Press release

Online Loans Market Aims to Expand at Double-Digit Growth Rate

HTF MI recently launched the Global Online Loans study with 100+ market data Tables, Pie Chat, Graphs & Figures spread through Pages and easy to understand detailed analysis. At present, the market is developing its presence. The Research report presents a complete assessment of the Market and contains a future trend, current growth factors, attentive opinions, facts, and industry validated market data. The research study provides estimates for Global Online Loans Forecast till 2025*.Request Sample of Global Online Loans Report 2018 @: https://www.htfmarketreport.com/sample-report/1850770-global-online-loans-market-1

#Summary:

The in-depth information by segments of the Global Online Loans market helps monitor future profitability & to make critical decisions for growth. The information on trends and developments focuses on markets and materials, capacities, technologies, CAPEX cycle and the changing structure of the Global Online Loans Market.

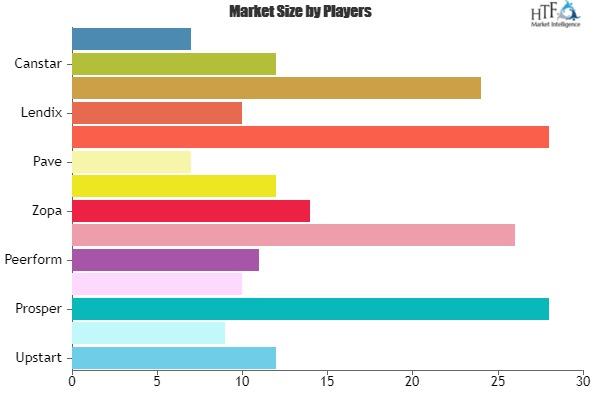

Professional Key players: Upstart, Funding Circle, Prosper, CircleBack Lending, Peerform, Lending Club, Zopa, Daric, Pave, Mintos, Lendix, RateSetter, Canstar & Faircent

Global Online Loans Product Types In-Depth: , On-Premise, Cloud-Based, Industry Segmentation, Individuals, Businesses, Channel (Direct Sales, Distributor) Segmentation, Section 8: 400 USDTrend (2018-2023), Section 9: 300 USD Product Type Detail, Section 10: 700 USD Downstream Consumer, Section 11: 200 USD Cost Structure & Section 12: 500 USD Conclusion

Global Online Loans Major Applications/End users:

**The market is valued based on weighted average selling price (WASP) and includes any applicable taxes on manufacturers. All currency conversions used in the creation of this report have been calculated using constant annual average 2018 currency rates.

The Global Online Loans is valued at million US$ in 2018 and will reach million US$ by the end of 2025, growing at a CAGR XX% during 2018-2025.

Geographical Analysis: Regional and country level analysis integrating the demand and supply forces that are influencing the growth of the market, currently covering North America Country (United States, Canada), South America, Asia Country (China, Japan, India, Korea), Europe Country (Germany, UK, France, Italy), Other Country (Middle East, Africa, GCC) & Section (5 6 7): 500 USD

** For global version, list of countries by region can be added as part of customization at minimum cost.

North America (United States, Canada & Mexico)

Asia-Pacific (Japan, China, India, Australia etc)

Europe (Germany, UK, France etc)

Central & South America (Brazil, Argentina etc)

Middle East & Africa (UAE, Saudi Arabia, South Africa etc)

In order to get a deeper view of Market Size, competitive landscape is provided i.e. Revenue (Million USD) by Players (2013-2018), Revenue Market Share (%) by Players (2013-2018) and further a qualitative analysis is made towards market concentration rate, product/service differences, new entrants and the technological trends in future.

