Press release

Neo and Challenger Bank Market Size is Set for Swift Growth and is Expected to Reach $578,143 Million By 2027

Facts & Factors has published a new report titled “Neo and Challenger Bank Market By Type (Neo Bank and Challenger Bank) and By Applications (Personal and Business): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 - 2027”. According to the report, the global neo and challenger bank market was valued at approximately USD 18,604 million in 2018 and is expected to reach a value of around USD 578,143 million by 2027, at a CAGR of around 46.5% between 2019 and 2027.Neobank is a kind of direct bank providing online banking services as well as telephone. It can provide services through mobile applications as well as personal computers. Moreover, Neobank adopts technologies like artificial intelligence and machine learning. Apparently, challenger bank is the kind of small retail bank in the UK competing directly with the established financial institutions in the country. Precisely, Neo and challenger bank are the online banking tools that can be accessed through the website and online applications. These banks are replacing the conventional banking systems through a reduction in the tedious, monotonous, and cumbersome banking process activities like account opening manually and loan processing.

Browse through over 30 Tables & 25 Figures spread over 130 Pages and in-depth TOC on “Global Neo and Challenger Bank Market: By Type, Size, Share, Industry Segments and Analysis Forecast, 2018 – 2027”.

Request Free Sample Copy of Neo and Challenger Bank Market Research Report @ https://www.fnfresearch.com/sample/neo-and-challenger-bank-market-by-type-neo-146

Higher interest rates & reduced transaction charges to drive the market growth by 2027

The rates of interest provided by the neo & challenger bank are more as compared to traditional banks. Apart from this, the rate of money transfer is reasonable due to the use of neo & challenger bank tool. Even the transaction charges of the neo & challenger bank are less in comparison to the transaction charges levied by traditional banks.

Furthermore, neo & challenger bank provide speed, easy accessibility, functionality, and simplicity. Additionally, flexible government laws for neo and challenger investors will impel the expansion of the neo and challenger bank industry during the forecast timeline. Apparently, the massive demographic shift towards digitization along with escalating demand for digital apps across the finance industry will boost the growth of the market during the forecast timeline. Nonetheless, the growing use of smartphones in developed as well as emerging economies will boost the demand for digital & app-based banking services, thereby driving the market growth.

Inquire more about this report before purchase @ https://www.fnfresearch.com/inquiry/neo-and-challenger-bank-market-by-type-neo-146

Neo bank type segment to register the highest CAGR during the forecast period

The growth of the segment is due to the low cost of transactions, no monthly fees, no withdrawal expenses, and reduced reloading fees. Apart from this, huge ATM networks with no charges along with reloadable debit cards are expected to prompt the segmental growth during the period from 2019 to 2027.

Business segment to dominate the application landscape in terms of revenue by 2027

Rise in the adoption of mobile and digital banking as the modes of payment by the large firms as well as small & medium-sized enterprises is anticipated to boost the growth of the business segment over the forecast period.

Europe to contribute majorly towards the overall regional market revenue share by 2027.

The growth of the regional market is due to countries like the UK being the early adopters of neo and challenger banking services.

Browse the full “Neo and Challenger Bank Market – By Type (Neo Bank and Challenger Bank) and By Applications (Personal and Business): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at https://www.fnfresearch.com/neo-and-challenger-bank-market-by-type-neo-146

Key players in the neo and challenger bank industry include DBS (digibank), Simple, Starling Bank, Kakao Bank, Koho Financial Inc., Atom Bank plc, WeBank, Hello bank (BNP Paribas), Fidor Solutions AG, MYbank, Pockit Limited, Monzo Bank Limited, Moven, Jibun Bank Corporation, N26 GmbH, Holvi Payment Services Ltd., Timo, Tandem Bank Limited, and Fidor Bank.

Request customized copy of report @ https://www.fnfresearch.com/customization/neo-and-challenger-bank-market-by-type-neo-146

Related Reports:

Next Generation Sequencing (NGS) Market: https://www.fnfresearch.com/next-generation-sequencing-ngs-market-by-products-and-148

SLAM Technology Market: https://www.fnfresearch.com/slam-technology-market-by-platform-augmented-reality-unmanned-157

Enterprise Data Management Market: https://www.fnfresearch.com/enterprise-data-management-market-by-deployment-mode-cloud-166

Content Management Software Market: https://www.fnfresearch.com/content-management-software-market-by-deployment-mode-cloud-168

Real Estate Crowdfunding Market: https://www.fnfresearch.com/real-estate-crowdfunding-market-by-investors-individual-investors-182

This report segments the neo and challenger bank market as follows:

Global Neo and Challenger Bank Market: By Type Segment Analysis

• Neo Bank

• Challenger Bank

Global Neo and Challenger Bank Market: By Applications Segment Analysis

• Personal

• Business

Contact Us:

Facts & Factors

Global Headquarters

Level 8, International Finance Center, Tower 2,

8 Century Avenue, Shanghai,

Postal - 200120, China

Tel: +86 21 80360450

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Market Size is Set for Swift Growth and is Expected to Reach $578,143 Million By 2027 here

News-ID: 1898271 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

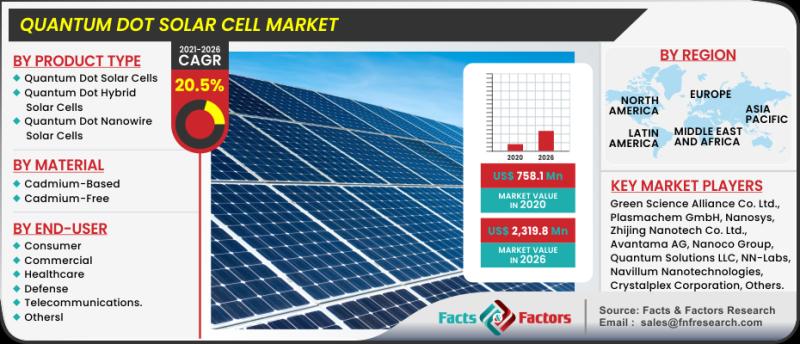

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…