Press release

Catana Capital: New collaboration with Life Science AI pioneer Innoplexus

Catana Capital partners with a leading provider of AI solutions in the Life Science sectorFrankfurt am Main, December 16, 2019: As a pioneer in the application of Big Data and AI for quantitative asset management, Catana Capital is always open to collaborate with other innovators in the space in order to develop new innovative investment strategies. After a successful first year of the Data Intelligence Fund and the recent launch of overlay strategies for institutional investors, Catana Capital has now partnered with Innoplexus, a leading provider of artificial intelligence solutions in the Life Science sector.

Innoplexus has proven to provide deep insights into the Life Sciences data universe and especially the assessment of outcomes of clinical trials, which, combined with Catana Capital’s know how and experience in quantitative asset management, will form the basis for a successful joint venture. Innoplexus’ proprietary use of artificial intelligence and machine learning fits perfectly into Catana Capital’s strategy to further scale its revolutionary new investment strategy based on independent trading signals in the area of European pharmaceutical equities, where both companies will work together on an exclusive basis.

Catana Capital’s innovative Data Intelligence Fund (ISIN: DE000A2H9A76) has met all expectations since its launch and the additional approach into the pharma sector is a solid diversification within the fund which will further contribute to its success.

Catana Capital GmbH

Friedensstraße 7

60311 Frankfurt a. M.

+49 69 2561 7004

For further information please contact sabrina.beckmann@catanacapital.de

Catana Capital GmbH is a financial services institution licensed in compliance with Section 32 of the German Banking Act (KWG) and domiciled in Frankfurt am Main. The FinTech was founded in August 2015 and manages the Data Intelligence Fund, a public fund based entirely on big data and artificial intelligence. Catana Capital sees itself as a pioneer in the development of new approaches to asset management and offers innovative investment products for private investors and institutional clients.

Further information can be found at https://catanacapital.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Catana Capital: New collaboration with Life Science AI pioneer Innoplexus here

News-ID: 1880251 • Views: …

More Releases from Catana Capital GmbH

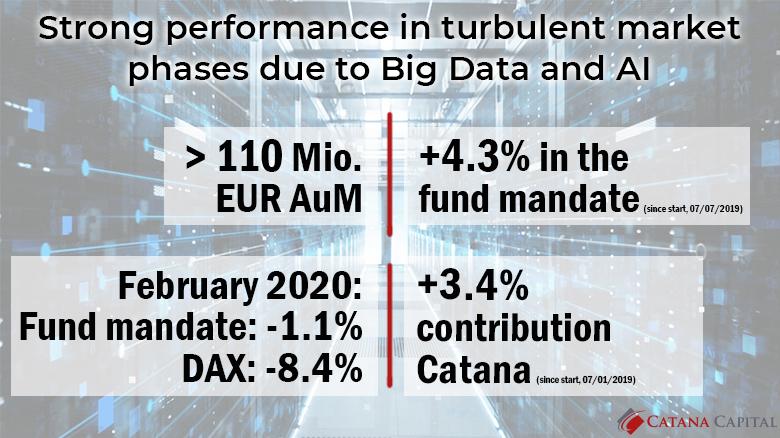

Catana Capital's overlay strategy with successful month in a turbulent market ph …

03/09/2020, Frankfurt: After Catana Capital successfully launched an overlay strategy for an existing fund in October 2019 and exceeding the EUR 100m AuM mark, the Frankfurt asset manager can now look back on a very positive month in an exceptionally turbulent market phase. While the German DAX index lost about five percent since start of the mandate in July 2019, the fund mandate with Catana's overlay strategy was able to…

Catana Capital launches overlay strategies and crosses EUR 100 million (AuM) lev …

Frankfurt am Main, October 09, 2019: Following the successful market launch of the Data Intelligence Fund (ISIN: DE000A2H9A68) by the innovative Asset Manager Catana Capital, the Frankfurt-based FinTech now offers additional customized overlay strategies for institutional clients to stabilize the performance of existing funds.

Within the framework of the overlay strategies, various sub-models of Catana Capital are applied and implemented via DAX Future Short positions. In order to meet customer requirements…

Catana Capital launches Data Intelligence Fund

- Combination of Big Data analysis and Artificial Intelligence forms basis of investment decision

- Selective investment in European Large Cap stocks

- Attractive risk-return profile due to management of exposure level via index futures

Frankfurt am Main, 04. December. The Frankfurt based Asset Manager Catana Capital launches the Data Intelligence Fund (DE000A2H9A68), an innovative UCITS fund, that relies entirely on Big Data and Artificial Intelligence (AI).

For the investment decisions, internet data on…

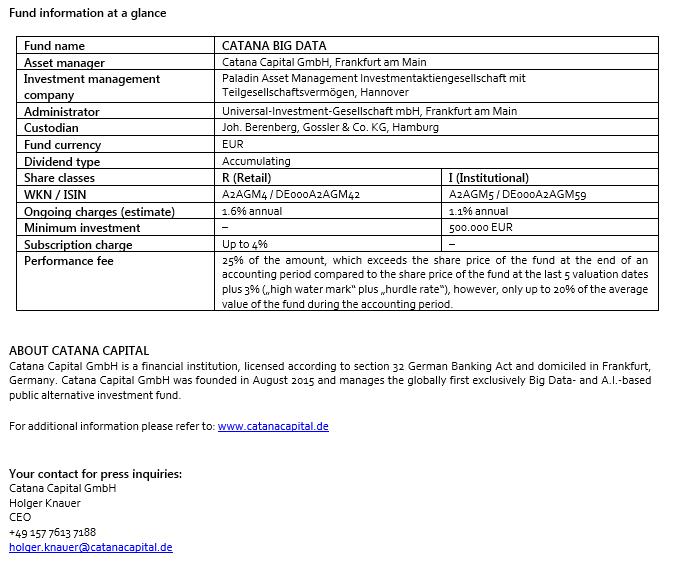

Worldwide first Big Data-based fund “CATANA BIG DATA“ is Germany's most inno …

- Catana's fund "CATANA BIG DATA" ranked first in the category "Fund Innovations" at the 2017 Fund Awards of FERI EuroRating Services

- Catana Capital was able to compete against well-known fund providers such as Credit Suisse, Deutsche Bank, Blackrock and LBBW

- Automated Big Data analysis forms basis of investment decision of the fund

- Focused investment strategy in DAX stocks and DAX futures without leverage allows market independent positioning

Frankfurt am Main,…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…