Press release

Neo and Challenger Bank Trends, Share, Size and Forecast Report 2019-2027

The report covers the forecast and analysis of the armored cable market on a global and regional level. The study provides historical data from 2015 to 2018 along with a forecast from 2019 to 2027 based on revenue (USD Million). The study includes drivers and restraints of the armored cable market along with the impact they have on the demand over the forecast period. Additionally, the report includes the study of opportunities available in the armored cable market on a global level.In order to give the users of this report a comprehensive view of the armored cable market, we have included a competitive landscape and an analysis of Porter’s Five Forces model for the market. The study encompasses a market attractiveness analysis, wherein all the segments are benchmarked based on their market size, growth rate, and general attractiveness.

Request For Full Report:https://www.kennethresearch.com/sample-request-10172700

The report provides company market share analysis to give a broader overview of the key players in the market. In addition, the report also covers key strategic developments of the market including acquisitions & mergers, new product & service launches, agreements, partnerships, collaborations & joint ventures, research & development, and regional expansion of major participants involved in the market on a global and regional basis.

The study provides a decisive view of the armored cable market by segmenting the market based on type, application, and regions. All the segments have been analyzed based on present and future trends and the market is estimated from 2019 to 2027. The regional segmentation includes the current and forecast demand for North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Neo & challenger bank provide speed, easy accessibility, functionality, and simplicity. In addition to this, flexible government rules for neo and challenger investors will propel the expansion of the neo and challenger bank industry over the forecast timeframe. Apparently, the massive shift of the people towards digitization coupled with escalating demand for digital apps across the finance industry will enhance the expansion of the market during the forecast timeline. Nonetheless, the mammoth use of smartphones in developed as well as emerging economies will perpetuate the demand for digital & app-based banking services, thereby driving the market surge over the forecast timeline.

Download Sample of This Strategic Report:https://www.kennethresearch.com/sample-request-10172700

Based on the type, the market is sectored into Neo bank and challenger bank. Application-wise, the industry is classified into personal and business applications.

Key players in the neo and challenger bank industry include DBS (digibank), Simple, Starling Bank, Kakao Bank, Koho Financial Inc., Atom Bank plc, WeBank, Hello bank (BNP Paribas), Fidor Solutions AG, MYbank, Pockit Limited, Monzo Bank Limited, Moven, Jibun Bank Corporation, N26 GmbH, Holvi Payment Services Ltd., Timo, Tandem Bank Limited, and Fidor Bank.

Contact Us

David

Email: Sales@kennethresearch.com

Phone: +1 313 462 0609

About Kenneth Research:

Kenneth Research provides market research reports to different individuals, industries, associations and organizations with an aim of helping them to take prominent decisions. Our research library comprises of more than 10,000 research reports provided by more than 15 market research publishers across different industries. Our collection of market research solutions covers both macro level as well as micro level categories with relevant and suitable market research titles. As a global market research reselling firm, Kenneth Research provides significant analysis on various markets with pure business intelligence and consulting services on different industries across the globe. In addition to that, our internal research team always keep a track on the international and domestic market for any economic changes impacting the products’ demand, growth and opportunities for new and existing players.

David

sales@kennethresearch.com

Kenneth Research

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo and Challenger Bank Trends, Share, Size and Forecast Report 2019-2027 here

News-ID: 1897153 • Views: …

More Releases from Kenneth Research

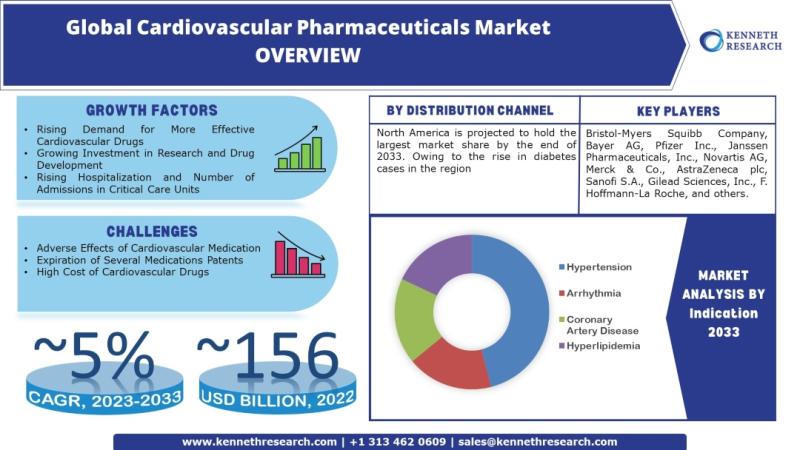

Global Cardiovascular Pharmaceuticals Market to be Propelled by Growing Investme …

Kenneth Research published a report titled "Cardiovascular Pharmaceuticals Market: Global Demand Analysis & Opportunity Outlook 2033" which delivers detailed overview of the global cardiovascular pharmaceuticals market in terms of market segmentation by drug class, distribution channel, indication and by region.

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, supply and demand risk, along with detailed discussion on current and future market trends that are associated with…

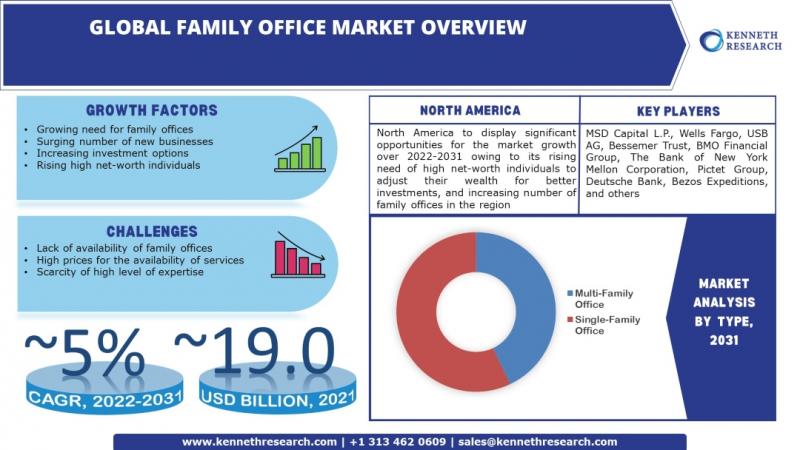

Global Family Office Market to be Propelled by Surging Number of New Businesses …

Kenneth Research published a report titled "Family Office Market: Global Demand Analysis & Opportunity Outlook 2031" which delivers detailed overview of the global family office market in terms of market segmentation by services, type, net worth managed, and by region.

Access Full Description: https://www.kennethresearch.com/report-details/family-office-market/10346745

Further, for the in-depth analysis, the report encompasses the industry growth indicators, restraints, supply and demand risk, along with detailed discussion on current and future market trends that…

Photomask Market Growth Analysis by Revenue, Size, Share, Scenario on Latest Tre …

Kenneth Research provides an extensive study by our analysts which offers forecast assessment by correlating the historical data with key market dynamics. The Photomask Market further includes trends and opportunities that are highlighted, along with the market valuation. The market is segmented by segments and portrays the industry overview along with elaborate description of the market for the forecast period 2020-2025. The report also constitutes future growth statistics which is…

Embedded Systems Market 2020 New Innovations Trends, Research, Global Share and …

Kenneth Research provides an extensive study by our analysts which offers forecast assessment by correlating the historical data with key market dynamics. The Embedded Systems Market further includes trends and opportunities that are highlighted, along with the market valuation. The market is segmented by segments and portrays the industry overview along with elaborate description of the market for the forecast period 2020-2025. The report also constitutes future growth statistics which…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…