Press release

Philippines Auto Loan Outstanding Expected to Reach of over PHP 4,700 Billion by the Year ending 2023: Ken Research

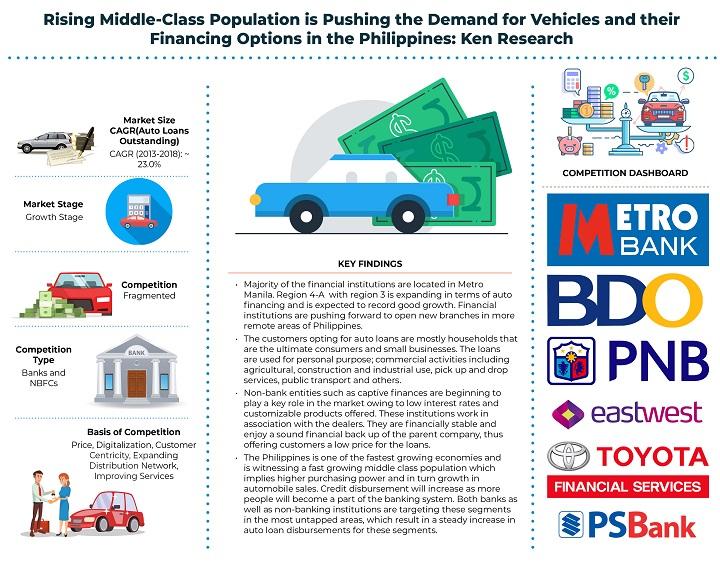

• New vehicle financing will continue to lead the market share in next 5 years. Pre-owned car financing shall enhance owing to rising government initiatives.• The share of multi finance companies has been projected to incline over the coming years. As compared to the banks, multi-finance companies generate better returns and offer customized and innovative credit products. These products are more appealing to masses and banks cannot provide such products because of the size of operations and standardization involved with the size.

• Various Fintech start-ups are likely to penetrate the market in order to expand them within the Philippines auto financing sector.

Technological Advancement in the Philippines Financial Sector: Due to advances in technology, the market has become more efficient and competitive. Developments in financial technology has allowed for various improvements such as quick retrieval of documents, quicker transactions and customized services based on the customers past preferences. Motor vehicle financing has become seamless, fast and transparent leading to improved operations. As a result, a positive outlook can be expected out of Filipino auto finance market.

Rising Middle Class Population: The Philippines is one of the fastest growing economies and is witnessing a fast growing middle class which implies higher purchasing power and in turn growth in automobile sales. As a result of this, credit disbursement will increase as more people will become a part of the banking system. Also, banks and non-banks are targeting these segments in the most untapped areas, which will also result in steady increase in auto loan disbursements for these segments.

The recovering nature of the market has opened avenues for change in operating models, thereby laying huge potential for future growth. Operational precision, consolidated and synchronized compliance-controls amongst various analogous regulatory organizations, generalization and standardization bought in licensing and documentation and digitalization are some of the key changes expected in the coming five years.

Analysts at Ken Research in their latest publication “Philippines Auto Finance Market Outlook to 2023 – By Banks and NBFCs including Captive Units (Auto Loan Portfolio and Motor Cycle Loan Portfolio), By New and Used Motor Vehicles, By Motor Vehicle Financed (Passenger and Commercial Vehicles), By Loan Time Period” believe that the Philippines Auto Finance demand would grow in the near future by opting digitalization and market innovation, providing customized services, focusing towards marketing and promotion, providing commercial and used vehicle financing and other factors. The market is further anticipated to register a positive CAGR of 17% in terms of AUM during the forecasted period 2018-2023.

