Press release

Anti-Money Laundering Solution Market Ongoing Trends and Recent Developments | Key Players like SAS Institute, FICO, ACI Worldwide, BAE Systems and Oracle

According to recent research "Anti-Money Laundering Solution Market by Component, Technology Type (KYC Systems, Transaction Monitoring, Case Management, Compliance Management, Auditing and Reporting), Deployment Mode, Organization Size, and Region - Global Forecast to 2024", published by MarketsandMarkets, the global Anti-Money Laundering (AML) solution market is expected to grow from USD 1.5 billion in 2019 to USD 3.6 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period.The major aspects driving the AML solution market include increase in money laundering and terrorist funding activities; increase in stringent compliance requirements and mandates; and an increase in the adoption of digital payment modes. The AML solution market is growing drastically on account of the proliferation of cloud-based services in the Banking, Financial Services and Insurance (BFSI) sector and increasing Money Laundering and Terrorist Financing (ML/TF) activities and frauds in this sector.

Browse 66 market data Tables and 37 Figures spread through 137 Pages and in-depth TOC on "Anti-Money Laundering Solution Market”

https://www.marketsandmarkets.com/Market-Reports/anti-money-laundering-solutions-market-95490454.html?utm_source=Openpr

Know Your Customer systems technology segment to grow at the highest CAGR during the forecast period

The Know You Customer (KYC) technology refers to the process of verifying the identity of the users. Authentication plays a crucial role in the AML solution market. Financial institutions hold a high level of responsibility to prevent financial crime. These instituties establish KYC and AML policies, to on-board genuine customers, which helps to keep track of customer transactions. KYC systems help enterprises maintain the credibility of transactions/information by blocking unauthorized access to the information or identifying false inputs from its users. KYC is a fundamental practice to protect an organization from fraud and losses resulting from illegal funds and transactions. Due to increasing money laundering activities, organizations are deploying KYC systems to keep track of all the transactions.

Managed services to grow at a higher CAGR during the forecast period

An increase in the number of customers demanding for managed services across the globe is expected to result in higher growth of AML services. Managed services include managing databases and collecting data. These services are outsourced to Managed Service Providers (MSP). Managed Security Service Providers (MSSPs) offer specialized security services to other companies whereas Managed Security Services (MSS) are available in many forms, such as pure system management, sophisticated fraud investigators, on-premises device monitoring and management services, and cloud services. Since these services require attention regularly, it becomes difficult for BFSI organizations to manage them along with their core business operations. Therefore, these companies are rapidly outsourcing their AML services to specialized service providers known as MSSPs.

Ask for Sample Pages @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=95490454&utm_source=Openpr

Asia Pacific to grow at the highest CAGR in the market during the forecast period

The primary forces driving the APAC market growth are rising eCommerce and non-cash transactions, and the increase in the number of startups in APAC countries, especially India. In recent years, the APAC region has witnessed tremendous economic growth, political transformations, and social changes. The region has a large number of established Small and Medium-sized Enterprises (SMEs) in the BFSI sector, which are growing at an exponential rate to cater to their broad customer base. The financial sector in this region is gaining demand owing to the value of proposition seen by customers. Moreover, the ease of transactions due to the advent of digital transactions, low premiums, and high term amounts are luring customers to invest in this sector.

Various growth strategies have been adopted by the major players to increase their market presence, such as mergers and acquisitions, partnerships and collaborations, business expansions, and product developments. Some of the major technology vendors in the AML solution market are FICO (US), NICE (Israel), BAE Systems (UK), SAS Institute (US), Experian (Ireland), LexisNexis (US), FIS Global (US), CaseWare (Canada), WorkFusion (US), Fiserv (US), ACI Worldwide (US), TransUnion (US), Oracle (US), Finacus Solutions (India), and Nelito Systems (India).

Mr. Shelly Singh

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA : 1-888-600-6441

Email: newsletter@marketsandmarkets.com

MnM Blog: https://mnmblog.org/

Content Source: https://www.marketsandmarkets.com/PressReleases/anti-money-laundering-solutions.asp

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies’ revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model – GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets’s flagship competitive intelligence and market research platform, "Knowledgestore" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering Solution Market Ongoing Trends and Recent Developments | Key Players like SAS Institute, FICO, ACI Worldwide, BAE Systems and Oracle here

News-ID: 1845420 • Views: …

More Releases from MarketsandMarkets

Top Ultrasound Market Trends Driving Growth in 2025 and Beyond | Philips Healthc …

The global ultrasound market is entering a transformative phase in 2025. Once primarily associated with pregnancy scans and basic imaging, ultrasound has now evolved into a powerful, multipurpose diagnostic tool with applications across cardiology, oncology, musculoskeletal care, emergency medicine, and beyond.

