD 11,022 million by 2025, at a CAGR of around 3.8% between 2019 and 2025.Insurance Policy Administration Systems Software implements insurance functions comprising rating, issuing, endorsements, quoting, binding, and renewals. Earlier these systems were neither flexible nor customizable and were costly. Today, these modern core insurance systems for policy administration have proved to be efficient, cost-effective, and flexible with the adoption of microservices architecture and cloud hoisting solutions.

Request Free Sample Copy of Research Report @ http://bit.ly/38mH3iE

(Free sample report contains research report overview, TOC, list of tables and figures, an overview of major market players and key regions included)

Furthermore, the insurance policy administration systems software services enable quick launching of insurance products, reduction in the overhead costs, minimization of growth timeline, and creating customized solutions for fulfilling the business objectives of the insurers.

Large-scale acceptance of cloud services to steer the market growth

In the current era, cloud-based asset management services have gained huge popularity with growing technological expansion along with a high preference for AI & big data analytics by the firms for proficiently managing business operations. Moreover, shifting of business functions to the cloud is predicted to benefit the firms in case of the later possessing lesser resources and a lower budget. All these aforementioned factors are predicted to steer the expansion of the market over the forecast timeline.

Furthermore, the growing utilization of the digital business model in the insurance sector to positively influence business expansion over the forecast period. The digital revolution has greatly influenced the business fraternity and insurance business is no exception to this. Moreover, the digital revolution has enabled the consumers to shift towards personalized insurance coverage encompassing usage-based, on-demand, and all-in-one insurance lifestyle items. This, in turn, is predicted to accentuate the expansion of the Insurance Policy Administration Systems Software market over the forecast period. However, data security concerns & stringent laws governing the use of the product will hinder the market growth over the forecast period.

Inquire more about this report before purchase @ http://bit.ly/3aqYeBt

Cloud-based segment to register highest CAGR over the forecast period

The cloud-based segment is anticipated to record the highest growth rate of over 5% during the period from 2019 to 2025. The growth of the segment is attributed to the myriad advantages offered by cloud-based installation including cost-efficacy, scalability, high computing speed, and reduced spending on IT infrastructure facilities.

Large enterprises to dominate the organization size segment over the forecast period in terms of revenue

The growth of the large enterprises segment during the timespan from 2019 to 2025 is owing to the massive demand for Insurance Policy Administration Systems Software from giant firms.

Asia Pacific market to record the highest CAGR over the forecast timeline

The Insurance Policy Administration Systems Software market in the Asia Pacific is set to register the highest growth rate of over 4% during the period from 2019 to 2025. The regional market expansion over the forecast timespan is owing to the massive demand for the product in countries like China, India, Japan, and Australia.

Some of the key players in the market include Andesa Services, Damco Group, DXC Technology Company, Ebix Inc., EXL, FINEOS, FIS, InsPro Technologies, Oceanwide Canada Inc., OneShield Inc., Oracle, Pegasystems Inc., Sapiens International, Scorto, Inc., Solartis, and Target Group.

Request customized copy of report @ http://bit.ly/2G6iFWj

This report segments the Insurance Policy Administration Systems Software market as follows:

Global Insurance Policy Administration Systems Software Market: By Offerings Segment Analysis

Standalone Software

Integrated Platform

Global Insurance Policy Administration Systems Software Market: By Organization Size Segment Analysis

Large Enterprises

Small & Medium-Sized Enterprises

Global Insurance Policy Administration Systems Software Market: By Deployment Mode Segment Analysis

On-Premise

Cloud-Based

Global Insurance Policy Administration Systems Software Market: By End-User Segment Analysis

Conventional Insurance Providers

Bancassurance Companies

Global Insurance Policy Administration Systems Software Market: Regional Segment Analysis

North America

U.S.

Europe

UK

France

Germany

Asia Pacific

China

Japan

India

Latin America

Brazil

Middle East and Africa

Contact Us:

Facts & Factors

Global Headquarters

Level 8, International Finance Center, Tower 2,

8 Century Avenue, Shanghai,

Postal - 200120, China

Tel: +86 21 80360450

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Policy Administration Systems Software Market Size Predicted to Reach USD 11,022 Million By 2025 here

News-ID: 1901280 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

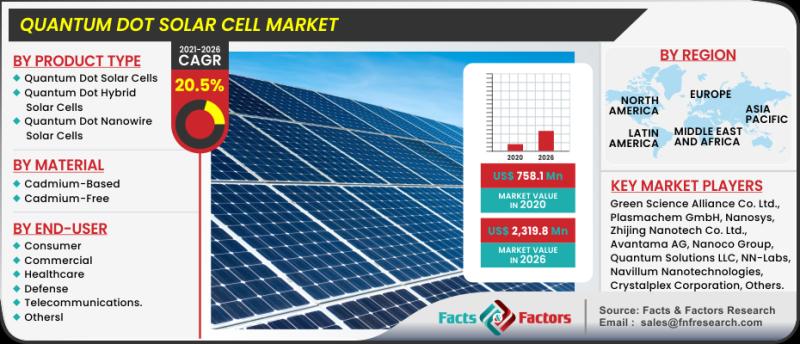

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…