Press release

Indonesia Car Finance Market is further expected to reach a Market Size of around USD 1366 Billion by the year ending 2024: Ken Research

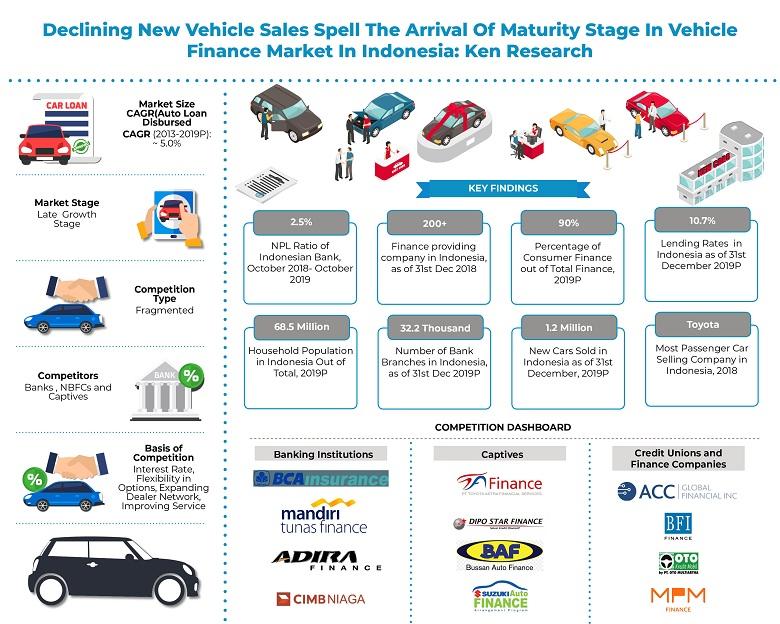

The report provides a comprehensive analysis of the Indonesia Car finance market including market evolution, market overview, market genesis, and market size and market segmentation. Extensive focus has been placed in quantifying the credit disbursed and a number of vehicles financed, both new and used. The report covers aspects such as market segmentation (by loan tenure, new and used C and type of Lending Institution), customer perspective in the market and snapshot on online Aggregating ecosystem in Indonesia. Competitive landscape of major lenders Bank of Central Asia (BCA Finance), Mandiri Bank (Mandiri Tunas Finance), Danamon Bank (Adira Dinamika Finance), CIMB Niaga , Bank Rakyat Indonesia, Bank Negara Indonesia, Megabank (WOM), ACC Finance, BFI Finance, Oto Multiartha, MPM Finance, Rabana Investindo, Toyota Astra Finance (Toyota and Daihatsu), Dipo Star Finance (Mitsubishi), Bussan Car Finance (Yamaha), Suzuki Car Finance (Suzuki). The report also covers the future industry analysis (by credit disbursed and new and used Car Finance), future market segmentation, growth opportunities, up-coming business models, government regulations and analyst recommendations.• Strong credit demand from businesses and consumers allowed for significant net interest rate margins, helping commercial lenders generate handsome earnings on their loan business.

• Indonesia's financial services authority (OJK) has removed down payment requirements for vehicle loans extended by some multi-finance companies in a bid to boost economic growth.

• It is also expected that the spread of online lending, models will continue in the future. Lead Generation, Online Lending, Loan Aggregation and Technology trends such as Blockchain, Artificial Intelligence, and Fin-tech are expected to impact and disrupt the traditional indirect lending model in the market.

Harnessing Fintech to achieve financial inclusion: FinTech has an ability to solve Indonesia’s financial inclusion challenges, which include being an archipelago country with limited infrastructure and a lack of credit information on corporates and individuals. Due to advances in technology and the emergence of Fin-tech startups, which are leveraging their resources to improve the lending experience for the consumer, the market has become more efficient and competitive. Developments in financial technology have allowed for various improvements such as quick retrieval of documents, quicker transactions and customized services based on the customer’s preferences. Car vehicle financing has become seamless, fast and transparent leading to improved operations. However, a key challenge is the lack of credit scoring data. Fintech companies are seeking to overcome this through credit-assessment built on alternative data, including airtime usage.

Changing Nature of ownership: Consumers in Indonesia are increasingly moving forward to accommodate newer models of mobility and prefer partial ownership of vehicles instead of full ownership. Leasing and Car Rental were foreign concepts in Indonesia a couple of years ago, however, they are now some of the growing operating models in the automobile industry in Indonesia. This perception shift is forcing lenders to adopt new models and incorporate newer products in their portfolio offerings to consumers.

Analysts at Ken Research in their latest publication “Indonesia Car Finance Market Outlook to 2024: Growing Prominence of Captive Finance Companies Backed by Surging Car Sales to Drive Market Growth”, believe that the Indonesia Car Finance market demand is likely to follow a stable trend in the near future due to a forthcoming Increase in used Cars sales and a shift towards newer models of mobility such as car-sharing and leasing, which will, in turn, help the economy grow as well. Some positive factors expected to impact the market is the influx of digitization based lending models (Introduction of Fintech Products), the spread of customized loan products and a further rise in the penetration rate of C finance. The market is anticipated to register a positive CAGR of ~5.3% in terms of Credit Disbursed during the forecasted period 2019P-2024.

For More Information On The Research Report, Refer To Below Link:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-car-finance-market-outlook/286575-93.html

Key Segments Covered:-

By New and Used Cars

New cars

Used cars

By Lender Institutions

Banks

Captives

Multi Finance Companies (NBFCs)

By Loan Tenure between New and Used Cars

Two Years

Three Years

Four Years

Five Years

One year

Five Years or more

Key Target Audience

Existing Car Finance Companies

Banks

Captive Finance Companies

Credit Unions

Private Finance Companies

New Market Entrants

Government Organizations

Investors

Car mobile Associations

Car mobile OEMs

Time Period Captured in the Report:-

Historical Period: 2013-2019P

Forecast Period: 2019P-2024

Key Companies Covered:-

Banks

Bank of Central Asia (BCA Finance)

Mandiri Bank (Mandiri Tunas Finance)

Danamon Bank (Adira Dinamika Finance)

CIMB Niaga

Bank Rakyat Indonesia

Bank Negara Indonesia

Megabank (WOM)

NBFCs

ACC Finance

BFI Finance

Oto Multiartha

MPM Finance

Batavia Prosperindo

Radana Bhaskara

Indomobil Multi Jasa

Mandala Multifinance

Tifa Finance

Adira Quantum Multifinance

Clemont Finance Indonesia

Captives

Toyota Astra Finance (Toyota and Daihatsu)

Dipo Star Finance (Mitsubishi)

Bussan Auto Finance (Yamaha)

Suzuki Auto Finance (Suzuki)

Key Topics Covered in the Report:-

Executive Summary

Research Methodology

Indonesia Car Finance Market Overview and Genesis

Value Chain Analysis of Indonesia Car Finance Market, 2019P

Indonesia Finance Market Value Chain Analysis

Indonesia Car Finance Market Size, 2013-2019P

Indonesia Car Finance Market Segmentation

Major Trends and Development in Indonesia Car Finance Market

Regulatory Framework in the Indonesia Car Finance Market

Product Feature on Indonesia Car Finance Market

Related Reports by Ken Research:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/vietnam-auto-finance-market/180197-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market/179514-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/227542-93.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@Kenresearch.Com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Indonesia Car Finance Market is further expected to reach a Market Size of around USD 1366 Billion by the year ending 2024: Ken Research here

News-ID: 1875791 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…