Press release

Detailed Study on Pension Insurance Market Developing Trends and Outlook to 2023 | Analysis by UnitedHealthcare, Allianz, Kaiser Permanente

This report provides in depth study of “Pension Insurance Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Pension Insurance Market report also provides an in-depth survey of key players in the market organization.Global Pension Insurance Market Synopsis:

The Global “Pension Insurance Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 90 Pages, figures, graphs and table of contents to analyze the situations of global Pension Insurance Market and Assessment to 2023.

Get Sample Study Papers of “Global Pension Insurance Market” @ https://www.businessindustryreports.com/sample-request/203579 .

This report studies the Global Pension Insurance Market over the forecast period of 2019 to 2023. The Global Pension Insurance Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2019 to 2023.

Pension Insurance Market report begins from overview of Industry Chain structure, and describes industry environment, then analyses market size and forecast of Pension Insurance Market by product, region and application, in addition, this report introduces market competition situation among the vendors and company profile, besides, market price analysis and value chain features are covered in this report. The scope of the report includes a detailed study of Pension Insurance Market with the reasons given for variations in the growth of the industry in certain regions.

Pension Insurance Market Covers the Table of Contents With Segments, Key Players And Region. Based on Product Type, Pension Insurance Market sub segmented into Personal/Private Pensions and Company/Workplace Pensions. On the Basis of Application, Market is sub segmented into Individuals & Families and Organizations.

Vendor Landscape Analysis:

The competitive landscape of the global Pension Insurance Market is extensively researched in the report. The analysts have largely concentrated on company profiling of major players and also on competitive trends. All of the companies studied in the report are profiled on the basis of production, revenue, growth rate, markets served, areas served, market share, and market growth. The report will help readers to study significant changes in market competition, the level of competition, and factors impacting future market competition. It discusses important target market strategies that leading players are expected to adopt in future. In addition, it throws light on future plans of key players.

Major Players profiled in the Pension Insurance Market report incorporate: UnitedHealthcare, Allianz, Kaiser Permanente, MetLife, CNP Assurances, PICC, Dai-ichi Life Group, ICICI Prulife, Ping An, China Life, CPIC.

Current Industry News:

1 UnitedHealthcare:

Over the last 12 years, Nokia has partnered with UnitedHealthcare® Retiree Solutions to build and maintain a retirement benefits program designed for longevity and member satisfaction.

The UnitedHealthcare® Group Medicare Advantage (PPO) plan, sponsored by Nokia of America Corporation, supports 69,000 past and present retirees and their families, with about 60% of that population within the Formerly Represented Retiree group. That group includes past employees from AT&T, Lucent and Alcatel following spin-offs and mergers and acquisitions. The remaining 40% are Management Retirees from those same companies, as well as Nokia.

Ingrid Orav, Director of Health Plans at Nokia, worked with her team to shape the popular retiree benefits program, while cutting costs at the same time — an ideal outcome for benefits planners today. “Our challenge going into this was that we needed to decrease our spend, but it was imperative that we continue to offer quality, affordable coverage to our retirees,” Orav said.

2 Allianz:

Allianz, one of the world’s largest insurers, and PIMCO, one of the world’s premier fixed income managers owned by Allianz, announced today the launch of a new business in Australia, Allianz Retire+ Powered by PIMCO, to deliver the next generation of retirement income solutions.

Allianz Retire+ Powered by PIMCO marks the first-ever co-branded business between the two global firms and combines the scale and technical expertise of Allianz’s global life insurance business with PIMCO’s global investment management experience. Allianz manages over 650 billion euros on behalf of its insurance customers and has 127 years’ experience. PIMCO has 47 years of investment management expertise and manages $1.77 trillion (as at March 2018) on behalf of global investors.

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/203579 .

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of Pension Insurance in these regions, from 2014 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

Significant points in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

Pension Insurance Market Questions Answered in this Report:

1 What are the major market drivers, challenges, and opportunities in the global Pension Insurance Market?

2 What was the market value of the leading segments and sub-segments of the global Pension Insurance Market in 2018?

3 How will each segment of the global Pension Insurance Market grow during the forecast period and what will be the revenue generated by each of the segments by the end of 2023?