For more information on the market research report, please refer to the below link:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/philippines-auto-finance-market-outlook/227542-93.html

Key Segments Covered

By Type of Motor Vehicle Loans Provided By Banks and NBFCs

Auto Loan Portfolio

Motor Cycle Loan Portfolio

By Type of Motor Vehicle

New Vehicle

Pre-Owned Vehicles

By Type of Motor Vehicle Financed

Passenger Vehicles

Passenger Cars

Utility Vehicles

Sports Utility Vehicles

Two Wheelers

Commercial Vehicles

Trucks

Buses

Trailers

By Time Period of Loan between New and Pre-Owned Motor Vehicles and

One Year

Two Year

Three Year

Four Year

Five Years

By Vehicles Registered Under Various Regions

Key Target Audience

• Existing Auto Finance Companies

• Banks & Subsidiaries

• Auto OEM Captive Finance Companies

• Non Banking Financial Institutions

• New Market Entrants

• Automobile Financing Companies

• Government Organizations

• Investors

• Automobile Associations

• Automobile Original Equipment Manufacturer

Time Period Captured in the Report:

• Historical Period: 2013-2018

• Forecast Period: 2018-2023

Key Companies Covered:

• Banking Institutions

Metro Bank

BDO Bank

PS Bank

East West Bank

Philippine National Bank

Bank of the Philippine Islands

Maybank Philippines Incorporated

Others

• Non-Banks and Dealership Financing

Toyota Financial Services Philippines Corporation (TFSPH)

MAFS

Unistar Credit and Finance Corporation

Radio Wealth finance Company

Others

Key Topics Covered in the Report

• Philippines Auto Finance Market Evolution

• Philippines Auto Finance Market Overview and Genesis

• Philippines Auto Finance Market Ecosystem, 2018

• Philippines Auto Finance Market Value Chain Analysis

• Philippines Auto Finance Market Size, 2013-2018

• Philippines Auto Finance Market Segmentation, 2013-2018

• Major Trends and Development in Philippines Auto Finance Market

• Regulatory Framework in the Philippines Auto Finance Market

• Snapshot on Philippines Automotive Sales And Manufacturing Market, 2013-2023

• Comparative Landscape in the Philippines Auto Finance Market

• Philippines Auto Finance Market Future Outlook and Projections, 2018-2023

• Analyst Recommendations for the Philippines Auto Finance Market

Other Related Reports:

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/vietnam-auto-finance-market/180197-93.html

The report provides a comprehensive analysis of Vietnam's Auto Finance Market including market evolution, overview, genesis, market size and market segmentations. Extensive focus has been placed in quantifying the market size of this industry by credit disbursed, auto loans outstanding and number of vehicles financed. The report covers aspects such as market segmentation (by loan tenure, type of vehicles and type of institutions) and snapshot on general automotive space in Vietnam. Competitive landscape of major players including Vietinbank, Bank for Investment and Development of Vietnam, Vietnam International Bank, Saigon Hanoi Bank, Tien Phong Bank, FE Credit, Home Credit and HD Saison have been extensively covered mentioning company overview, major business strategies, USP, car finance delivered, products and services, market share, strengths, financials and various other parameters. Value chain analysis has been given prime importance covering role & nature of major entities along with mentioning the major vendor selection criteria and pain points. The report also covers future industry analysis (by credit disbursed and by auto loan outstanding), future market segmentation, SWOT analysis, growth opportunities, upcoming business models, government regulations and analyst recommendations. The report is useful for existing auto finance companies, potential entrants, investors and other stakeholders to align their market centric strategies according to ongoing and expected trends in the future.

https://www.kenresearch.ae/banking-financial-services-and-insurance/loans-and-advances/thailand-auto-finance-market/179514-93.html

The report provides a comprehensive analysis of Thailand’s Auto Finance Market including market evolution, overview, genesis, market size and market segmentations. Extensive focus has been placed in quantifying the auto credit disbursed, auto loans outstanding and number of vehicles financed. The report covers aspects such as market segmentation (by loan tenure, type of vehicles, new and used cars and type of institutions) and snapshot on general automotive space in Thailand. Competitive landscape of major players including Thanachart Bank, Bank of Ayudhya, Siam Commercial Bank, Ayudhya Capital Auto Lease, Kasikorn Bank and TISCO Bank have been extensively covered. The report also covers future industry analysis (by credit disbursed and by auto loan outstanding), future market segmentation, SWOT analysis, growth opportunities, upcoming business models, government regulations and analyst recommendations.

