Press release

Growth in Digital Banking Market Size & Trends Will Grow to USD 8,970.77 Billion By 2027

Facts and Factors Market Research has published a new report titled “Digital Banking Market – By Banking Type (Retail Banking, Investment Banking, and Corporate Banking), By Solutions (Payments, Risk Management, Processing Services, and Customer & Channel Management), By Organization Size (Small & Medium Size Enterprises and Large Size Enterprises), By Technology (Chatbots, BaaS (Banking as a Service), White Label Banking, BaaP (Banking as a Platform), and Cloud-Based), and By Payment Verticals (Banking Cards, Micro ATMs, Mobile Banking, Unstructured Supplementary Service Data, Mobile Wallets, Uniform Payment Interface, Point of Sale, and Internet Banking): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027”. According to the report, the global Digital Banking Market is predicted to be valued at approximately USD 6,620.87 billion in 2018 and is expected to reach a value of around USD 8,970.77 billion by 2027, at a CAGR of around 3.8 % between 2019 and 2027.Digital banking is the automation of the banking activities in which all the banking facilities can be availed as well as provided through the use of the internet. Traditionally, all the services offered by the banks were made available to the consumers by the nominated representatives. Nonetheless, with the beginning of the digital banking era, customers can access financial data and avail personalized banking services with the help of their mobile phones or desktops.

Request Free Sample Copy of Research Report @ https://www.fnfresearch.com/sample/digital-banking-market-by-banking-type-retail-banking-100

Furthermore, digital banking encompasses high levels of mechanized processes and web-based solutions. Moreover, digital banking services also include an application programming interface that facilitates effective delivering of banking products & services along with improving the speed & proficiency of the banking transactions. The digital banking activities also aid the businesses to easily transfer the payments from one banking account to another one.

Beneficial features to drive the market trends over the forecast period

The growth of the digital banking industry is credited to its easy access, reduced costs, and optimum utilization by the customers. Moreover, the massive acceptance of digital banking activities across the globe will further proliferate business growth. Furthermore, banks are launching new services like internet banking, mobile banking, and SMS banking to proficiently fulfill the end-user requirements.

Apparently, prominent utilization of the digital equipment in effectively handling business, burgeoning demand for cloud-based services, and a mounting number of smartphone devices are the key aspects likely to steer the expansion of the digital banking market over the forecast timeline. However, a low level of organized internet infrastructure facility along with the growing security concerns is a few of the challenges that can diminish the growth of the industry during the forecast period.

Inquire more about this report before purchase @ https://www.fnfresearch.com/inquiry/digital-banking-market-by-banking-type-retail-banking-100

Retail banking to dominate the banking type segment over the forecast period

The growth of the retail banking segment during the period from 2019 to 2027 is owing to large-scale acceptance of mobile payment services by the customers.

Payments segment to contribute majorly towards the overall market revenue share by 2027

Digitization in the payment sector has helped in improving the efficiency of banking activities. Apart from this, the escalating demand for cashless transactions among the end-users has lucratively influenced the expansion of digital banking. Moreover, digitization of the payment activities saves time, cost of delivery, reduces risks, and enhances the security of the deals.

Request customized copy of report @ https://www.fnfresearch.com/customization/digital-banking-market-by-banking-type-retail-banking-100

North America to account for the major revenue chunk of the overall market share by 2027

The growth of the regional market is due to the acceptance of new technologies and a large focus on innovation in banking services. Apart from this, the massive utilization of digital banking tools in countries like Canada and the U.S. will push the regional market growth trends over the forecast timeframe.

Some of the key players in the market include Capital Banking Solutions, ACI Worldwide, JPMorgan Chase & Co., Temenos Headquarters SA, Ally Financial Inc., Backbase, CR2, Digiliti Money, Inc., Fiserv, Inc., Infosys Ltd., Technisys, Innofis, TRG Mobilearth Inc., Kony, Inc., Microsoft Corporation, Oracle, Tata Consultancy Services, and Urban FT (North America), LLC.

Browse the full “Digital Banking Market – By Banking Type (Retail Banking, Investment Banking, and Corporate Banking), By Solutions (Payments, Risk Management, Processing Services, and Customer & Channel Management), By Organization Size (Small & Medium Size Enterprises and Large Size Enterprises), By Technology (Chatbots, BaaS (Banking as a Service), White Label Banking, BaaP (Banking as a Platform), and Cloud-Based), and By Payment Verticals (Banking Cards, Micro ATMs, Mobile Banking, Unstructured Supplementary Service Data, Mobile Wallets, Uniform Payment Interface, Point of Sale, and Internet Banking): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2018 – 2027” Report at https://www.fnfresearch.com/digital-banking-market-by-banking-type-retail-banking-100

This report segments the Digital Banking market as follows:

Global Digital Banking Market: By Banking Type Segment Analysis

Retail Banking

Investment Banking

Corporate Banking

Global Digital Banking Market: By Solutions Segment Analysis

Payments

Risk Management

Processing Services

Customer & Channel Management

Global Digital Banking Market: By Organization Size Segment Analysis

Small & Medium Size Enterprises

Large Size Enterprises

Global Digital Banking Market: By Technology Segment Analysis

Chatbots

BaaS (Banking as a Service)

White Label Banking

BaaP (Banking as a Platform)

Cloud-Based

Global Digital Banking Market: By Payment Verticals Segment Analysis

Banking Cards

Micro ATMs

Mobile Banking

Unstructured Supplementary Service Data

Mobile Wallets

Uniform Payment Interface

Point of Sale

Internet Banking

Contact Us:

Facts & Factors

Global Headquarters

Level 8, International Finance Center, Tower 2,

8 Century Avenue, Shanghai,

Postal - 200120, China

Tel: +86 21 80360450

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Growth in Digital Banking Market Size & Trends Will Grow to USD 8,970.77 Billion By 2027 here

News-ID: 1891527 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

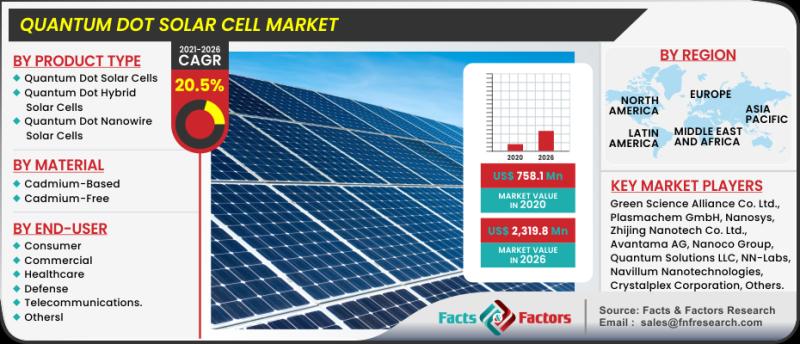

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…