Press release

Liquidity Asset Liability Management Solutions Industry 2019 Market Trends, Share, Growth, Revenue, Demand, Top Companies-IBM, Oracle, SAP SE, Infosys, FIS, Finastra, Fiserv, Moody's, Polaris Consulting&Services, Wolters Kluwer

Liquidity Asset Liability Management Solutions Market Overview: Asset Liability Management (ALM) can be defined as a mechanism to address the risk faced by a bank due to a mismatch between assets and liabilities either due to liquidity or changes in interest rates. Liquidity is an institution's ability to meet its liabilities either by borrowing or converting assets.Get Sample Copy at https://www.orianresearch.com/request-sample/1231973

The Liquidity Asset Liability Management Solutions Industry Report is an in-depth study analyzing the current state of the Liquidity Asset Liability Management Solutions Market. It provides a brief overview of the market focusing on definitions, classifications, product specifications, manufacturing processes, cost structures, market segmentation, end-use applications and industry chain analysis. The study on Liquidity Asset Liability Management Solutions Market provides analysis of market covering the industry trends, recent developments in the market and competitive landscape.

The study provides a decisive view of the market by segmenting it in terms of form and application. The segment has been analyzed based on present and future trends. Regional segmentation includes the current and projected demand in North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Inquire More or Share Questions If Any before the Purchase on This Report @ https://www.orianresearch.com/enquiry-before-buying/1231973

Market Participants:

The Major Players associated with the Liquidity Asset Liability Management Solutions Market are

• IBM

• Oracle

• SAP SE

• Infosys

• FIS

• Finastra

• Fiserv

• Moody's

• Polaris Consulting&Services

• ….

The key players in the Liquidity Asset Liability Management Solutions market are constantly focusing on research and development in order to expand their product portfolio and increase their customer base in developing regions. Additionally, players associated with the global Liquidity Asset Liability Management Solutions market are focusing mainly on merger and acquisition and developing strategic partnerships with other players in order to expand their product portfolio and to increase the market share.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins. Competitive analysis includes competitive information of leading players in Liquidity Asset Liability Management Solutions market, their company profiles, product portfolio, capacity, production, and company financials.

In addition, report also provides upstream raw material analysis and downstream demand analysis along with the key development trends and sales channel analysis. Research study on Liquidity Asset Liability Management Solutions Market also discusses the opportunity areas for investors.

Market segment by Type, the product can be split into

• Services

• Solutions

Market segment by Application, split into

• Banks

• Brokers

• Specialty Finance

• Wealth Advisors

• Other

Order a Copy of Global Liquidity Asset Liability Management Solutions Market Report @ https://www.orianresearch.com/checkout/1231973

Report on (2019-2025 Liquidity Asset Liability Management Solutions Market Report) mainly covers 12 sections acutely display the global market:

Chapter 1: To describe Liquidity Asset Liability Management Solutions Introduction, product scope, market overview, market opportunities, market risk, market driving force.

Chapter 2: To analyze the top manufacturers of Digital Content Creation, with sales, revenue, and price of Digital Content Creation, in 2014 and 2019.

Chapter 3: Liquidity Asset Liability Management Solutions Creation, to display the competitive situation among the top manufacturers, with sales, revenue and market share in 2014 and 2019.

Chapter 4: To show the global market by regions, with sales, revenue and market share of Digital Content Creation, for each region, from 2014 Liquidity Asset Liability Management Solutions to 2019.

Chapter 5, 6, 7, 8 and 9 To analyze the market by countries, by type, by application and by manufacturers, with sales, revenue and market share by key countries in these regions.

Chapter 10 and 11 To show the market by type and application, with sales market share and growth rate by type, application, from 2014 Liquidity Asset Liability Management Solutions to 2019.

Chapter 11 Liquidity Asset Liability Management Solutions market forecast, by regions, type and application, with sales and revenue, from 2019 to 2025 Digital Content Creation.

