Press release

Europe Inbound remittance Transaction Value is Anticipated to Reach over EUR 26 Billion by 2023: Ken Research

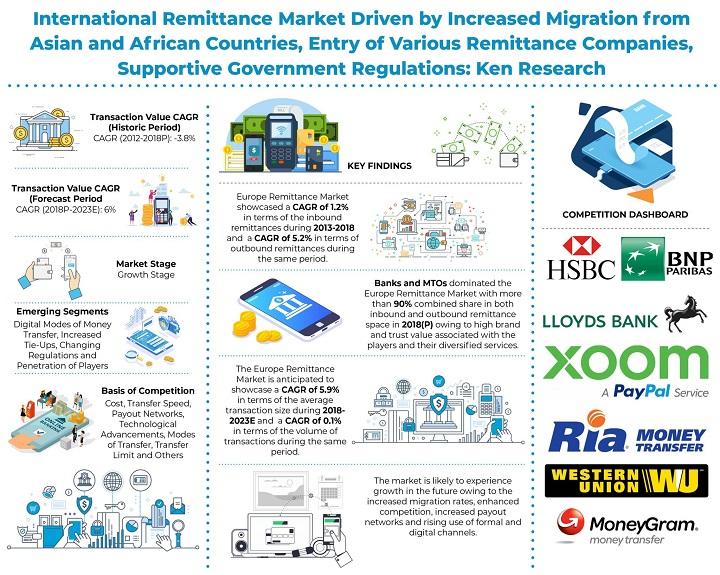

• It is expected that by the end of 2023, Banks would continue to lead the inbound remittance space capturing more than half of the market and registering a CAGR of close to -2% during 2018-2023. MTOs will lead the outbound remittance segment in terms of remittance transaction volume and register a robust CAGR of over 5% during the same.• Europe’s corridor with Asia and North Africa is likely to showcase the highest CAGRs close to 7% and 4% respectively during 2018-2023. This would be owing to rise in demand for remitting money to and from the region to these regions. A rising influx of migrants is expected towards European countries such as Italy, Germany, France and others from Asian and African regions.

The coming five years has been poised to be positive for the remittance industry. The market is facing an intensified competition and new players are entering the market every year. To curb the intensity of the competition, both banks and MTOs are focusing on mobile transfers through launching their wallets and applications. The use of cash is still dominant in the region. In 20 out of 28 EU countries cash represents over 50% of all remittance transactions. Countries like Greece, Bulgaria and Romania almost solely pay by means of cash and cash is the largest payment instrument in terms of volume in all EU countries, except Denmark, Sweden and Luxembourg. However, the launch of mobile wallets and applications by the major players in the industry is expected to reduce the share of cash remittances in the coming years. In inbound remittance the major point of contact in the coming years is expected to be the online and mobile transactions leaving the branch pick-up option behind. By the year 2023, the online and mobile transactions are anticipated to account for a share of 60% in terms of inbound remittance transaction volume.

Ken Research in its latest study “Europe International Remittance Market Outlook to 2023 - By Inbound & Outbound Remittance, By Channels (Banks, MTOs, M-wallets and Others), By Inflow & Outflow Remittance Corridors, By Point of Contact (Branch Pick-up, Mobile Payment & Online Transactions, Prepaid Cards)” suggests that the growth is dependent upon European government to unlock migrant entry barriers restraining the industry. This would lead the market to grow registering a CAGR close to 4% for inbound remittance market and close to 7% for the outbound remittance market in terms of transaction value of the region during the forecast period 2018-2023.

