Press release

IoT in Banking and Financial Services Market to Witness Robust Expansion by 2026

Banking and Financial Services Market 2019:The Global IoT in Banking and Financial Services Market research report provides a unique methodology for evaluating the market insights, highlighting opportunities and supporting strategic and tactical decision-making. This report recognizes the requirement of a rapidly-evolving and competitive environment, up-to-date marketing information is essential to monitor performance and make critical decisions for growth and profitability. It provides information on the latest trends and developments and focuses on innovations with emerging new technologies, and on the changing structure of the IoT in Banking and Financial Services market.

To obtain a Sample copy of this report, click here @ https://straitsresearch.com/report/IoT-in-Banking-and-Financial-Services-Market/request-sample

The research study evaluates the overall size of the Global IoT in Banking and Financial Services Market, by making use of a bottom-up approach, wherein data for different industry verticals, and end-user industries and its applications across various product types have been recorded and predicted during the forecast period. These segments and sub-segments have been documented from the industry specialists and professionals, as well as company representatives, and are outwardly validated by analyzing previous years’ data of these segments and sub-segments for getting an accurate and complete market 2019-26 size. The market also offers different auxiliary sources, such as company insights, financial reports, press releases, company annual reports, and investor presentations.

Some of the major players in the IoT in banking and financial services market are IBM (U.S.), Microsoft (U.S.), Capgemini (France), Cisco (U.S.), SAP (Germany), Oracle (U.S.), Accenture (Ireland), Infosys (India), Software AG (Germany), and Vodafone (U.K.).

The research report tracks the major market events including product launches, technological developments, mergers & acquisitions, and the innovative business strategies opted by key market players. Along with strategically analyzing the key micro trends in the global markets, the report also focuses on industry-specific drivers, restraints, opportunities, and challenges in the IoT in Banking and Financial Services market.

The IoT in Banking and Financial Services market has been witnessing a considerable change in its size and value. The report presents an in-depth analysis of the various segments and sub-segments of the market, including the product types, upcoming technologies, application developments, industry verticals, and regions that are expected to dominate the market during the forecast period 2019-26. The report also presents a detailed overview of the market, which comprises of the key definitions and the key trends witnessed in the previous years.

The report has been gathered by making use of both primary and secondary research methodologies. A list of the major industry participants has also been mentioned in this research study, after which a primary research study has been undertaken with the enlisted key players. The primary research methodology also studied the service offerings, M&A, distribution and channels, and all major partnerships and collaborations worldwide, while the secondary research methodology identified all the major suppliers, distributors, and service providers functioning in the target market. While interviewing, the respondents were also inquired about their competitors.

To get a copy of the sample report, click here @ https://straitsresearch.com/report/IoT-in-Banking-and-Financial-Services-Market/request-sample

IoT in Banking and Financial Services Report Highlights:

Market Dynamics – Trends, Drivers, Restraints

SWOT Analysis

Distribution Channel Analysis

Import/Export Strategies

Product Bench-marking and Pricing Analysis of Key Industry Players

Policy and Regulation.

Reasons to Go For this Report:

To study and evaluate the overall size of the market, as well as the aggregate share, in terms of value and volume.

To identify and forecast the global market based on product type, application, end-user, technology, industry vertical, and region/country.

To determine the driving and restraining factors, challenges, threats, and lucrative opportunities for the market.

To determine and study the profile of major IoT in Banking and Financial Services industry participants.

To conduct the pricing analysis for the global IoT in Banking and Financial Services market.

To study the competitive developments such as expansions, new product launches, and mergers & acquisitions in the market.

Lastly, the report presents statistics, market current trends, and end-user applications. The research conclusions, findings, appendix, and data source with a summarized view of the IoT in Banking and Financial Services market 2019 is also included in this report.

To read a detailed description of the report, click here @ https://straitsresearch.com/report/IoT-in-Banking-and-Financial-Services-Market

If You Need More Information regarding this IoT in Banking and Financial Services Market, Please Drop a mail on sales@straitsresearch.com OR Call on +1 6464807505 (US)

For more details, please contact us -

Email: sales@straitsresearch.com

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: +1 6464807505, +44 203 318 2846

Website: https://straitsresearch.com/

About Us:- Straits Research is a leading market research and market intelligence organization, specializing in research, analytics, and advisory services along with providing business insights & market research reports.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IoT in Banking and Financial Services Market to Witness Robust Expansion by 2026 here