Chapter 12: To describe Liquidity Asset Liability Management Solutions sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

Customization Service of the Report:

Orian Research provides customization of reports as per your need. This report can be personalized to meet your requirements. Get in touch with our sales team, who will guarantee you to get a report that suits your necessities.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Liquidity Asset Liability Management Solutions Industry 2019 Market Trends, Share, Growth, Revenue, Demand, Top Companies-IBM, Oracle, SAP SE, Infosys, FIS, Finastra, Fiserv, Moody's, Polaris Consulting&Services, Wolters Kluwer here

News-ID: 1826570 • Views: …

More Releases from Orian Research

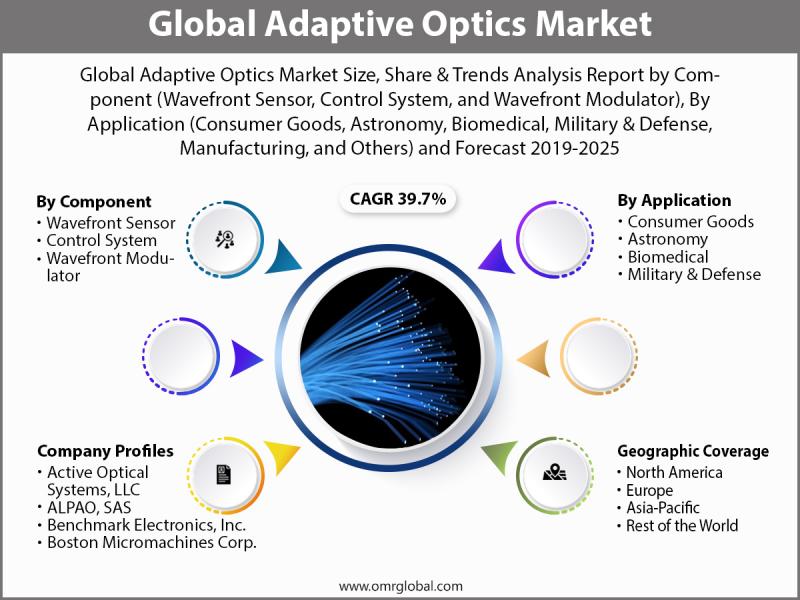

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

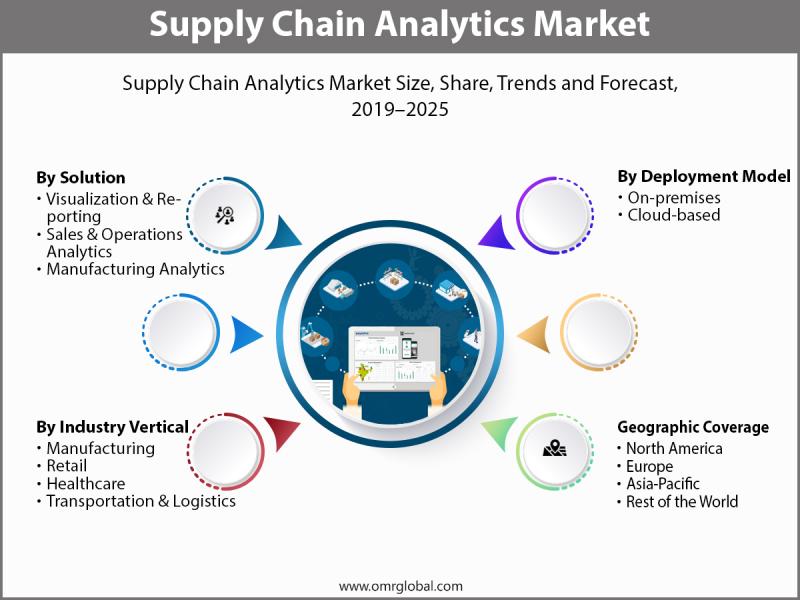

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

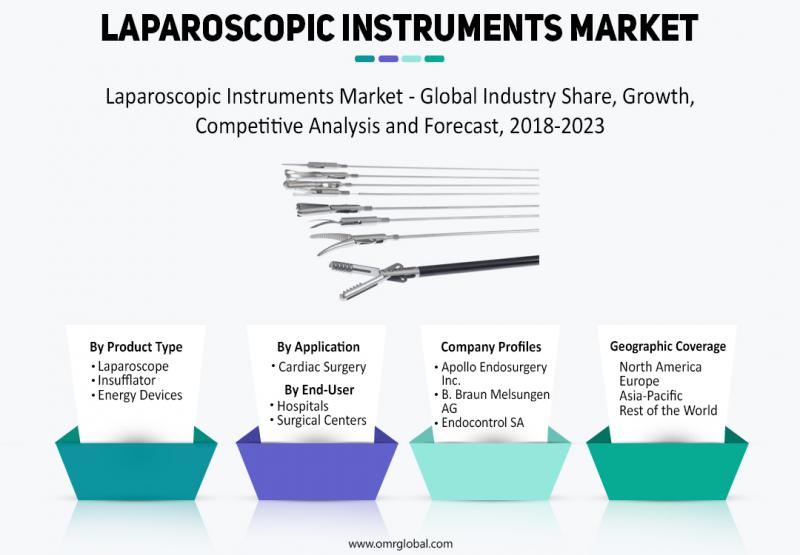

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Liquidity

Best altcoins analysis includes Pepenode liquidity strategy

This section frames our altcoin analysis around three forces shaping market moves: meme coins, crypto presales, and emerging utility tokens. Recent volatility in PEPE has pulled traders back into risky, fast-moving markets, while projects like Remittix show capital rotating toward functional platforms with listings and certified smart contracts.

We focus on the best altcoins by pairing technical cues with on-chain liquidity tactics. Expect discussion of price action signals-EMA placement, VWAP, RSI…

Best altcoins analysis includes Pepenode liquidity strategy

Assessing the best altcoins means marrying project fundamentals with market microstructure. Historical moves show how thin crypto liquidity and low sentiment create outsized returns: Solana traded below $15 and dipped under $10 in 2023, then surged past $294 in January 2025, illustrating how patient accumulation during quiet markets can yield large asymmetric gains.

That context matters for altcoin analysis and altcoin selection. Projects such as BMIC launched presales during tight liquidity…

Pepe Plus TO, vs Hyperliquid (HYPE) & Meme Liquidity Tokens: Structural Liquidit …