For more information on market research report, please refer to the link below:

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/europe-international-remittance-market/194013-93.html

Key Segments Covered in Europe International Remittance Market

• By Inbound Remittance Flow Corridor

On the Basis of Channels (Volume of Transactions)

o Banking channels

o MTOs

o M-Wallets

o Others

On the Basis of Inflow Countries (By Value of Transactions)

o Italy

o Poland

o Portugal

o Romania

o United Kingdom

o Other EU-28 Countries

• By Outbound Remittance Flow Corridor

On the Basis of Channels (Volume of Transactions)

o Banking channels

o MTOs

o M-Wallets

o Others

On the Basis of Outflow Countries (By Value of Transactions)

o Germany

o Spain

o France

o Italy

o United Kingdom

o Other EU-28 Countries

• By Point of Contact (By Volume)

o Branch Pick-up

o Mobile Payment & Online Transactions

o Prepaid Cards

• By Flow Corridors (By Volume)

o Asia

o North Africa

o South America

o Central & South Africa

o Non-EU Countries

o North America

o Central America

o Near & Middle East

o Oceania

Key Target Audience

• Banks

• Money Transfer Operators

• M-Wallet Companies

• Hawalas

• Convenience and Retail Stores

• Supermarket Chains

• Bills and Payments Companies

• Investors & Venture Capital Firms

• Government Bodies

Time Period Captured in the Report:

• 2013-2018 – Historical Period

• 2019-2023 – Future Forecast

Companies Covered: HSBC Bank, Lloyds Bank, BNP Paribas, Barclays Plc, Deutsche Bank, Bank of China, Credit Agricole, BBVA Dinero Express, Unicredit Banca, Western Union, Money Gram, Ria Money Transfer, Transferwise, UAE Exchange, World Remit, Metro Remittance, Azimo, RemitGuru, Xoom by Paypal, Skrill, Neteller, Postbank, La Poste and PosteItaliane

Related Reports

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/egypt-remittance-market/182340-93.html

https://www.kenresearch.ae/banking-financial-services-and-insurance/financial-services/kuwait-remittance-bill-payment-market/143002-93.html

https://www.kenresearch.ae/banking-financial-services-and-insurance/financial-services/philippines-money-transfer-bill-payments-market/152427-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/financial-services/nigeria-remittance-bill-payment-market/142292-93.html

Key Topics Covered in the Report

• Market Ecosystem

• Market Overview

• Market Size on the Basis of Transaction Value, 2013–2018

• Market Size on the Basis of Transaction Volume, 2013-2018

• Market Size on the Basis of Average Transaction Size, 2013-2018

• Market Segmentation by Remittance Channels (Volume of Transactions)

• Outbound Remittance Market Segmentation by Remittance Channels (Volume of Transactions)

• Inbound Remittance Market Segmentation by Remittance Receiving Countries (Value of Transactions)

• Outbound Remittance Market Segmentation by Remittance Sending Countries (Value of Transactions)

• Inbound Remittance Market Segmentation by Point of Contact (Volume of Transactions)

• Market Segmentation by Top Flow Corridors (Value of Transactions)

• Snapshots of Major Countries in Europe Remittance Market

• Regulatory Landscape in Europe Remittance Market

• Decision Making Process and Pain points in Europe Remittance Market

• SWOT Analysis in Europe Remittance Market

• Competition Scenario in Europe Remittance Market

• Strengths and Weaknesses of Major Players in Europe Remittance Market

• Company Profile of Major Players

• Future Outlook and Projections

• Analyst Recommendations

Contact Us:

Ken Research

Ankur Gupta, Head Marketing & Communications

Ankur@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a Global aggregator and publisher of Market intelligence, equity and economy reports. We provides business intelligence and operational advisory in 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Europe Inbound remittance Transaction Value is Anticipated to Reach over EUR 26 Billion by 2023: Ken Research here

News-ID: 1858768 • Views: …

More Releases from Ken Research

Global Synthetic Rubber Market Surpasses USD 36 Billion Milestone - Latest Insig …

Comprehensive market analysis maps the growth trajectory, investment opportunities, and strategic imperatives for industry leaders in the global rubber and polymer ecosystem.

Delhi, India - October 24, 2025 - Ken Research released its strategic market analysis titled "Global Synthetic Rubber Market Outlook to 2030," revealing that the current market size is valued at USD 36 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Top Players Are Reshaping the India Telemedicine Market: Who's Leading and Why I …

In 2024, the India Telemedicine market was valued at USD 2.3 Bn, dominated by players such as Practo and Apollo TeleHealth due to their extensive doctor networks and full-stack digital infrastructure. From strategic acquisitions to AI-driven platforms, these leaders are setting new standards for virtual care delivery across India.

