Press release

South Africa International Remittance Market is Expected to Reach over ZAR 34 billion by 2023: Ken Research

• It is expected that by the end of 2023, Banks would continue to dominate the domestic market as being the most preferred channel of remittance. While in the international space, ADLAs & MTOs together would supersede banks with over 30% share in terms of value of international remittance transactions.• In terms of corridors, Angola-South Africa and Lesotho-South Africa are likely to showcase the highest CAGRs of close to 15% and 5% respectively during 2018-2023 in terms of total value of transactions in the inbound and outbound remittance space respectively.

• In domestic remittance market, the Urban to Rural Corridor is expected to showcase highest growth registering a CAGR of close to 11% by the end of the forecast period. In the next 5-7 years, the market growth is expected to be fueled by rising migration rates, simulative government regulations and declining remittance fees.

South Africa is expected to experience increased internal migration with the rising economic opportunities in the urban areas. The rural population is looking for prospects in the urban areas thus mounting the remittance market forward. The country continues to remain as being one of the costliest spaces to remit money from across the world. However, in the coming 5 years it is expected to see a decline in costs owing to the increasing rivalry and intense competition from the ADLAs. The government and banks in the country are increasingly focusing on financial inclusion moreover; radical technological innovations are expected to accelerate the same. Use of Bitcoin is expected to boom mainly as an easier and cheaper means for disposal to send money back to their families.

The South African market is expected to adopt digitalization at a rapid pace over the next 5 years. The smart phone users in South Africa would increase to 27.3 million users by 2022. This increase in penetration of technologically advanced mobile phones is expected to showcase the adoption of mobile wallets, e-wallets and other electronic modes of remittance services like WeChat across South Africa. South African government has been liberalizing their policies and regulatory frameworks for remittance service providers. The documentation, fee structure and business conducting guidelines are likely to be improvised by the regulators leading to a higher remittance business. The flexibility expected to be adopted by the government is serving as an incentive for both the service providers as well as the customers availing remittance services. The growth rate for mobile/digital channel is expected to be very high in the coming years since ADLAs are expected to be market leaders with their low pricing strategy focusing on making the services available to all the segments of the population. The market is also likely to expand in terms of the digital channels like mobile wallets and bitcoins which can be used readily for international transfers and deliver services within few hours.

People from SADC countries will continue to migrate to South Africa as a result of increasing income opportunities. As a result of increase in migration, the remittance sector is expected to showcase growth with rise in the value and volume of remittance across all major corridors. The government support policies are likely to increase and thereby augment the value of transactions remitted by the immigrants.

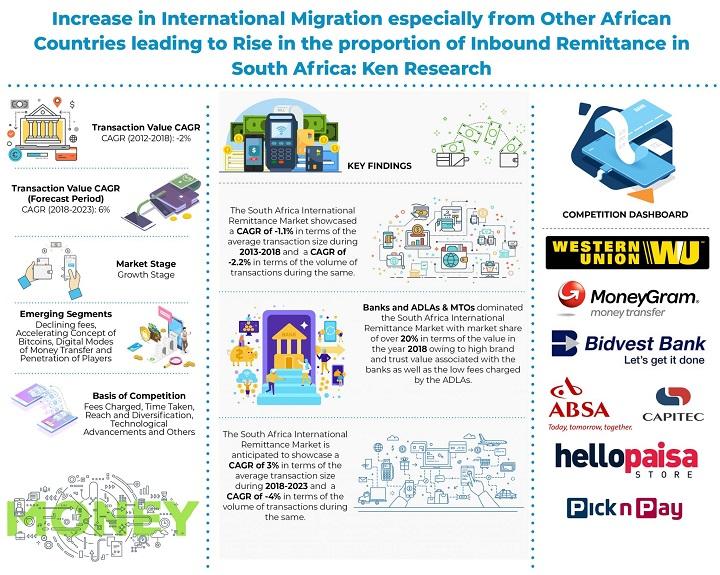

Ken Research in its latest study “South Africa Domestic and International Remittance Market Outlook to 2023 - By Channels Used (Banking Channels, Retailers, ADLAs & MTOs and Others), Remittance Corridors (Inbound-Outbound and Rural-Urban)” suggest that Western Union, MoneyGram, Hello Paisa, Mama Money and Mukuru together captured majority market share of the overall South Africa International Remittance market in 2018. The market is projected to witness a CAGR of close to 6% in terms of total value of transactions during 2018-2023.

For more information on the market research report please refer to the link below:

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/south-africa-domestic-international-market/193845-93.html

Key Segments Covered in South Africa International Remittance Market

• By Channels used (Value of Transactions)

o Banking channels,

o ADLAs & MTOs

o Retailers

o Others

• By International Inbound Remittance Flow Corridor (Value of Transactions)

o United Kingdom

o New Zealand

o Australia

o Angola

o Others

• By International Outbound Remittance Flow Corridor (Value of Transactions)

o Zimbabwe

o Lesotho

o Mozambique:

o Others

• By Work Profile (Value of Transactions)

Key Segments Covered in South Africa Domestic Remittance Market

• By Channels used (Value of Transactions)

o Banking channels,

o ADLAs & MTOs

o Retailers

o Others

• By Domestic Remittance Flow Corridor (Value of Transactions)

o Urban to Rural

o Urban to Urban

o Rural to Urban

• By Work Profile (Value of Transactions)

Key Target Audience

• Banks

• Money Transfer Operators

• ADLAs

• M-Wallet Companies

• Hawalas

• Convenience and Retail Stores

• Supermarket Chains

• South Africa Reserve Bank

• Bills and Payments Companies

• Investors & Venture Capital Firms

Time Period Captured in the Report:

