Press release

Business Strategy of Ridesharing Insurance Market in Global Industry 2019 to 2023 | Key Players - Allianz, AXA, State Farm, GEICO, Safeco, Allstate

This report provides in depth study of “Ridesharing Insurance Market” using SWOT analysis i.e. Strength, Weakness, Opportunities and Threat to the organization. The Ridesharing Insurance Market report also provides an in-depth survey of key players in the market organization.Global Ridesharing Insurance Market Synopsis:

This report studies the Ridesharing Insurance Market over the forecast period of 2019 to 2023. The Ridesharing Insurance Market is expected to grow at an impressive Compound Annual Growth Rate (CAGR) from 2019 to 2023.

Get Sample Study Papers of “Global Ridesharing Insurance Market” @ https://www.businessindustryreports.com/sample-request/189741 .

The Global “Ridesharing Insurance Market” research 2019 highlights the major details and provides in-depth analysis of the market along with the future growth, prospects and Industry demands analysis explores with the help of complete report with 90 Pages, figures, graphs and table of contents to analyze the situations of global Ridesharing Insurance Market and Assessment to 2023.

With tables and figures helping analyze worldwide Ridesharing Insurance market, this research provides key statistics on the state of the industry and is a valuable source of guidance and direction for companies and individuals interested in the market.

Ridesharing Insurance Market report begins from overview of Industry Chain structure, and describes industry environment, then analyses market size and forecast of Ridesharing Insurance Market by product, region and application, in addition, this report introduces market competition situation among the vendors and company profile, besides, market price analysis and value chain features are covered in this report. The scope of the report includes a detailed study of Ridesharing Insurance Market with the reasons given for variations in the growth of the industry in certain regions.

The official name for a ride-sharing business is a Transportation Network Company (TNC). TNCs contract with drivers who use their personal vehicles to transport passengers. Therefore, many of the drivers who work for TNCs do not have a livery driver’s license, and their cars are neither registered nor insured as commercial vehicles. These drivers are distinct from limousine or taxi drivers, who use a commercial vehicle and already have commercial insurance coverage.

Rideshare insurance provides liability and damage coverage when driving for Uber, Lyft, or other ride-hailing companies. It provides primary coverage when the app is on and the driver is waiting for a ride request. Rideshare insurance covers gaps in a driver’s personal auto policy and the insurance policies provided by rideshare companies.

Ridesharing Insurance Market Covers the Table of Contents With Segments, Key Players And Region. Based on Product Type, Ridesharing Insurance Market is sub segmented into Peer-to-peer ridesharing and Real-time ridesharing. On the Basis of Application, Market is sub segmented into Commercial and Personal.

Major Players profiled in the Ridesharing Insurance Marketreport incorporate: Allianz, AXA, State Farm, GEICO, Safeco, Allstate, USAA, American Family Insurance, PEMCO, Erie Insurance, Farmers, Liberty Mutual, Travelers, PICC, PianAn, AIG

Industry News:

For the past year, Allstate has partnered with Uber Technologies, Inc. to provide commercial insurance protection to riders and drivers in Illinois, New Jersey, New York and Wisconsin. Coverage now expands to Alaska, Idaho, Michigan, Minnesota, Montana, New Mexico, Nevada, Oregon, Utah, Washington and Wyoming.

The policies, managed by Allstate Business Insurance, insure the entire cycle of an Uber trip, from when a driver-partner turns on the Uber app, to rider pick up and during the trip. Riders are protected under the Allstate policies at no additional cost every time they take an Uber. Allstate’s expanded commercial coverage for Uber also includes its fast-growing food delivery service in certain states.

“We know consumers are embracing the sharing economy,” said Allstate Executive Vice President Tom Troy. “We want to grow by protecting people from life’s uncertainties, including those within this emerging market. We’re excited to expand our partnership with Uber and bring Allstate’s legacy of safety to even more people.”

Request a Discount on standard prices of this premium report @ https://www.businessindustryreports.com/check-discount/189741 .

Region segment: This report is segmented into several key regions, with sales, revenue, market share (%) and growth Rate (%) of RIDESHARING INSURANCE in these regions, from 2014 to 2023 (forecast), covering: North America, Europe, Asia Pacific, Middle East & Africa and South America.

Ridesharing Insurance Market Questions Answered in this Report:

1 What are the major market drivers, challenges, and opportunities in the global Ridesharing Insurance Market?

2 What was the market value of the leading segments and sub-segments of the global Ridesharing Insurance Market in 2018?

3 How will each segment of the global Ridesharing Insurance Market grow during the forecast period and what will be the revenue generated by each of the segments by the end of 2023?

4 What are the influencing factors that may affect the market share of the key players?

5 How will the industry evolve during the forecast period 2019-2023?

6 Who are the key players in the Ridesharing Insurance Market and end user market and what are their contributions?

Major Points in Table of Contents:

Table of Contents

Section 1 Ridesharing Insurance Product Definition

Section 2 Global Ridesharing Insurance Market Manufacturer Share and Market Overview

2.1 Global Manufacturer Ridesharing Insurance Shipments

2.2 Global Manufacturer Ridesharing Insurance Business Revenue

2.3 Global Ridesharing Insurance Market Overview

Section 3 Manufacturer Ridesharing Insurance Business Introduction

3.1 Allianz Ridesharing Insurance Business Introduction

3.1.1 Allianz Ridesharing Insurance Shipments, Price, Revenue and Gross profit 2014-2018

3.1.2 Allianz Ridesharing Insurance Business Distribution by Region

………………. Request free sample to get a complete Table of Content

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company, we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed, strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Strategy of Ridesharing Insurance Market in Global Industry 2019 to 2023 | Key Players - Allianz, AXA, State Farm, GEICO, Safeco, Allstate here

News-ID: 1832052 • Views: …

More Releases from Business Industry Reports

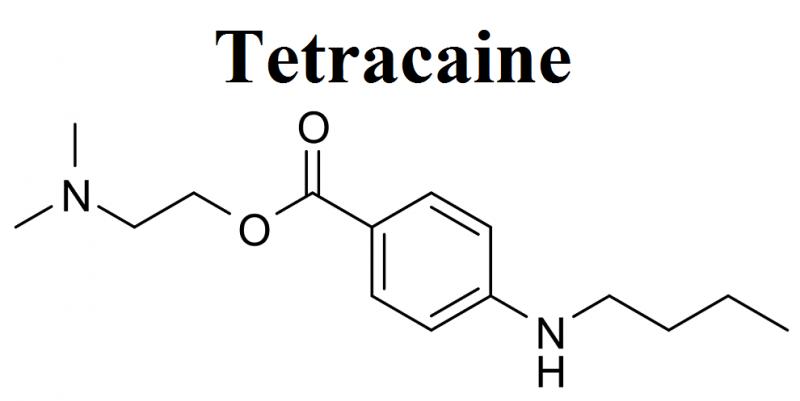

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

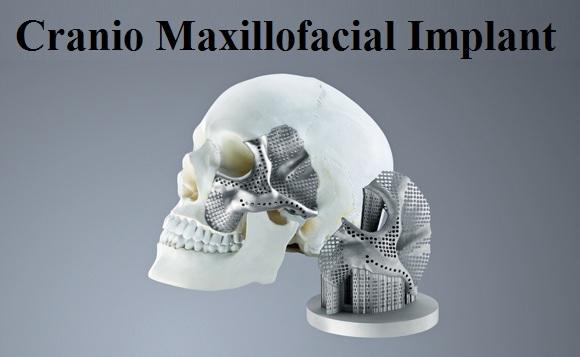

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…