Press release

Agricultural Insurance Market Opportunities, Challenges with Top Key Players Analysis - PICC, Zurich, Chubb, QBE, China United Property Insurance | Global Forecast till 2024

This report provides in depth study of “Agricultural Insurance Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Agricultural Insurance Market report also provides an in-depth survey of key players in the market organization.Global Agricultural Insurance Market Synopsis:

This report studies the Global Agricultural Insurance Market over the forecast period of 2019 to 2024. The Global Agricultural Insurance Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2019 to 2024.

Get Sample Study Papers of “Global Agricultural Insurance Market” @ https://www.businessindustryreports.com/sample-request/205498 .

The Global “Agricultural Insurance Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 90 Pages, figures, graphs and table of contents to analyze the situations of global Agricultural Insurance Market and Assessment to 2024.

The competitive landscape of the global Agricultural Insurance Market is extensively researched in the report. The analysts have largely concentrated on company profiling of major players and also on competitive trends. All of the companies studied in the report are profiled on the basis of production, revenue, growth rate, markets served, areas served, market share, and market growth. The report will help readers to study significant changes in market competition, the level of competition, and factors impacting future market competition. It discusses important target market strategies that leading players are expected to adopt in future. In addition, it throws light on future plans of key players.

The growth of the market is driven by Policy reformation and boom in the public-private partnership is anticipated to propel the demand in the southeast part of Asia Pacific. Overall, propelled by demand for risk protection against natural losses and to support the economic growth, demand for agriculture insurance products is set to witness high growth over the forecast period.

Agriculture Insurance has evolved on a great scale in the past few decades. This can be attributed to the fact that government support increased in the form of subsidies and increased demand for reinsurance. Countries like India, China & Brazil made a significant investment in the agriculture sector over the past few decades. Also, the growing private-public partnership also added to the growth of agriculture insurance market.

Agricultural Insurance Market Covers the Table of Contents With Segments, Key Players And Region. Based on Product Type, Agricultural Insurance Market sub segmented into Agricultural Insurance. On the Basis of Application, Market is sub segmented into Crop/MPCI, Crop/Hail, Livestock.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Major Players profiled in the Agricultural Insurance Market report incorporate: PICC, Zurich (RCIS), Chubb, QBE, China United Property Insurance, American Financial Group, Prudential, XL Catlin, Everest Re Group, Endurance Specialty, CUNA Mutual

Current Industry News:

Chubb

Rain and Hail, a division of Chubb's agriculture business, the leading crop insurance franchise in the United States, signed a multi-year agreement with Bushel™, the grain industry's first software platform that allows grain elevators, cooperatives and ethanol plants to connect with their growers digitally, providing them with an efficient way to automate the sharing of scale tickets from participating elevators, grain buyers and ethanol facilities with their crop insurance agent.

The Multiple Peril Crop Insurance (MPCI) program, which is insurance coverage designed to help protect growers from a variety of potential losses, requires growers to report the quantity of crops they harvest to their crop insurance agent each year, which can be a time consuming process.

"Chubb is committed to the agriculture business and is continually looking for ways to simplify the crop insurance program for growers," said Scott Arnold, President of Rain and Hail. "The addition of Bushel™ to our platform provides growers and agents a quick and efficient way to report critical production information that can help save them time during their busy harvest seasons."

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/205498 .

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Agricultural Insurance in these regions, from 2014 to 2024 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

Significant points in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

Agricultural Insurance Market Questions Answered in this Report:

1 What are the major market drivers, challenges, and opportunities in the global Agricultural Insurance Market?

2 What was the market value of the leading segments and sub-segments of the global Agricultural Insurance Market in 2018?

3 How will each segment of the global Agricultural Insurance Market grow during the forecast period and what will be the revenue generated by each of the segments by the end of 2024?

4 What are the influencing factors that may affect the market share of the key players?

5 How will the industry evolve during the forecast period 2019-2024?

6 Who are the key players in the Agricultural Insurance Market and end user market and what are their contributions?

Report contents include

1 Analysis of the Agricultural Insurance Market including revenues, future growth, market outlook

2 Historical data and forecast

3 Regional analysis including growth estimates

4 Analyzes the end user markets including growth estimates.

5 Profiles on Agricultural Insurance Market including products, sales/revenues, and market position

6 Market structure, market drivers and restraints.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Agricultural Insurance Market Opportunities, Challenges with Top Key Players Analysis - PICC, Zurich, Chubb, QBE, China United Property Insurance | Global Forecast till 2024 here

News-ID: 1855451 • Views: …

More Releases from Business Industry Reports

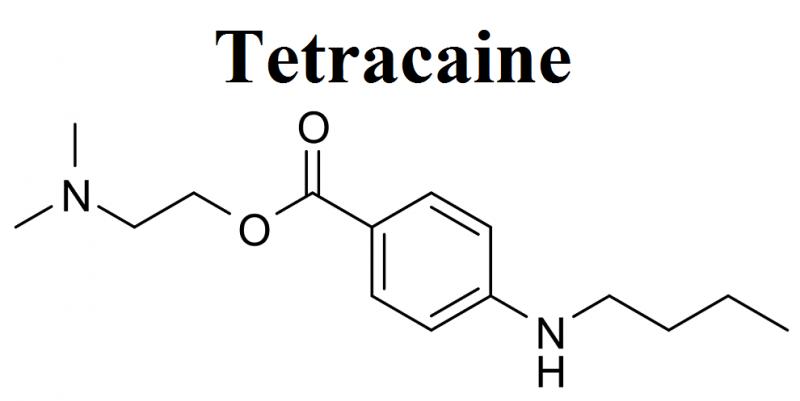

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

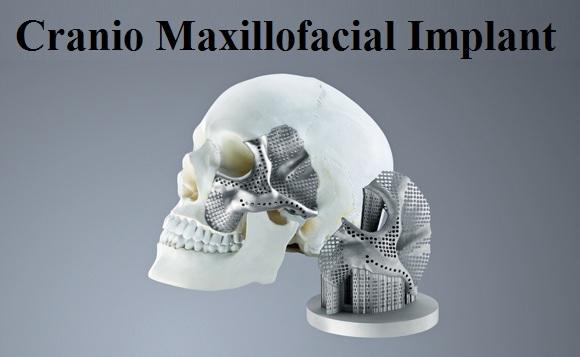

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…