Press release

UAE ATM Managed Services Market Size is expected to rise to AED 0.3 Billion in terms of Revenue by the year ending 2024: Ken Research

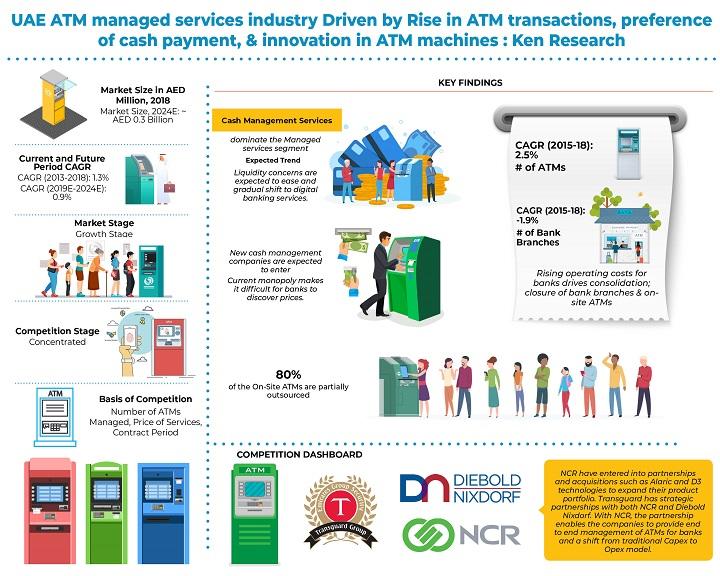

Key Findings• UAE ATM Managed Services Market size is expected to grow at a forecasted CAGR of 0.9% during the forecast period 2018-2024.

• Cash Management Services market is expected to grow at a CAGR of 2.9% for the period 2018-2023. The segment will continue to dominate the UAE ATM Managed services segment as liquidity concerns are expected to ease in the future and shift to digital banking services will be gradual.

• New companies in cash logistics market are expected to enter in the future as the current monopoly makes it difficult for banks to discover prices.

• The ATM Supply segment is expected to grow at a forecasted CAGR of 1.2% during 2018-2024. ATM suppliers are expected to launch cash management services as a value added service along with their ATM machines and software solutions. Also, innovation in ATM Machines will further drive the UAE ATM supply market in the future. Technology and software upgradation will entail lesser maintenance require-ments and lower costs for Banks.

Reduction in On-Site ATMs in the Country: As of 2018, nearly 66.0% of the banks’ ATMs are located Off-Site. As rising costs drives consolidation in banking industry, these entities are expected to close down branches and therefore, on-site ATMs. This would tend to increase the Off-Site ATMs further and also drive the outsourcing of managing such ATMs. Presently, around 80.0% of the On-Site ATMs are partially outsourced. Banks are expected to completely outsource these ATMs in the future.

Emergence of New Business Models: Currently, banks have completely outsourced off-site ATMs and most of the on-site ATMs. It is expected that new models of ATM outsourcing will drive the market in future. Emergence of white label ATMs which are managed by non-banking financial entities will be a possibility in the future as banks would further be able to cut costs. Different contracts between banks and managed service providers such as CAPEX and OPEX may allow newer companies to operate in the market.

Entry of New Cash Management Companies: Currently, Transguard is the only company operating in UAE that provides cash management services. As the company has a monopoly in UAE, banks are price takers. This has made it difficult for banks to discover prices. NCR and Diebold both do not provide cash management services in the UAE. It is expected that international cash logistics companies may enter the UAE market to challenge Transguard’s monopoly.

Analysts at Ken Research in their latest publication “UAE ATM Managed Services Market Outlook to 2024 – By Off-Site and On-Site ATMs and By Type of Service (Cash Management Services, ATM Maintenance Services and ATM Supply)” believe growth in cash circulation in the economy, reliance on cash for all transactions, innovation in ATM Machine technology and software and rising need for banks to outsource ATM management to cut costs and entry of new cash management services companies are some of the factors that will drive the market to register a 0.9% CAGR growth in terms of revenue for the period 2018-2024.

For more information on market research report, please refer to the link below:

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/uae-atm-managed-services-market/263653-93.html

Key Segments Covered

• By Location of ATM

On-Site

Off-Site

• By Type of Services

Cash Management Services

ATM Maintenance Services

ATM Supply

Key Target Audience

• Banking and Financial Services Companies

• Investors and Venture Capital Firms

• Technology Service Providers

• Government Entities

• Cash Management Companies

• ATM Machine Manufacturers

Time Period Captured in the Report:

• Historical Period: 2013 -2018

• Forecast Period: 2018-2024

Companies Covered:

• Transguard

• NCR Corporation

• Diebold Nixdorf

Key Topics Covered in the Report

• UAE ATM Managed Services Market Introduction

• Market Ecosystem of UAE ATM Managed Services Industry, 2018

• Value Chain Analysis of UAE ATM Managed Services Industry

• UAE ATM Managed Services Market by Revenues, 2013-2018

• UAE ATM Managed Services Market Segmentation, 2018

• Major Cost Components and Profitability Analysis of ATMs in UAE, 2018

• Issues and Challenges in UAE ATM Managed Services Industry

• Trends and Development in UAE ATM Managed Services Industry

• Regulations in the UAE ATM Managed Services Industry

• Snapshot of UAE ATM Supply Market, 2018

• Company Profiles of Major Players in UAE ATM Managed Services Market

• UAE ATM Managed Services Future Market Outlook and Projections, 2018-2024

• Analyst Recommendations

Related Reports

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/indonesia-atm-managed-service-market-outlook/228785-93.html

https://www.kenresearch.ae/banking-financial-services-and-insurance/banking/saudi-arabia-atm-managed-service-market/215822-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/banking/india-atm-cash-management-market-forecast-2023-/154994-93.html

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release UAE ATM Managed Services Market Size is expected to rise to AED 0.3 Billion in terms of Revenue by the year ending 2024: Ken Research here

News-ID: 1863807 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…