Press release

US Vehicle Finance Market is Further Expected to Reach a Market Size of around USD 1366 Billion by the year ending 2023: According to a Market Research Report by Ken Research

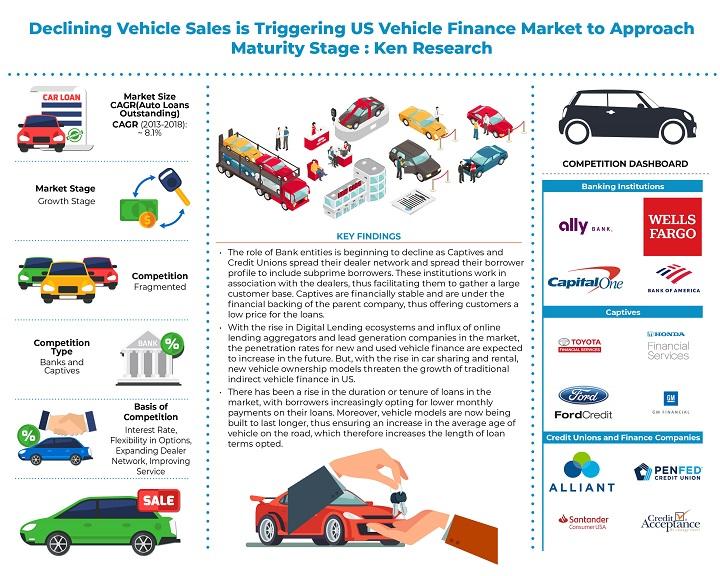

• It is expected that by the year ending 2023, financing towards new vehicles when expressed by credit disbursed would continue to lead the market share. Whereas, pre-owned car financing shall enhance owing to rising government initiatives towards the segment.• Banks and Captives are expected to continue their dominance in the market in the future, owing to their vastly expanding dealership networks and vast variety of loan products offered.

• It is also expected that the spread of online lending models will continue in the future. Lead Generation, Online Lending, Loan Aggregation and Technology trends such as Blockchain, Artificial Intelligence and Fin-tech are expected to impact and disrupt the traditional indirect lending model in the market.

The report provides a comprehensive analysis of the US vehicle finance market including market evolution, market overview, market genesis, market size and market segmentations. Extensive focus has been placed in quantifying the credit disbursed and auto loans outstanding and number of vehicles financed. The report covers aspects such as market segmentation (by loan tenure, risk tier, type of vehicles, new and used vehicles and type of institutions), customer perspective in the market and snapshot on online lending ecosystem in the US. Competitive landscape of major lenders including Ally Financial, Bank of America, Capital One, Wells Fargo, Chase Auto Finance, Toyota Motor Credit, Ford Motor Credit, American Honda Finance Corporation, GM Financial, Nissan Motor Acceptance, Credit Acceptance Corporation, Santander Consumer USA and Pentagon Federal Credit Union. The report also covers future industry analysis (by credit disbursed and auto loan outstanding), future market segmentation, PESTEL Analysis, growth opportunities, up-coming business models, government regulations and analyst recommendations.

Technological Advancement in the US Financial Sector: Due to advances in technology and emergence of Fin-tech startups, who are leveraging their resources to improve the lending experience for the consumer, the market has become more efficient and competitive. Developments in financial technology has allowed for various improvements such as quick retrieval of documents, quicker transactions and customized services based on the customer’s preferences. Motor vehicle financing has become seamless, fast and transparent leading to improved operations.

Changing Mobility Scenario: Consumers in the US are increasingly moving forward to accommodate newer models of mobility and are preferring partial ownership of vehicles instead of full ownership. Leasing and Car Rental are strongly growing operating models in the automobile industry in the US. This perception shift is forcing lenders to adopt new models and incorporate newer products in their portfolio offerings to consumers.

Analysts at Ken Research in their latest publication “US Vehicle Finance Market Outlook to 2023 –By Banks and Non Bank Entities including Captives and Credit Unions and Finance Companies (Auto Loan Portfolio), By New and Used Vehicles, By Type of Vehicle Financed (Passenger Cars and Light Trucks), By Loan Time Period and By Risk Category” believe that the US Vehicle Finance market demand is likely to follow a slight growth trend in the near future due to a forthcoming slowdown in light vehicle sales and a shift towards newer models of mobility such as car sharing and leasing. Some positive factors expected to impact the market, are the influx of digitization based lending models, the spread of customized loan products and a further rise in the penetration rate of vehicle finance. The market is anticipated to register a positive CAGR of ~4% in terms of AUM during the forecasted period 2018-2023.