News-ID: 1857098 • Views: …

More Releases from Straits Research

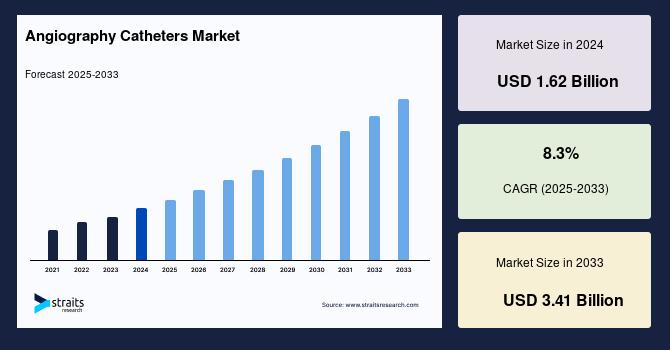

Angiography Catheters Market Size to Reach USD 3.41 Billion by 2033, Driven by R …

The global angiography catheters market is experiencing strong momentum, driven by the growing burden of cardiovascular diseases (CVDs), rising preference for minimally invasive diagnostic and interventional procedures, and ongoing innovations in catheter-based imaging technologies. Industry estimates indicate that the market is expected to expand from USD 1.8 billion in 2025 to USD 3.41 billion by 2033, progressing at a compound annual growth rate (CAGR) of 8.3% over the forecast period.

Angiography…

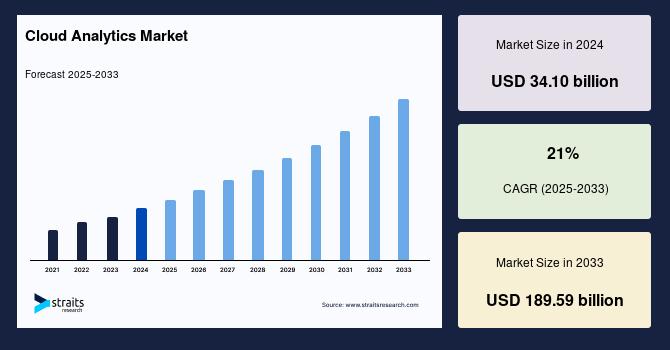

Cloud Analytics Market Size Set to Surge to USD 189.59 Billion by 2033 | Massive …

The global cloud analytics market is poised for exceptional growth as organisations leverage the power of the cloud to collect, analyse and visualise large volumes of data for actionable business insights. According to recent research, The global cloud analytics market size was worth USD 34.10 billion in 2024 and is estimated to reach an expected value of USD 189.59 billion by 2033, growing at a CAGR of 21% during the…

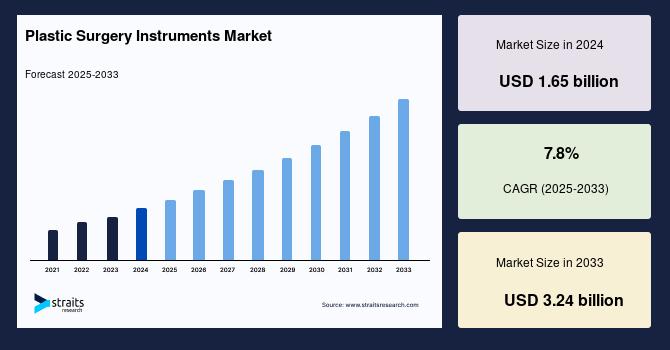

Plastic Surgery Instruments Market Size to Reach USD 3.24 Billion by 2033 | Glob …

The global plastic surgery instruments market is witnessing robust expansion, driven by the rising demand for cosmetic and reconstructive surgeries worldwide. According to a new study by Straits Research, the market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 3.24 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period (2025-2033).

The rising popularity of aesthetic enhancement procedures…

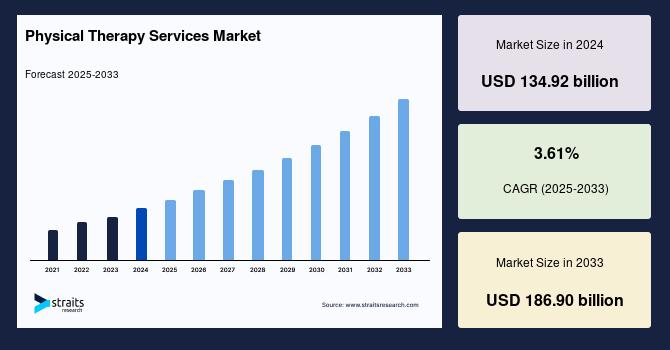

Physical Therapy Services Market Outlook 2025-2033: Rise of Home-Based Care and …

The global physical therapy services market is witnessing significant expansion, fueled by the growing prevalence of chronic diseases, increasing sports-related injuries, and technological innovations such as tele-rehabilitation and AI-based therapy platforms. According to Straits Research, the global market size is estimated at USD 140.69 billion in 2025 and is projected to reach USD 186.90 billion by 2033, exhibiting a steady CAGR of 3.61% during the forecast period.

Read the full report…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…