Press release

Universal-Investment and Global Evolution launch the first fixed income fund focused on frontier markets

Kolding/Frankfurt, 27 July 2011. Universal-Investment and Danish based emerging markets specialist Global Evolution launch the first fixed income fund focused on frontier markets. The investment managers of the Saxo Invest-Global Evolution Frontier Markets (Fixed Income) (ISIN LU0501220429) invest in government bonds from countries, which are at the beginning of their economic development like Mongolia, Mozambique and Serbia. Frontier markets have a very high potential for growth and credit improvements. Therefore, the return potential is much higher than for traditional emerging markets. The fund is highly diversified with current exposure to sovereign debts from 33 countries across Latin America, Eastern Europe, Middle East, Africa and Asia. The average yield to maturity of the portfolio is currently around 11%, the annual fund target return is about 10-12%. While all US-Dollar investments are hedged to Euro, investments in local currency instruments are unhedged.The Global Evolution management team has invested in emerging markets sovereign debt and FX since the mid-nineties and built up a fundamental expertise for the characteristics of these markets. In this period, emerging markets have outperformed most other asset classes. “But the asset class of traditional emerging markets debt has been through a significant structural maturation and credit improvement”, says Global Evolution CIO Morten Bugge, who analyses and visits with his investment team frontier countries around the world to identify investment opportunities before mainstream investors do.

Decreasing yields for traditional emerging markets bonds

While traditional emerging markets debt is now rated investment grade and offers yields of typically 6-7%, new markets are entering the dynamic emerging markets debt universe. So called frontier markets as Congo, Sri Lanka and Uruguay increase their financial strength and open up for a financial market by issuing international debt or give international investors access to their own local debt markets. ”The current economic and financial status of frontier markets can be compared to the traditional emerging markets in the late nineties”, describes emerging markets expert Bugge this sector, which was so far out of mind for most investors.

Frontier financial markets are generally smaller, less developed and sovereign credit risks are higher than for traditional emerging markets. The current average credit rating of the Global Evolution Frontier Markets (Fixed Income) is “single B”. Bugge expects that frontier markets will undergo the same very positive development in the coming 5-10 years as traditional emerging markets have gone through in the last decade.

Examples of frontier markets with very good prospects that the fund is invested in are Mongolia, Mozambique and Serbia. “Mongolia offers vast natural resources, very high growth, yields of 10% and large potential for currency appreciation” exemplifies Bugge. Mozambique, a major coal producer and exporter in the making, turned out the best performing position in the first six months of 2011. Serbia stands to benefit significantly from closer integration with the EU and offers yields of 12.5%. Serbian bonds have been one of the best performing positions in the fund since launch.

First member of a new emerging markets family

The Global Evolution Frontier Markets (Fixed Income) Fund was launched in Luxemburg on Saxo Invest SICAV, the fund platform of Danish Saxo Bank and is now also licensed for distribution in Austria, Germany, Sweden and United Kingdom. The fund already reached a volume of around €56 m. The Global Evolution Frontier Markets (Fixed Income) Fund is the first member of a new emerging markets family launched by Global Evolution and Universal-Investment. Other interesting investment strategies for emerging market debts, both in hard and local currencies, as well as emerging markets currency strategies and dynamically managed emerging markets funds has also been launched by Global Evolution under the umbrella of the Saxo Invest SICAV and will be licensed for distribution in Germany in the coming period.

FUND DATA AT A GLANCE

Investment Managers: Global Evolution Fondsmæglerselskab A/S, Kolding, Denmark

SICAV: Saxo Invest

Promoter: Saxo Bank A/S, Hellerup, Denmark

Management Company:Universal-Investment-Luxembourg S.A.

Fund currency: Euro (EUR)

ISIN: LU0501220429

Fund category: Emerging Markets Debt

Management fee: 1,5% p.a.

Initial charge: Up to 5% –

Performance fee: 10% of the performance with high watermark

Min. initial investment: EUR 300

ABOUT GLOBAL EVOLUTION

Global Evolution is a dedicated emerging markets boutique with an established 10+ year track record and a tight-knit investment management team with an investment process that has been well-tested through various market cycles. The company has distinguished itself in the market with its singular focus on and long-standing expertise in the sovereign debt of emerging and frontier market countries. It is that focus and expertise, combined with a diversified style and active management approach and their unique proprietary systems for advanced portfolio and risk management, that have earned them industry recognition and accolades, including membership of JPMorgan’s EMBI & GBI-EM Index advisory committees.

ABOUT UNIVERSAL-INVESTMENT

With fund assets in excess of more than EUR 130 billion under administration, 1,100 funds and investment mandates and a workforce of around 380, Universal-Investment is the largest independent investment company in German-spoken Europe. The focus lies on the efficient and transparent administration of funds, securities and alternative asset classes. Universal-Investment is the central platform for independent asset management and combines the investment expertise of boutiques, private banks, international asset managers and investment firms to offer an exceptional collection of first-class private label funds. The hallmark of Universal-Investment is that it has no single company philosophy. This means investors can choose from a broad universe of mutual funds with a wide range of investment philosophies and styles. Universal-Investment was founded in 1968 as subsidiary of several well-known private banks. The company is headquartered in Frankfurt/Main and has subsidiaries and holdings in Luxemburg and Austria. As pioneer of the investment industry Universal-Investment is now market leader in the areas of master-KAG and private label funds. Members of the management board are Oliver Harth, Markus Neubauer, Stefan Rockel, Alexander Tannenbaum and Bernd Vorbeck (spokesman). (As per 30 June 2011)