For more information on the market research report, please refer to the below link:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/us-vehicle-finance-market-outlook/252780-93.html

Key Segments Covered

By New and Used Vehicle

New Vehicle

Used Vehicle

By Type of Vehicle

Passenger Cars

Light Trucks

By Lender Category

Banks

Captives and BHPH

Credit Unions

Private Finance Companies

By Risk Category between New and Used Vehicles

Super Prime

Prime

Non-prime

Sub-prime

Deep Sub-rime

By Loan Tenure between New and Pre-Owned Motor Vehicles and

Less than 3 Years

Three Years

Four Years

Five Years

Six Years

Seven Years or more

Key Target Audience

• Existing Auto Finance Companies

• Banks

• Captive Finance Companies

• Credit Unions

• Private Finance Companies

• New Market Entrants

• Government Organizations

• Investors

• Automobile Associations

• Automobile OEMs

Time Period Captured in the Report:

• Historical Period: 2013-2018

• Forecast Period: 2018-2023

Key Companies Covered:

• Banks

• Ally Financial

• Wells Fargo

• Bank of America

• Chase Auto Finance

• Capital One

• Captives, Credit Unions and Finance Companies

• Toyota Motor Credit Corporation

• Ford Motor Credit

• Nissan Motor Acceptance Corporation

• GM Financial

• American Honda Motor Corporation

• Credit Acceptance

• Santander Consumer USA

• Pentagon Federal Credit Union

Key Topics Covered in the Report

• Executive Summary

• Research Methodology

• US Vehicle Finance Market Evolution

• US Vehicle Finance Market Overview and Genesis

• US Vehicle Finance Market Ecosystem, 2018

• US Vehicle Finance Market Value Chain Analysis

• US Vehicle Finance Market Size, 2013-2018

• US Vehicle Finance Market Segmentation, 2013-2018

• Major Trends and Development in US Vehicle Finance Market

• Regulatory Framework in the US Vehicle Finance Market

• Snapshot on Digitization of Vehicle Finance in US

• Customer Perspective in US Vehicle Finance Market

• Competitive Landscape containing Company and Product Profiles in the US Vehicle Finance Market

• US Vehicle Finance Market Future Outlook and Projections, 2018-2023

• Analyst Recommendations for the US Vehicle Finance Market

Other Related Reports:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/vietnam-auto-finance-market/180197-93.html

The report provides a comprehensive analysis of Vietnam’s Auto Finance Market including market evolution, overview, genesis, market size and market segmentations. Extensive focus has been placed in quantifying the market size of this industry by credit disbursed, auto loans outstanding and number of vehicles financed. The report covers aspects such as market segmentation (by loan tenure, type of vehicles and type of institutions) and snapshot on general automotive space in Vietnam. Competitive landscape of major players including Toyota Financial Services Vietnam, Bank for Investment and Development of Vietnam, Sacom Bank, Vietnam International Bank, Saigon Hanoi Bank, Tien Phong Bank and HD Saison have been extensively covered mentioning company overview, major business strategies, USP, car finance delivered, products and services, market share, strengths, financials and various other parameters. Value chain analysis has been given prime importance covering role & nature of major entities along with mentioning the major vendor selection criteria and pain points. The report also covers future industry analysis (by credit disbursed and by auto loan outstanding), future market segmentation, SWOT analysis, growth opportunities, upcoming business models, government regulations and analyst recommendations.

Vietnam auto finance market has witnessed continuous growth since 2014 and has constituted approximately 6% of the overall South Asian auto finance market in 2018. The market compasses similar trends fairly in-line with domestic vehicle sales market, qualitatively & quantitatively with banks and non-banking financial institutions being the major operating entities in the space. The market is currently in its growth stage.

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market/179514-93.html

The report provides a comprehensive analysis of Thailand’s Auto Finance Market including market evolution, overview, genesis, market size and market segmentations. Extensive focus has been placed in quantifying the auto credit disbursed, auto loans outstanding and number of vehicles financed. The report covers aspects such as market segmentation (by loan tenure, type of vehicles, new and used cars and type of institutions) and snapshot on general automotive space in Thailand. Competitive landscape of major players including Thanachart Bank, Bank of Ayudhya, Siam Commercial Bank, Ayudhya Capital Auto Lease, Kasikorn Bank and TISCO Bank have been extensively covered. The report also covers future industry analysis (by credit disbursed and by auto loan outstanding), future market segmentation, SWOT analysis, growth opportunities, upcoming business models, government regulations and analyst recommendations.