Enquire for customization in Report @ https://www.htfmarketreport.com/enquiry-before-buy/1850770-global-online-loans-market-1

In this study, the years considered to estimate the market size of Global Online Loans are : History Year: 2014-2018; Base Year: 2018; Estimated Year: 2019; Forecast Year 2019 to 2025

Key Stakeholders/Global Reports:

Online Loans Manufacturers

Online Loans Distributors/Traders/Wholesalers

Online Loans Subcomponent Manufacturers

Industry Association

Downstream Vendors

Browse for Full Report at @: https://www.htfmarketreport.com/reports/1850770-global-online-loans-market-1

What this Research Study Offers:

Global Online Loans Market share assessments for the regional and country level segments

Market share analysis of the top industry players

Strategic recommendations for the new entrants

Market forecasts for a minimum of 5 years of all the mentioned segments, sub-segments, and the regional markets

Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

Strategic recommendations in key business segments based on the market estimations

Competitive landscaping mapping the key common trends

Company profiling with detailed strategies, financials, and recent developments

Supply chain trends mapping the latest technological advancements...Continued

Actual Numbers & In-Depth Analysis, Business opportunities, Market Size Estimation Available in Full Report.

Buy Full Copy Global Online Loans Report 2018 @ https://www.htfmarketreport.com/buy-now?format=1&report=1850770

Thanks for reading this article, you can also get individual chapter wise section or region wise report version like North America, Europe or Asia.

Contact US :

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA – 08837

Phone: +1 (206) 317 1218

sales@htfmarketreport.com

Connect with us at LinkedIn | Facebook | Twitter

About Author:

HTF Market Report is a wholly owned brand of HTF market Intelligence Consulting Private Limited. HTF Market Report global research and market intelligence consulting organization is uniquely positioned to not only identify growth opportunities but to also empower and inspire you to create visionary growth strategies for futures, enabled by our extraordinary depth and breadth of thought leadership, research, tools, events and experience that assist you for making goals into a reality. Our understanding of the interplay between industry convergence, Mega Trends, technologies and market trends provides our clients with new business models and expansion opportunities. We are focused on identifying the “Accurate Forecast” in every industry we cover so our clients can reap the benefits of being early market entrants and can accomplish their “Goals & Objectives”.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Online Loans Market Aims to Expand at Double-Digit Growth Rate here

News-ID: 1880278 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Automotive Fasteners Market to Expand Rapidly Over Next Decade| Stanley Black & …

The latest study released on the Global Automotive Fasteners Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Automotive Fasteners study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

Financial Crime Prevention Market May See a Big Move | Major Giants FIS, Fiserv, …

The latest study released on the Global Financial Crime Prevention Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Financial Crime Prevention study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

Weight Management Product Market is Booming Worldwide | Nestlé Health Science, …

The latest study released on the Global Weight Management Product Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Weight Management Product study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

Kol Software Market May See a Big Move | Major Giants Microsoft, Adobe, HubSpot, …

The latest study released on the Global Kol Software Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Kol Software study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider how these…

More Releases for Loans

Online Payday Loans Texas & USA | Online Installment Loans for Bad Credit | Loom …

https://www.loomloans.com

Loom Loans: Your Gateway to Financial Flexibility Across the United States

Have you been searching for $255 payday loans online same day, online payday loans Texas, or maybe even online installment loans for bad credit? Look no further; Loom Loans can help! Understanding that time is often of the essence when it comes to financial needs, our service specializes in linking applicants to available loans, allowing you to find the right…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Syndicated Loans Market : Surge in Demand for Large Loans | 2031

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape.…

Online Loans at GoodCheddar Make Comparing Loans Easier in Canada

GoodCheddar offers a personal finance solution that is about helping consumers find the answers they need when it comes to personal loans. Expanding its reach in the consumer marketplace, GoodCheddar.com aims to lower the barriers of borrowing by making options more accessible to Canadians.

When a consumer needs a personal loan, it can be a big financial decision. GoodCheddar empowers consumers in their decisions and helps them make smart financial…

Loans Now Website Educates Consumers on Bad Credit Loans

JACKSONVILLE, FL – MAY 6, 2019–Bad credit can make people feel hopeless when they face issues out of their control like car crashes and medical emergencies. Personal loan provider Loans Now educates consumers so that they can get the help they need.

Loans Now’s website serves as an extensive resource meant to inform potential borrowers about how to borrow money responsibly. Its representatives work with borrowers to find the loan that’s…

Guaranteed Personal Loans: Instant Approval Loans

Real-personal-loans.com is today devoted to offering instant approval loan for people with low income to see to it that they kind out their financial conditions soon after they harass. This is a very convenient solution compared with the old times where system for the financial loan was a very frustrating process and people could spend days to get the cash. Application will only require a few clicks and the creditors…