Press release

Bank Reconciliation Software Market is Likely to Boom with Robust Growth Rate in the Projected Period 2020-2025

Los Angeles, United StateJanuary 2nd, 2020 :QY Research offers an overarching research and analysis-based study on the global Bank Reconciliation Software Market , covering growth prospects, market development potential, profitability, supply and demand, and other important subjects. The report presented here comes out as a highly reliable source of information and data on the global Bank Reconciliation Software market. The researchers and analysts who have prepared the report used an advanced research methodology and authentic primary and secondary sources of market information and data. Readers are provided with clear understanding on the current and future situations of the global Bank Reconciliation Software market based on revenue, volume, production, trends, technology, innovation, and other critical factors.The report offers an in-depth assessment of key market dynamics, the competitive landscape, segments, and regions in order to help readers to become better familiar with the global Bank Reconciliation Software market. It particularly sheds light on market fluctuations, pricing structure, uncertainties, potential risks, and growth prospects to help players to plan effective strategies for gaining successful in the global Bank Reconciliation Software market. Importantly, it allows playe rs to gain deep insights into the business development and market growth of leading companies operating in the global Bank Reconciliation Software market. Players will also be able to know about future market challenges, distribution scenarios, product pricing changes, and other related factors beforehand.

Get PDF template of this report: https://www.qyresearch.com/sample-form/form/953125/global-bank-reconciliation-software-market

Bank Reconciliation Software Market Leading Players :

ReconArt ,SmartStream ,BlackLine ,Adra ,Fiserv, Inc ,SAP ,Flatworld Solutions Pvt. Ltd. ,IStream Financial Services ,Aurum Solution ,AutoRek ,Xero ,Unit4 ,Cashbook ,Trintech ,Rimilia ,Fiserv ,Open Systems ,Fund Recs ,Oracle

Market Segment Analysis : The report offers a comprehensive study of product type and application segments of the global Bank Reconciliation Software market. The segmental analysis provided in the report is based on significant factors such as market share, market size, consumption, production, and growth rate of the market segments studied.Readers of the report are also provided with exhaustive geographical analysis to provide clear understanding of the regional growth of the Bank Reconciliation Software market. Developed as well as developing regional markets for Bank Reconciliation Software have been deeply studied to help market players identify profit-making opportunities in different regions and countries.

Table of Contents :

Executive Summary: It includes key trends of the global Bank Reconciliation Software market related to products, applications, and other crucial factors. It also provides analysis of the competitive landscape and CAGR and market size of the global Bank Reconciliation Software market based on production and revenue.

Production and Consumption by Region: It covers all regional markets focused in the research study. It discusses about prices and key players besides production and consumption in each regional market.

Key Players: Here, the report throws light on financial ratios, pricing structure, production cost, gross profit, sales volume, revenue, and gross margin of leading and prominent companies competing in the global Bank Reconciliation Software market.

Market Segments: This part of the report discusses about product type and application segments of the global Bank Reconciliation Software market based on market share, CAGR, market size, and various other factors.

Research Methodology: This section discusses about the research methodology and approach used to prepare the report. It covers data triangulation, market breakdown, market size estimation, and research design and/or programs.

Get Complete Global Bank Reconciliation Software Market Report in your Inbox within 24 hours at 3,350 USD : https://www.qyresearch.com/settlement/pre/c32e9f799194ac3489cea1d10c12e159,0,1,Global-Bank-Reconciliation-Software-Market-Report-History-and-Forecast-Breakdown-Data-by-Companies-Key-Regions-Types-and-Applicatio

Contact Us

QY Research, INC.

17890 Castleton, Suite 218,

Los Angeles, CA - 91748

USA: +1 6262 952 442

China: +86 1082 945 717

Japan: +81 9038 009 273

India: +91 9766 478 224

Emails – enquiry@qyresearch.com

Web – www.qyresearch.com

About Us:

QYResearch always pursuits high product quality with the belief that quality is the soul of business. Through years of effort and supports from huge number of customer supports, QYResearch consulting group has accumulated creative design methods on many high-quality markets investigation and research team with rich experience. Today, QYResearch has become the brand of quality assurance in consulting industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Bank Reconciliation Software Market is Likely to Boom with Robust Growth Rate in the Projected Period 2020-2025 here