Thailand auto finance market played an essential role in the overall GDP contribution in the Thai economy. After witnessing a burst in 2015, the market is currently placed in its recovery phase registering a slow-moving growth rate. Major operations are conducted by three types of entities namely, banks & subsidiaries, captive finances and non bank financial institutes. Numerous new business strategies were adopted by major players including the launch of “Cash Your Car”, First Car Buyer Scheme, and Floor Plan Model with competitors indulging in maintaining extensive collaborations with luxury dealers like Volvo for product sales expansion.

Thailand auto finance market on the basis of total credit disbursed has expanded registering a CAGR of close to 4% during 2013-2018. The number of automobiles financed witnessed a CAGR of close to 6% owing to an increase in the household disposable income and more affluent middle class in the economy. Two-wheelers market experienced a growth with the rise in motorcycle demand fueled by Thai farmers. Growing consumer confidence index, constant prime lending rates, growing car sales and evolving used car market have been the major growth factors. In terms of total auto loans outstanding, the market registered a CAGR of almost 5% during the review period.

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/227542-93.html

The report titled provides a comprehensive analysis of Philippines’ auto finance market including market evolution, market overview, market genesis, market size and market segmentations. Extensive focus has been placed in quantifying the auto credit disbursed auto loans outstanding and number of vehicles financed. The report covers aspects such as market segmentation (by loan tenure, type of vehicles, new and used cars and type of institutions) and snapshot on general automotive space in Philippines. Comparative landscape of major banks including Metro Bank, BDO, Ps Bank, East West Bank, Philippine National Bank (PNB Saving Bank), Bank of the Philippine Islands, RCBC, May Bank Philippines Incorporated and others as well as the comparative landscape of major NBFCs including the Toyota Financial Services Philippines Corporation (TFSPH), MAFS, Unistar Credit and Finance Corporation, Radio Wealth finance Company, Asia Link Finance Corporation and others have been extensively covered. The report also covers future industry analysis (by credit disbursed and auto loan outstanding), future market segmentation, SWOT analysis, growth opportunities, up-coming business models, government regulations and analyst recommendations.

Philippines auto finance market has been identified in its growth stage. The auto finance market tends to align itself with the domestic market for automobiles. Given its relation with this huge market, the sector naturally plays an important role in the overall growth of the economy. During the last 5 years, the auto finance market has boomed as demand and supply for automotives was growing at double digits year on year. Lenders (supply side entities), in this period have evolved to provide a range of innovative products and services to further improve attraction and penetration of the market. There have been various factors driving the growth of the Philippines auto finance market by value as well as by credit disbursed. Some of these factors are the growing economy of Philippines, increasing motorization rate, increased disposable income leading to an increase in purchase of automobiles and the advent of web aggregators. Along with these factors, an increase in per capita income has led more households to own an automobile in Philippines.

https://www.kenresearch.ae/banking-financial-services-and-insurance/loans-and-advances/indonesia-car-finance-market/142267-93.html

The report provides a comprehensive analysis of the car finance market in Indonesia. The report covers aspects such as the market size of the Indonesia Car Finance market segmentation on the basis of type of car financed, tenure of loan and type of financial institution. The report also covers the competitive landscape, government regulations, customer preferences, and value chain analysis of the Indonesia Car Finance Market. In addition to this, the report also covers company profiles and product portfolio of major players. This report will help industry consultants, car finance providers, potential entrants and other stakeholders to align their market centric strategies according to the ongoing and expected trends in the future.

Indonesia car finance market is in the growing stage. It is dominated by the unorganized players as they offer simpler documentation and convenient car finance options. The market has witness increasing use of technology such as simulation tools, online application and payment methods and others.

Contact Us:

Ankur Gupta, Head Marketing

Ken Research Private Limited

Ankur@kenresearch.com

+91-9015378249

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Vehicle Finance Market is Further Expected to Reach a Market Size of around USD 1366 Billion by the year ending 2023: According to a Market Research Report by Ken Research here

News-ID: 1865594 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…