As healthcare systems worldwide shift towards non-invasive, affordable, and portable imaging solutions, ultrasound is becoming central to modern diagnostics. According to market insights, the ultrasound industry is poised for steady…

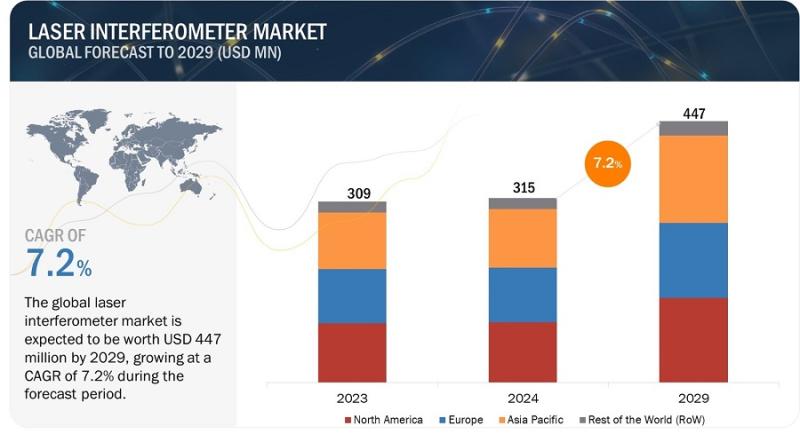

Laser Interferometer Market Set to Grow at the Fastest Rate- Time to Grow your R …

The global laser interferometer market is expected to be valued at 315 million in 2024 and is projected to reach USD 447 million by 2029, at a CAGR of 7.2% from 2024 to 2029. Emerging applications in industries push the market's growth due to the growing demand for precision in the manufacturing sector. However, challenges such as higher initial investments and maintenance costs cause problems. Despite these, opportunities arise for…

With 19.6% CAGR, Battery Testing, Inspection, and Certification Market Growth to …

The battery testing, inspection, and certification market is projected to reach USD 36.7 billion by 2029 from USD 14.9 billion in 2024 at a CAGR of 19.6% during the forecast period. Increasing adoption of EVs and energy storage systems, rising enforcement of stringent standards to ensure battery safety, thriving portable electronics industry, and rapid advances in battery technology are the major factors contributing to the market growth.

Download PDF Brochure @…

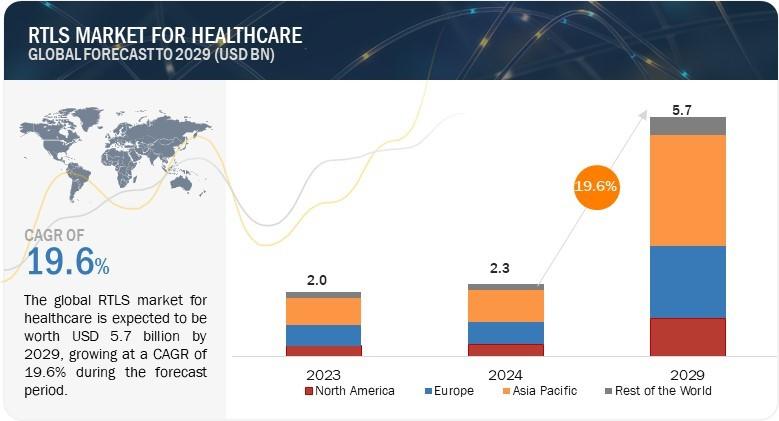

Real-Time Location Systems Revolutionize Healthcare: Insights from MarketsandMar …

The global RTLS market for healthcare is projected to grow from USD 2.3 billion in 2024 to USD 5.7 billion by 2029, at a compound annual growth rate of 19.6% from 2024 to 2029. As it attracts more and more players who enter this market with innovative RTLS features for customers, the market for RTLS technology is rapidly increasing. Top companies in this market focus on healthcare, retail, and manufacturing…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…