News-ID: 1888443 • Views: …

More Releases from QY Research, INC.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

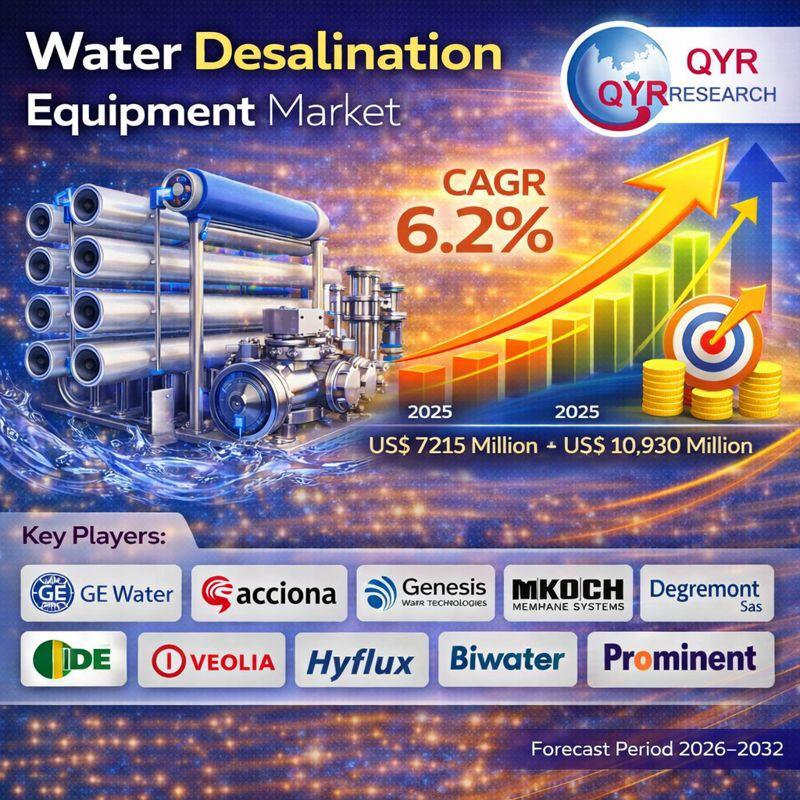

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

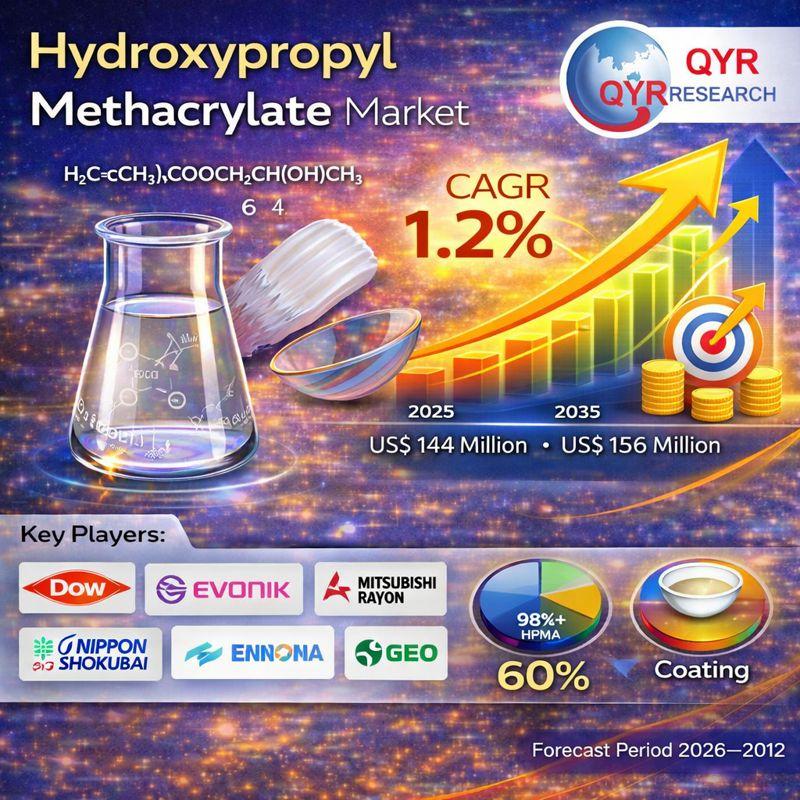

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…