• 2013-2018 – Historical Period

• 2019-2023 – Future Forecast

Companies Covered: ABSA Bank Limited, Albaraka Bank Limited, Bidvest Bank Limited, BNP Paribas SA – South Africa Branch, Capitec Bank Limited, China Construction Bank-Johannesburg Branch, Citibank-South Africa, Deutsche Bank AG-Johannesburg Branch, FirstRand Bank Limited, Habib Overseas Bank Limited, HBZ Bank Limited, HSBC Bank PLC–Johannesburg Branch, Investec Bank Limited, JPMorgan Chase Bank-Johannesburg Branch, Mercantile Bank Limited, Nedbank Limited, Sasfin Bank Limited, Societe Generale, Standard Chartered Bank–Johannesburg Branch, State Bank of India, The South African Bank of Athens Limited, The Standard Bank of South Africa Limited, First National Bank, Bank of Baroda, Bank of India, Bank of China, Bank of Taiwan, Western Union , Money Gram, Hello Paisa, Mama Money, Mukuru, Exchange4Free, Imali Express (Pty), Ace Currency Exchange (Pty), Forex World (Pty) Limited, Global Foreign Exchange (Pty) Limited, Inter Africa Bureau de Change (Pty) Limited, Interchange RSA (Pty) Limited, Master Currency (Pty) Limited, Sikhona Forex (Pty) Limited, Tourvest Financial Services (Pty) Limited, American Express Foreign Exchange Services, Tower Bureau de Change (Pty) Limited, Travelex Africa Foreign Exchange (Pty) Limited, Southeast Exchange Company (South Africa), Terra Payment Services South Africa (RF) (Pty), WorldRemit South Africa (Pty) Limited, Shoprite, Pep Stores, Pick n Pay, Checkers, Spar, Ackermans and Boxers.

Other Related Reports:

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/egypt-remittance-market/182340-93.html

The report provides a comprehensive analysis of International Remittance, Domestic Remittance, and Bill Payment Market in Egypt. It includes the transactions occurring in Egypt by major flow corridors, mode of transfer, inbound and outbound transactions, channel of transfer, and bill payment details such as type of bill payments and mode of bill payments. The report also covers the overall competitive landscape and company profiles of major Money Transfer Organizations in Egypt. The report concludes with market projection for future and analyst recommendations highlighting the major opportunities and cautions for the Egypt Remittance Market.

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/europe-international-remittance-market/194013-93.html

The report provides a comprehensive analysis of Europe international remittance market including market evolution, overview, genesis, market size and market segmentations. Extensive focus has been placed in quantifying the transaction value and volume over the period, 2013-2023. The report covers aspects such as market segmentation (by channels used, by sending and receiving countries, by inbound remittance point of contact and by top flow corridors) and a brief snapshot on the major sending countries in Europe Competitive landscape of major players including Western Union, MoneyGram, Ria Money Transfer, Transferwise, UAE Exchange, HSBC Bank, BNP Paribas, Lloyds Bank, Barclays Bank and XOOM by Paypal have been covered including company overview, major business strategies, USP, distribution network, remittance services offered, transfer speed and various other parameters. The report is useful for existing remittance companies, potential entrants, investors and other stakeholders to align their market centric strategies according to ongoing and expected trends in the future.

https://www.kenresearch.ae/banking-financial-services-and-insurance/financial-services/philippines-money-transfer-bill-payments-market/152427-93.html

The report provides a comprehensive analysis of Europe international remittance market including market evolution, overview, genesis, market size and market segmentations. Extensive focus has been placed in quantifying the transaction value and volume over the period, 2013-2023. The report covers aspects such as market segmentation (by channels used, by sending and receiving countries, by inbound remittance point of contact and by top flow corridors) and a brief snapshot on the major sending countries in Europe Competitive landscape of major players including Western Union, MoneyGram, Ria Money Transfer, Transferwise, UAE Exchange, HSBC Bank, BNP Paribas, Lloyds Bank, Barclays Bank and XOOM by Paypal have been covered including company overview, major business strategies, USP, distribution network, remittance services offered, transfer speed and various other parameters. The report is useful for existing remittance companies, potential entrants, investors and other stakeholders to align their market centric strategies according to ongoing and expected trends in the future.

https://www.kenresearch.ae/banking-financial-services-and-insurance/financial-services/nigeria-remittance-bill-payment-market/142292-93.html

The report provides a comprehensive analysis of international inbound, outbound, domestic remittance and bill payments market in Nigeria. The report covers market size, segmentation on the basis of inbound, outbound remittance, remittance channel, and mode of transfer and remittance corridor for international remittance market along with market share of major MTOs. For domestic remittance market, the report covers market size, segmentation on the basis of region and major remittance channel (bank, MTO, e-wallet/ mobile money, Post office) and the market share of major players.

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/russia-remittance-bill-payment-market/142289-93.html

The report provides a comprehensive analysis of remittance and bill payments market in Russia. The report covers market size, segmentation on the basis of inbound & outbound remittance, remittance channel, mode of transfer and remittance corridor for international remittance market. For domestic remittance market it covers market size, segmentation on the basis of region and major remittance channel. It also includes the bill payments market in the country covering the market size and segmentation of market by type of bills, channel of bill payment and bill payment methods.

Contact Us:

Ankur Gupta, Head Marketing

Ken Research Private Limited

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release South Africa International Remittance Market is Expected to Reach over ZAR 34 billion by 2023: Ken Research here

News-ID: 1859478 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…