Press release

Qatar Vehicle Finance Market is further Expected to Reach a Market Size of around QAR 25.2 Billion in terms of Auto Loans Outstanding & QAR 9.6 Billion in terms of Auto Loans disbursed by the year ending 2023: Ken Research

• Captives & NBFC’s are expanding their auto loan portfolios at an increasing rate. Many Automobile OEM’s, especially luxury brands like BMW, Audi etc. have started providing loans with 0% down-payments to increase the sale of their vehicles. This has proved very effective for these companies and has driven the sale of these dealerships.• Competition in the Qatar automobile market is expected to intensify as the market moves towards maturity. That means pricing wars will drive transaction prices down and lead to constant readjustment of after sales package prices (regular maintenance and servicing, parts etc.) in line with competition.

• The cost of vehicle ownership in Qatar is low compared to other countries globally, due to a favorable tax structure. Availability of attractive insurance and financing options also makes it convenient to own a car for a Qatari. Moreover, the lack of public transport system means that the availability of alternative means of transportation is limited which results in higher penetration of vehicle ownership in the country.

Increase in Competition: The auto finance market in Qatar is dominated by Banks, however Captives and NBFCs are increasing their presence in the Qatar auto finance market in the past few years. As a result, Banks are now forced to rethink their lending strategy to address their declining market share. The market is expected to be highly competitive in the future with lenders competing on interest rates or monthly repayment offered. Moreover, with the sales of used vehicles growing continually, lenders will be competing to capture this space as well with attractive financing options for new customer acquisitions.

Increasing Convenience by Digitization: With the number of millennial car purchasers increasing and increasing ease of digital interactions; digitalization and technology is set to play an important role in the Qatar auto finance industry in future and with technologies such as fin-tech and cloud services coming to the landscape, the loan process is on its way from being extremely complicated and time consuming to being increasingly streamlined and super fast.

Increasing Penetration Rate: Increasing online marketing and customer acquisition capabilities of dealers and lenders, the proportion of people who finance the purchase of a vehicle will increase. Dealerships partnering with online lead generation companies will help the stakeholders in the market to carefully target and expand their total addressable market. The used vehicles segment will see an increase in the penetration ratio in term of number of units and NBFCs & OEM captives are expected to capture majority of the share in auto financing requirement of consumers in this segment.

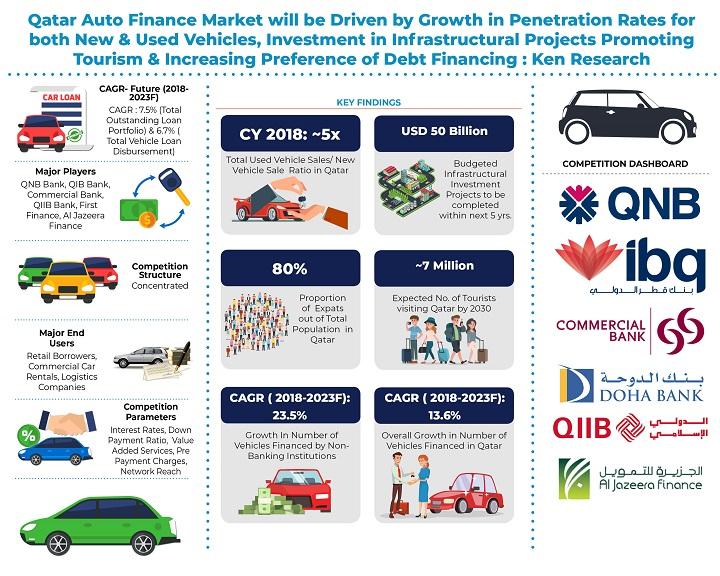

Analysts at Ken Research in their latest publication “Qatar Auto Finance Market Outlook to 2023 –By Banks, Non Banking Financial Companies and Captives, By New and Used Vehicles, By Type of Vehicle Financed (Motor Bikes, Cars and Light Commercial Vehicles) and By Loan Time Period” believe that the Qatar Auto Finance market demand is likely to follow a growth trend in the near future due to increasing penetration rates in used vehicles financing, increasing preference of debt financing & rising new vehicles sales. Some positive factors expected to impact the market, are the introduction of digitalization based lending models, the spread of customized loan products and a further rise in the penetration rate of both new & used vehicle finance. The market is anticipated to register a positive CAGR of 7.5% in terms of Loans Outstanding & CAGR of 6.7% in terms of Credit Disbursed during the forecasted period 2019-2023.