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-car-finance-market/142267-93.html

The report provides a comprehensive analysis of the car finance market in Indonesia. The report covers aspects such as the market size of the Indonesia Car Finance market segmentation on the basis of type of car financed, tenure of loan and type of financial institution. The report also covers the competitive landscape, government regulations, customer preferences, and value chain analysis of the Indonesia Car Finance Market. In addition to this, the report also covers company profiles and product portfolio of major players. This report will help industry consultants, car finance providers, potential entrants and other stakeholders to align their market centric strategies according to the ongoing and expected trends in the future.

Contact Us:

Ankur Gupta, Head Marketing

Ken Research Private Limited

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Auto Loan Outstanding Expected to Reach of over PHP 4,700 Billion by the Year ending 2023: Ken Research here

News-ID: 1860608 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Auto

Auto Leads: Revolutionizing Lead Generation for Auto Detailers

Auto Leads, a digital marketing company specializing in helping auto detailers grow their businesses, has quickly become a leader in lead generation for the industry. Founded by Austin Kennedy, a former auto detailer with three years of hands-on experience, Auto Leads offers a solution to help detailers attract high-quality customers, particularly for premium services like Ceramic Coating.

What Auto Leads Is

Auto Leads focuses on digital marketing solutions for auto detailing businesses,…

Winter Park Auto Repair: Cech Auto Unveils Auto Repair Financing, Expert Service …

Image: https://www.getnews.info/wp-content/uploads/2024/10/1730165920.png

Cech Auto announces the launch of flexible auto repair financing, offering Winter Park customers accessible payment solutions for essential vehicle maintenance and repairs.

A leading Winter Park auto repair [https://www.cechauto.com/] shop, Cech Auto unveils its new auto repair financing option, providing customers with flexible payment solutions for all repair services. With competitive financing plans available, Cech Auto makes essential vehicle maintenance and repairs more accessible, ensuring that customers can address…

Brampton Auto Glass Announces New Comprehensive Auto Glass Solutions

Brampton, Ontario July 24 2024 - Brampton Auto Glass Company, a leading name in auto glass repair and replacement for the Brampton and Mississauga areas, announces a significant expansion of its service portfolio. This enhanced suite caters to the diverse needs of local vehicle owners, ensuring optimal safety and a flawless visual experience on the road.

Unwavering Commitment to Excellence and Customer Satisfaction

Brampton Auto Glass Company prioritizes excellence in everything…

Auto Locksmith America Revolutionizes Auto Locksmith Services Nationwide

Newsdesk, March 22, 2024 - Auto Locksmith America Revolutionizes Auto Locksmith Services Nationwide Employing state-of-the-art tools and technology, the company ensures a seamless, hassle-free experience for clients.

Auto Locksmith America, a prominent auto locksmith company headquartered in Mississippi, unveils its latest suite of services and enticing offers tailored to cater to a spectrum of auto locksmith needs. With nearly 14 years of steadfast service, the company stands as a beacon of…

Auto Chess Game Market | Auto Chess, Dota Auto Chess, Hearthstone, Honor Of King …

The global auto chess game market report is a comprehensive report that provides a detailed analysis of the current status and future trends of the auto chess game market worldwide. This report provides valuable information to industry stakeholders by offering an in-depth perspective on market dynamics, competitive landscape, growth opportunities, and key challenges faced by industry participants.

From the perspective of market dynamics, this report explores the factors driving the growth…

Auto Driveaway Provides Reliable and Safe Auto Shipping Services

FOR IMMEDIATE RELEASE

Philadelphia, PA: Recently, Auto Driveaway has been awarded for being one of the most reliable and secure auto shipping companies in the country by renowned entities. The company has more than 40 offices across the country that helps to track and update every detail about the consignment. Every delivery is managed professionally resulting in scheduled delivery without providing any damage, dent or issues to the vehicle.

The company provides…