Universal-Investment-Gesellschaft mbH

Am Hauptbahnhof 18

60322 Frankfurt am Main

www.universal-investment.com

Bernd Obergfell

Press Officer

T: +49 (0) 69 7 10 43-575

E: bernd.obergfell@universal-investment.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Universal-Investment and Global Evolution launch the first fixed income fund focused on frontier markets here

News-ID: 185352 • Views: …

More Releases from Universal-Investment

Newcits – Universal-Investment and US hedge fund manager York launch jointly a …

First global merger arbitrage strategy as UCITS fund in Europe

- UCITS fund opens US investment strategy to European investors, that has been successful since 1996

- Expansion for alternative investments platform UI-Newcits

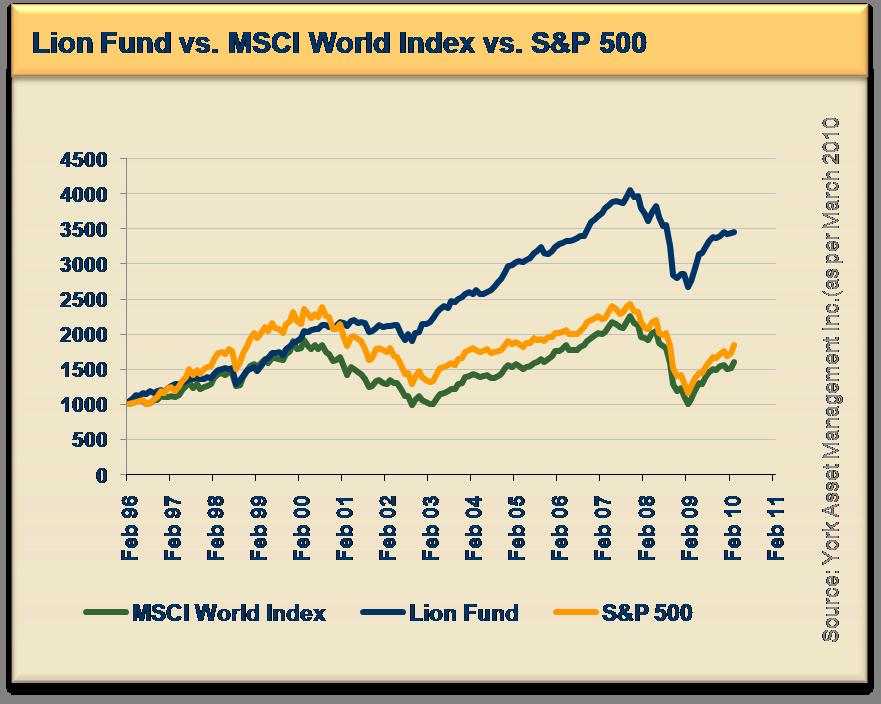

New York/Frankfurt, 17 July 2010. Universal-Investment and New York based hedge fund specialist York Asset Management Inc. have launched a new absolute return fund in collaboration: The York Lion Merger Arbitrage Liquidity Fund UI (DE000A1CSUN5) is based upon “The Lion…

More Releases for Invest

Robo-advisory Market Is Dazzling Worldwide with Major Giants TD Ameritrade, SoFi …

Latest Study on Industrial Growth of Robo-advisory Market 2024-2030. A detailed study accumulated to offer the Latest insights about acute features of the Robo-advisory market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments of…

How to invest in rental properties?

Investing in rental properties can be an excellent source of income. Do you know what to do to make this investment? Check out!

The real estate market is seen as an excellent opportunity for those who want to have a little more security in their financial life since it is an extremely safe and stable area over the years. However, do you know for sure what you need to invest in…

Robo-advisory Market to Witness Huge Growth by 2028 | Axos Invest, SoFi Invest, …

Global Robo-advisory Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Robo-advisory Market. Some of…

Renaissance Invest LTD - Online Investments Branch

Crypto trading specialist in London: https://www.renaissanceinvestltd.com

Renaissance Invest provide investors with trading software solutions to operate simply and professionally on the real-time markets:

Fox Trading platform multi-devices Access and the new Fox WebTrader to invest instantly from any internet browser or device.

Dedicated market Analysts support, daily technical analysis and forecasts for Cryptocurrencies, International Stocks, Indices, Currency, Gold and Oil trading.

Renaissance Invest is a Trading platform dedicated in Crypto Currencies and Live Investing.…

Warner Goodman invest in Linetime

Leading south coast law firm Warner Goodman LLP has signed up for the full Liberate software suite from Linetime. The fully integrated accounts, case and matter management system is to be rolled out to over 150 users across three branch offices in Southampton, Portsmouth and Fareham.

Andy Munden, partner at Warner Goodman said, “We are looking forward to working with Linetime to implement state of the art systems and processes that…

How would you Invest €100,000?

How would you Invest €100,000?

The big question is nowadays….what should I invest in and what will be safe enough to not lose money on? Imagine you have €100,000 to invest…. how should you invest it now? “Scan through your portfolio to see if there are any of your assets that you should now buy more of at lower prices or venture outside the box and look at the metal…