For more information on the research report, refer to below link:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/qatar-auto-finance-market-outlook-to-2023/274062-93.html

Key Segments Covered

By New and Used Vehicle

New Vehicle

Used Vehicle

By Type of Vehicle

Motor Bikes

Cars

Light Commercial Vehicles

By Lender Category

Banks

Captives

Non-Banking Financial Companies

By Loan Tenure between New and Pre-Owned Motor Vehicles

One Year

Two Years

Three Years

Four Years

Five Years or More

Key Target Audience

• Existing Auto Finance Companies

• Banks

• Non-Banking Financial Companies

• New Market Entrants

• Government Organizations

• Investors

• Automobile Associations

• Automobile OEMs

Time Period Captured in the Report:

• Historical Period: 2014-2018

• Forecast Period: 2019F-2023F

Key Companies Covered:

• Banks

• Qatar National Bank

• Doha Bank

• Commercial Bank

• International Bank of Qatar

• Qatar Islamic International Bank

• Qatar Islamic Bank

• Masraf Al Rayan

• Non-Banking Financial Companies

• First Finance Company (Barwa Bank)

• Al Jazeera Finance

Key Topics Covered in the Report

• Executive Summary

• Research Methodology

• Qatar Vehicle Finance Market Overview and Genesis

• Qatar Vehicle Finance Market Size, 2014-2018

• Qatar Vehicle Finance Market Segmentation, 2014-2018

• Major Trends and Development in Qatar Vehicle Finance Market

• Regulatory Framework in the Qatar Vehicle Finance Market

• A Snapshot on Digitalization of Auto Finance in Qatar

• Customer Perspective in Qatar Vehicle Finance Market

• Competitive Landscape containing Company Profiles in the Qatar Auto Finance Market

• Qatar Vehicle Finance Market Future Outlook and Projections, 2019F-2023F

• Analyst Recommendations for the Qatar Auto Finance Market

Related Reports:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/us-vehicle-finance-market-outlook/252780-93.html

https://www.kenresearch.ae/banking-financial-services-and-insurance/loans-and-advances/vietnam-auto-finance-market/180197-93.html

https://www.kenresearch.ae/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market/179514-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/227542-93.html

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Qatar Vehicle Finance Market is further Expected to Reach a Market Size of around QAR 25.2 Billion in terms of Auto Loans Outstanding & QAR 9.6 Billion in terms of Auto Loans disbursed by the year ending 2023: Ken Research here

News-ID: 1863727 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Qatar

Mawaqif Qatar, the leading car park operator in Qatar

Mawaqif Qatar has emerged as the leading car park operator in Qatar. The Company's reputation for expertise in parking operations, facilities management, technology development and infrastructure services has enabled it to partner with several reputable organizations and businesses in the region.

As part of its new project, Hamad Medical Corporation, Mawaqif Qatar implemented their state-of-the-art ticketless valet system consisting of a 100% cashless payment policy to provide customers with a seamless…

qatar engineering & construction company,china railway construction engineering …

ASCO Qatar Consulting Engineers (ASCO)

Al Bandary Engineering

Al Darwish Engineering Wll

Al Uthman Mechanical

AlKaun Group

Aljaber Engineering LLC

Anton Nehmeh

Arab Engineering Bureau

Arabian Construction Engineering Company (ACEC)

Arabian Mep Contracting

Arc De Triomphe

Black Cat Engineering Construction Wll

Boom Construction

CMTC

https://gzwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Descon Engineering

EHAF Consulting Engineers

Egis International

Electro Mechanical Engineering Company

Engineering Building Materials Co.

Erga Group Qatar

Etimaad

Get Qatar

Gulf Engineering and Industrial Consultancy

Jersey Group

https://gzwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

MEDGULF Construction Company

Mercury Engineering Qatar

Nael Bin Harmal

OB International

Prominent Qatar

Qatar Building Company

Qatar Integrated Building Solutions WLL

Seero Engineering…

Qatar World Bank International Remittance Report | Weekly Funding Limit Remittan …

Why is it important for exchange houses in Qatar to re-assess their current business positioning

Exchange houses in Qatar dominate the international remittance industry by facilitating more than 1 million transactions on a monthly basis. As of June 2021, there were 20 exchange houses operating with a total of 141 branches located in different provinces of Qatar. Al Dar for exchange works, established in 2006, operates highest number of ~21 branches…

International Remittance Industry in Qatar | Qatar Market share of Exchange Hous …

Qatar – 88% of Population are Expatriates

Qatar is home 2.8 Million population with more than 88% of population comprising of expats with India, Nepal, Philippines, Bangladesh, Sri Lanka, Egypt and others being key source countries. In 2019, outward remittances were recorded at 6.5% of total GDP of country with India being the prominent corridor of outward remittance transactions. During the period of 2013-19, there has been a multi-fold growth in…

Qatar Telecoms, Mobile and Broadband Market 2019 Upcoming Trends, Challenges and …

WiseGuyReports.com “Qatar - Telecoms, Mobile and Broadband - Statistics and Analyses” report has been added to its Research Database.

Scope of the Report:

Qatar - Telecoms

High focus on fixed and mobile broadband in Qatar The focus of fixed broadband network deployment has firmly shifted to fibre in Qatar, with the number of DSL connections declining by around 100,000 since they reached their peak in 2011. Today, 99% of households are in areas…

Qatar Telecoms, Mobile and Broadband Market Growth, Analysis, Challenges and Ind …

WiseGuyReports.com “Qatar - Telecoms, Mobile and Broadband - Statistics and Analyses” report has been added to its Research Database.

Scope of the Report:

Qatar - Telecoms

High focus on fixed and mobile broadband in Qatar The focus of fixed broadband network deployment has firmly shifted to fibre in Qatar, with the number of DSL connections declining by around 100,000 since they reached their peak in 2011. Today, 99% of households are in areas…