4 What are the influencing factors that may affect the market share of the key players?

5 How will the industry evolve during the forecast period 2019-2023?

6 Who are the key players in the Pension Insurance Market and end user market and what are their contributions?

Major Points in Table of Contents:

Global Pension Insurance Market Report 2019

Section 1 Pension Insurance Product Definition

Section 2 Global Pension Insurance Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Pension Insurance Shipments

2.2 Global Manufacturer Pension Insurance Business Revenue

2.3 Global Pension Insurance Market Overview

Section 3 Manufacturer Pension Insurance Business Introduction

3.1 UnitedHealthcare Pension Insurance Business Introduction

3.1.1 UnitedHealthcare Pension Insurance Shipments, Price, Revenue and Gross profit 2014-2019

3.1.2 UnitedHealthcare Pension Insurance Business Distribution by Region

………………. Request free sample to get a complete Table of Content

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Detailed Study on Pension Insurance Market Developing Trends and Outlook to 2023 | Analysis by UnitedHealthcare, Allianz, Kaiser Permanente here

News-ID: 1854757 • Views: …

More Releases from Business Industry Reports

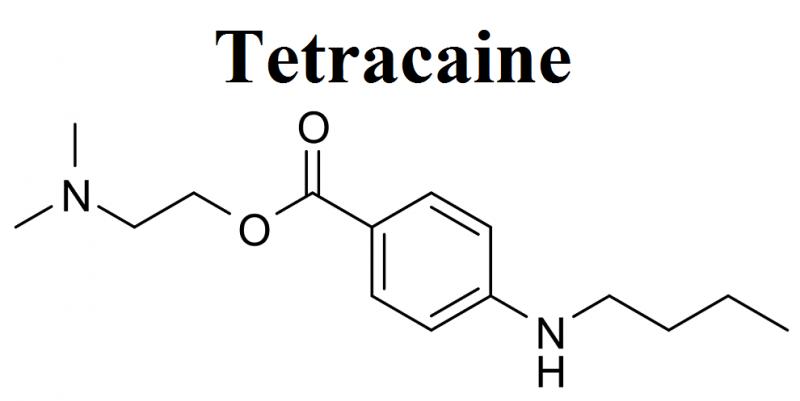

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Pension

Pension Funds Market Reworking Long Term Growth |AT&T Corporate Pension Fund, 11 …

The Latest published market study on Pension Funds Market provides an overview of the current market dynamics in the Pension Funds space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

The basic pension or Rürup pension - neglected old-age provision

Compared to other forms of pension provision, such as statutory pension insurance or the private Riester pension, the Rürup pension or basic pension is much less well known to the public. This special form of pension provision offers great opportunities to additionally strengthen purchasing power in old age. The topic of old-age provision and securing the statutory pension level via a statutory equity pension is on everyone's lips, although a…

Pension Fund Market Is Booming Worldwide : Blue Sky Group, NatWest Group Pension …

Advance Market Analytics published a new research publication on "Global Pension Fund Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study, you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market-associated stakeholders. The growth of the Pension Fund market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

Pension Funds Market to Eyewitness Massive Growth by 2030:AT&T Corporate Pension …

The Latest published market study on Pension Funds Market provides an overview of the current market dynamics in the Pension Funds space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in 2029. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and opportunities. Some of the players…

Pension Fund Market Booming Segments; Investors Seeking Growth| IBM, NatWest, BT …

AMA Research started a new business research with title Pension Fund Market Study Forecast till 2027 . This Pension Fund market report brings data for the estimated year 2021 and forecasted till 2027 in terms of both, value (US$ MN) and volume (MT). The report also consists of detailed assessment macroeconomic factors, and a market outlook of the Pension Fund market. The study is conducted by applying both top-down and…

Pension Administration Software Market 2022 Rising Pension Schemes In The Public …

According to Precision Business Insights (PBI), the latest report, the pension administration software market is expected to have a significant CAGR over the forecast period. The primary driver of the expansion of the global Pension Administration Software market is rising public pension schemes as required by the majorly old age population, and many private companies offer pension schemes with individuals' requirements.

View the detailed report description here - https://precisionbusinessinsights.com/market-reports/pension-administration-software-market/

…