New Delhi, April 14, 2025

Ken Research's latest Competitive Landscape Report 2025 on the India Telemedicine Market dissects how dominant players…

Smart Parking for Smart Cities: Unveiling the Future of US Parking Management

What is the Size of US Parking Management Industry?

US Parking Management industry is growing at a CAGR of ~% in 2017-2022 and is expected to reach ~USD Bn by 2028. The parking management in the United States is a substantial industry, driven by factors such as urbanization, increasing vehicle ownership & the need for efficient parking solutions.

The market consists of various types of parking facilities: on-street parking, off-street parking lots,…

The Transformative Growth of the US Acute Myeloid Leukemia Market

What is the Size of US Acute Myeloid Leukemia Industry?

US Acute Myeloid Leukemia Market is expected to grow at a CAGR of ~ % in 2022 and is expected to reach ~USD Mn by 2028. The US Acute Myeloid Leukemia market is the rapid advancement in precision medicine and targeted therapies. The emergence of innovative treatments tailored to the genetic and molecular characteristics of individual AML patients has transformed the…

More Releases for Remit

Europe Remittance Software Market In-depth Analysis by Statistics & Outlook 2028 …

Business Market Insights Latest update on “Europe Remittance Software Market” Analysis, Europe Remittance Software market growth analysis and Projection by – 2028. This report is highly predictive as it holds the overall market analysis of topmost companies into the Europe Remittance Software industry. With the classified Europe Remittance Software market research based on various growing regions this report provide leading players portfolio along with sales, growth, market share and so…

Europe Remittance Software Market Increasing Demand Due to COVID-19 Including To …

Businessmarketinsights Latest update on “Europe Remittance Software Market” Analysis, Europe Remittance Software market growth analysis and Projection by – 2027. This report is highly predictive as it holds the overall market analysis of topmost companies into the Europe Remittance Software industry. With the classified Europe Remittance Software market research based on various growing regions this report provide leading players portfolio along with sales, growth, market share and so on.

Remittance software…

North America Remittance Software Market Growth Analysis Till 2027 | Expert Rese …

The latest research documentation titled “North America Remittance Software Market” is a recently Published on business market insights that covers every aspect of North America Remittance Software 2020 along with an in-detailed analysis of growth elements, trends, Forecast, size, Share, demand, and distribution. This report also evaluates the past and current North America Remittance Software Market values to predict future market directions between the forecast period 2020 to 2027.

Remittance…

Remittance Software Market with highest growth in the near future Leading Player …

Global remittance software market is expected to grow from US$ 1279.64 Mn in 2017 to US$ 3323.41 Mn by 2025 at a CAGR of 12.7% during the forecast period.

The scope of study involves B2B, B2C and money transaction between families living abroad by using smartphone, tablet and computer. Also, provides the estimate and forecast of the revenue and market share analysis and also spots the significant remittance software market…

Remittance Software Market Analysis 2019-2025 by Key Companies – Remit One, Re …

Worldwide Remittance Software Market Analysis to 2025 is a specialized and in-depth study of the Remittance Software industry with a focus on the global market trend. The report aims to provide an overview of global Remittance Software Market with detailed market segmentation by product/application and geography. The global Remittance Software Market is expected to witness high Growth during the forecast period. The report provides key statistics on the market status…

Remittance Software Market Outlook to 2025 - Remit One, Remit Anywhere, FinCode, …

Global remittance software market is expected to grow from US$ 1279.64 Mn in 2017 to US$ 3323.41 Mn by 2025 at a CAGR of 12.7% during the forecast period.

An off-the-shelf report on Remittance Software Market which has been compiled after an in-depth analysis of the market trends prevailing across five geographies (North America, Europe, Asia-Pacific, Middle-East and Africa, and South America). Various segments of the market such as type/components/ application/industry…