Press release

Travel Insurance Market Will Surpass USD 41,807 Million By 2027

Facts and Factors Market Research has published a new report titled “Travel Insurance Market By Trip Type (Single Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and Long-Stay Travel Insurance), By Insurance Cover (Medical Treatment, Loss, Damage, & Theft, Resuming Your Journey, Cancellation Insurance, Lump Sum Payments, Caretaker Coverage, Death, and Itinerary), By Distribution Channel (Insurance Intermediaries, Insurance Company, Insurance Broker, Bank, and Insurance Aggregator), By Payment Method (Monthly Outstanding Balance Method and Single Payment Method), and By End-User (Senior Citizens, Backpackers, Education Traveler, Family Traveler, Business Traveler, and Fully Independent Traveler): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027”. According to the report, the global Travel Insurance market is predicted to be valued at approximately USD 20,027 million in 2018 and is expected to reach a value of around USD 41,807 million by 2027, at a CAGR of around 7.64 % between 2019 and 2027.Travel insurance is utilized to enhance the efficacy of the credit management operations, helping the staff to utilize the time to concentrate on the high priority jobs. Firms also adopt travel insurance for offering a seamless experience to the customers, thereby improving consumer relationships and retaining customers.

Request Free Sample Copy of Research Report @ http://bit.ly/2TljgeI

On other hand, travel Insurance is also available as the insurance software that arranges and restructures credit management workflows along with the storage of vital data along with preparation and performing of myriad routine tasks by the credit management team. Travel Insurance can also be blended into the complete organization and is also the component of other software systems.

Furthermore, some of the travel insurance software packages will integrate accounts receivables across the whole organization so that each function can help in accessing payment information whenever required. While other travel insurance software packages offer role-based operations and the probability of data sharing with particular roles in the company. This, in turn, gives everyone in the organization a complete overview of the consumer experience.

Increase in the business travels to steer the market trends

The surge in population has helped the business grow across the globe with many of the firms setting up offices abroad. This is likely to result in a rise in the business travels of the employees, thereby resulting in the growth of the travel insurance market. With strict enforcement of travel insurance laws across the developed countries like the U.S. and the UK, the market for travel insurance is likely to gain traction over the forecast timeline.

Inquire more about this report before purchase @ http://bit.ly/36U48J4

Furthermore, the rise in the tourist activities & thriving tourism sector will further enlarge the scope of the market over the forecast period. Nonetheless, unavoidable situations like the outbreak of war and pre-existing health issues can pose a threat to the market growth during the period from 2019 to 2027. However, emerging economies are trying to make the purchase of travel insurance mandatory and this, in turn, will offer lucrative opportunities for the market over the forecast period.

Single trip travel insurance to lead the trip type segment by 2027 in terms of revenue

The growth of the single trip travel insurance segment during the forecast timeline is due to the cost-effectiveness of the single trip travel insurance along with growing trends of honeymoon tours in foreign countries, affordability of the single trip travel insurance, and shopping trips overseas.

Insurance aggregator segment to record highest CAGR over the forecast timeline

The segment is predicted to register the highest growth rate of over 11% during the forecast period due to the ability of the insurance aggregator to provide the potential consumer with the insurance quotes along with the opportunity of discussing a particular quote. Apart from this, it also transfers the data of the prospective lead to the insurer for the latter to contact the potential customer for convincing him/her to buy the travel insurance policy.

Browse the full “Travel Insurance Market By Trip Type (Single Trip Travel Insurance, Annual Multi-Trip Travel Insurance, and Long-Stay Travel Insurance), By Insurance Cover (Medical Treatment, Loss, Damage, & Theft, Resuming Your Journey, Cancellation Insurance, Lump Sum Payments, Caretaker Coverage, Death, and Itinerary), By Distribution Channel (Insurance Intermediaries, Insurance Company, Insurance Broker, Bank, and Insurance Aggregator), By Payment Method (Monthly Outstanding Balance Method and Single Payment Method), and By End-User (Senior Citizens, Backpackers, Education Traveler, Family Traveler, Business Traveler, and Fully Independent Traveler): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at http://bit.ly/2FKQ2Ot

Europe to contribute majorly towards the overall market revenue share by 2027

The growth of the regional market during the forecast period is owing to the high purchase of travel insurance policies by families and groups in the European countries. Countries like the UK, France, Germany, and Italy are likely to be major drivers of the regional market growth over the forecast period.

Some of the key participants in the business include Apruve, Cforia Software Inc., Credit & Management Systems, Inc., Creman Debasso, Emagia Corporation, Innovation Software Limited, Solutions For Financials B.V., Prof. Schumann GmbH, Viatec Business Solutions Ltd., SystemPartner Norge AS, SOPLEX Consult GmbH, Triple A Solutions, Hanse Orga Group, Credit Management tools.com, Xolv BV, BVCM Collections BV, Care & Collect, Onguard, Credica Limited, HighRadius, Rimilia, Equiniti, Debtpack, Misys, and Esker.

Request customized copy of report @ http://bit.ly/37ZmzfA

This report segments the Travel Insurance market as follows:

Travel Insurance Market: By Trip Type Analysis

Single Trip Travel Insurance

Annual Multi-Trip Travel Insurance

Long-Stay Travel Insurance

Travel Insurance Market: By Insurance Cover Analysis

Medical Treatment

Loss, Damage, & Theft

Resuming Your Journey

Cancellation Insurance

Lump Sum Payments

Caretaker Coverage

Death

Itinerary

Travel Insurance Market: By Distribution Channel Analysis

Insurance Intermediaries

Insurance Company

Insurance Broker

Bank

Insurance Aggregator

Travel Insurance Market: By Payment Method Analysis

Monthly Outstanding Balance Method

Single Payment Method

Travel Insurance Market: By End-User Analysis

Senior Citizens

Backpackers

Education Traveler

Family Traveler

Business Traveler

Fully Independent Traveler

Travel Insurance Market: By Regional Segment Analysis

North America

The U.S.

Europe

UK

France

Germany

Asia Pacific

China

Japan

India

Latin America

Brazil

The Middle East and Africa

Contact Us:

Facts & Factors

Global Headquarters

Level 8, International Finance Center, Tower 2,

8 Century Avenue, Shanghai,

Postal - 200120, China

Tel: +86 21 80360450

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market Will Surpass USD 41,807 Million By 2027 here

News-ID: 1896025 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

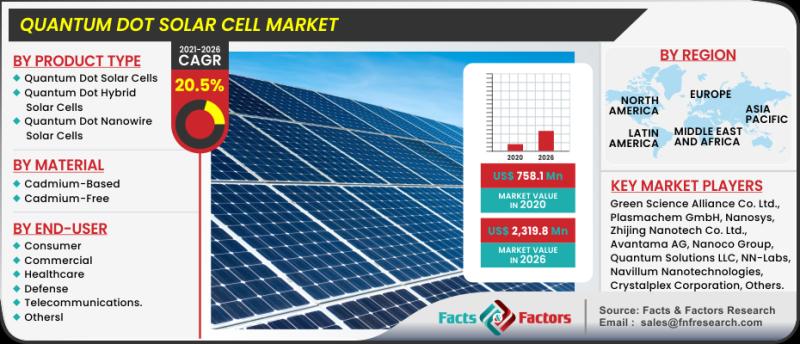

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…