Press release

Insurance Analytics Market Insights | Key players: IBM, Oracle, Microsoft, SAP and Salesforce

According to recent research "Insurance Analytics Market by Component, Business Application (Claims Management, Risk Management, Customer Management and Personalization, Process Optimization), Deployment Model, Organization Size, End-User, and Region - Global Forecast to 2023", The insurance analytics market is expected to grow from USD 6.63 Billion in 2018 to USD 11.96 Billion by 2023, at a Compound Annual Growth Rate (CAGR) of 12.5% during the forecast period. The major factors driving the insurance analytics market are the rapid adoption of data-driven decision-making process and increasing adoption of advanced analytics techniques.Browse 73 market data Tables and 51 Figures spread through 176 Pages and in-depth TOC on "Insurance Analytics Market”

Buy Now@ https://www.marketsandmarkets.com/Purchase/purchase_reportNew.asp?id=58298536&utm_source=Openpr

Customer management and personalization business application is expected to grow at the highest CAGR

Insurers are now leveraging analytics solutions to offer additional policy discounts and proactive risk management services. They are now able to understand their customers’ lifestyle and create customized coverage to match their requirements. For instance, if an insurer learns about a customer’s forthcoming travel plans, they can create a personalized travel coverage to take care of their travel insurance. Insurers are now able to send automated messages to inform drivers in case of adverse weather conditions or major road repair enabling their clients to take alternative routes providing an enriching experience.

Third-party administrators, brokers, and consultancies end-user segment is expected to grow at the highest rate during the forecast period

Third-party administrators (TPAs) can handle general liability, water damage, restoration, construction defect, automobile, property and casualty, product liability, professional liability and other claims. In many cases, TPAs act as a buffer between insurers and their customers. Insurance analytics solution provides TPAs, agents, and brokers with easy access to previously siloed data, so they can get actionable intelligence and provide customers with a valuable, tailored service saving time and costs, and giving insurers the opportunity to do more high value work.

Inquiry before Buying@ https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=58298536&utm_source=Openpr

North America is expected to dominate the insurance analytics market during the forecast period

North America is estimated to hold the largest share of the insurance analytics market in 2018, as it remains the largest insurance market by premium in addition to early adoption of technology advancements and analytics. The market size in Asia Pacific (APAC) is expected to grow at the highest CAGR from 2018 to 2023, owing to the increasing adoption of automation and huge opportunities across industries in the APAC countries, especially in Australia, China, and Japan.

The report also encompasses different strategies, such as acquisitions, partnerships and collaborations, new product launches, and product upgradations, adopted by major players to expand their shares in the market. Major technology vendors include IBM (US), Microsoft (US), Oracle (US), SAP SE (Germany), Salesforce (US), SAS Institute (US), OpenText (Canada), Verisk Analytics (US), Tableau Software (US), Pegasystems (US), Hexaware (India), Guidewire (US), MicroStrategy (US), Sapiens International (Israel), LexisNexis (US), Palantir (US), TIBCO Software (US), Applied Systems (US), Birst (US), BOARD International (Switzerland), Mitchell International (US), QlikTech (US), Vertafore (US), PrADS Inc. (US), and BRIDGEi2i (India).

Mr. Shelly Singh

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

Email: newsletter@marketsandmarkets.com

MnM Blog: https://mnmblog.org/

Content Source: https://www.marketsandmarkets.com/PressReleases/insurance-analytics.asp

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Analytics Market Insights | Key players: IBM, Oracle, Microsoft, SAP and Salesforce here

News-ID: 1882258 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

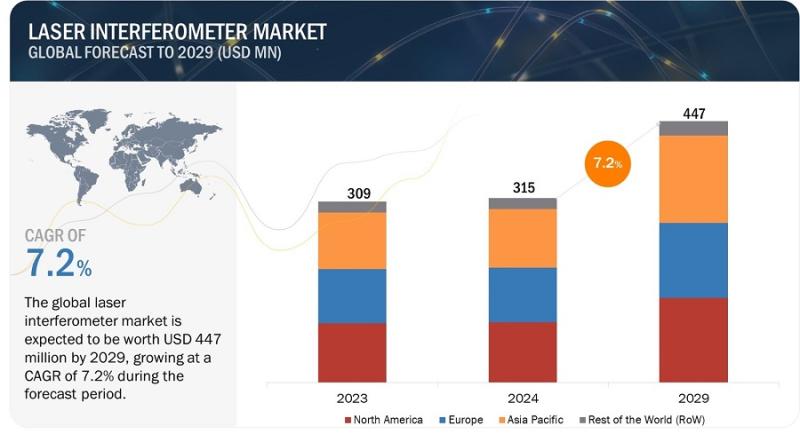

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

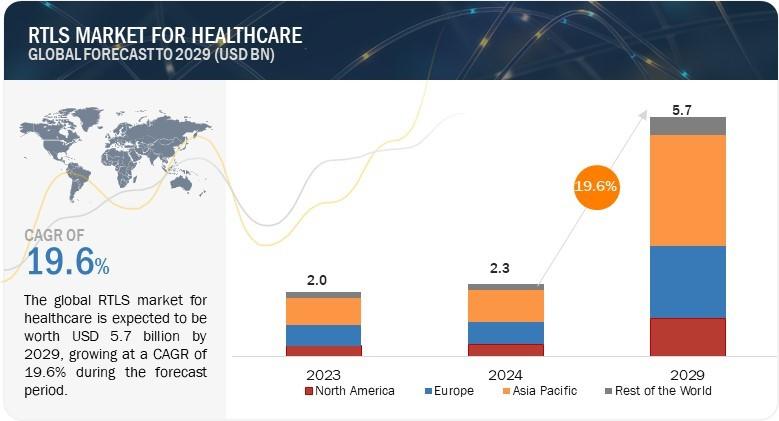

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…