Liquidity-first meme tokens including Hyperliquid depend on short-term pool incentives and mining rewards attracting temporary capital seeking yield farming opportunities before rotating toward fresher alternatives.

Pepeto ($PEPETO) emerges through routed liquidity architecture permanently channeling volume into PEPETO demand, creating structural superiority over incentive-dependent models. Sustainable ecosystem at (https://pepeto.io/) implements PepetoSwap zero-fee exchanges, Pepeto Bridge cross-chain aggregation, and verified meme exchange routing all activity through PEPETO token.

Current presale pricing…

Best altcoins analysis includes Pepenode liquidity strategy

As markets reopen to speculative capital in 2025, smart altcoin analysis focuses on concrete on-chain signals and presale due diligence. The best altcoins era rewards projects that pair visible fundraising with durable liquidity controls. Maxi Doge's reported $4 million presale showed how headline raises can thrust a token into presale trackers and retail feeds, but observers must verify totals on Etherscan or BscScan before assuming lasting depth.

Pepenode's (https://pepenode.io/) meme coin…

Best altcoins commentary references Pepenode liquidity planning

A shift in market structure is steering capital toward the best altcoins, and Pepenode (https://pepenode.io/) liquidity planning sits at the center of that conversation. With Bitcoin exchange reserves falling and on-chain activity showing accumulation, traders are reallocating from blue-chip holdings into higher-beta opportunities. This article frames how presale mechanics and on-chain liquidity cues are reshaping altcoin trends and investor behavior.

Presale dynamics now matter more to larger allocators. Early detection of…

iZiSwap: Transforming DeFi Trading with Discretized Liquidity

The decentralized finance (DeFi) sector continues to evolve, with innovative platforms reshaping how traders and liquidity providers interact with blockchain markets. Among these, iZiSwap has emerged as a standout decentralized exchange (DEX), offering unique solutions to enhance trading efficiency and liquidity management.

Launched in 2023, iZiSwap https://iziswap.org/ introduces Discretized-Liquidity Automated Market Maker (DL-AMM) technology, a game-changing approach that optimizes capital efficiency while reducing trading risks.

What Sets iZiSwap Apart?

Traditional AMMs, such as…