Press release

General Liability Insurance Market Outlook and in-Depth Analysis 2019-2025 by Top Players: insureon , Aviva , Allianz , AXA , GEICO

Introduction on General Liability Insurance Market Report 2019This report focuses on the global General Liability Insurance status, future forecast, growth opportunity, key market and key players. The study objectives are to present the General Liability Insurance development in United States, Europe and China.

The study explores in details about the recent trend fast gaining momentum in General Liability Insurance industry due to factors including but not limited to growing customer preference and a sudden rise in their spending capacity. Aspects attributed to the gross margin, profit, supply chain management and product value and their considerable impact on the development of the General Liability Insurance market during the forecast period, 2019 - 2025 is carefully scrutinized during the research.

Main Aspects covered in the Report

• Overview of the General Liability Insurance market including production, consumption, status & forecast and market growth

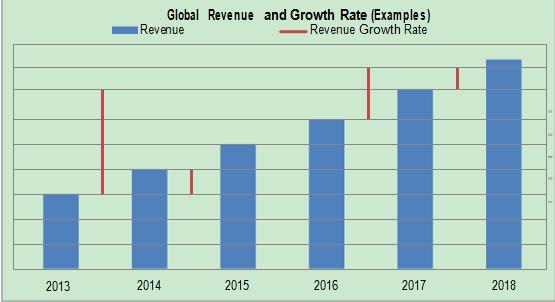

• 2015-2018 historical data and 2019-2025 market forecast

• Geographical analysis including major countries

• Overview the product type market including development

• Overview the end-user market including development

You Can Download Free Sample PDF of this Report at: https://www.supplydemandmarketresearch.com/home/contact/406921?ref=Sample-and-Brochure&toccode=SDMRSE406921&utm_source=ss

The Top key players covered in this study

• United Financial Casualty Company

• GEICO

• Nationwide Mutual Insurance Company

• insureon

• Liberty Mutual Insurance Company

• Farmers

• BizInsure LLC

• Intact Insurance Company

• The Travelers Indemnity Company

• Allianz

• AXA

• Nippon Life Insurance

• American Intl. Group

• Aviva

• Assicurazioni Generali

• State Farm Insurance

• Others

Market segment by Type, the product can be split into

• Life Insurance

• Property Insurance

Market segment by Application, split into

• Household

• Enterprise

Market segment by Regions/Countries, this report covers

• United States

• Europe

• China

• Japan

• Southeast Asia

• India

Grab Discount on Report at https://www.supplydemandmarketresearch.com/home/contact/406921?ref=Discount&toccode=SDMRSE406921

Reasons to Purchase this Report:

• Analyzing the outlook of the market with the recent trends and SWOT analysis

• Market dynamics scenario, along with growth opportunities of the market in the years to come

• Market segmentation analysis including qualitative and quantitative research incorporating the impact of economic and non-economic aspects

• Regional and country level analysis integrating the demand and supply forces that are influencing the growth of the market.

• Market value (USD Million) and volume (Units Million) data for each segment and sub-segment

• Distribution Channel sales Analysis by Value

• Competitive landscape involving the market share of major players, along with the new projects and strategies adopted by players in the past five years

• Comprehensive company profiles covering the product offerings, key financial information, recent developments, SWOT analysis, and strategies employed by the major market players

• 1-year analyst support, along with the data support in excel format.

• Central & South America

Key Stakeholders

• General Liability Insurance Manufacturers

• General Liability Insurance Distributors/Traders/Wholesalers

• General Liability Insurance Subcomponent Manufacturers

• Industry Association

• Downstream Vendors

Key Points from TOC

12 International Players Profiles

12.1 United Financial Casualty Company

12.1.1 United Financial Casualty Company Company Details

12.1.2 Company Description and Business Overview

12.1.3 General Liability Insurance Introduction

12.1.4 United Financial Casualty Company Revenue in General Liability Insurance Business (2014-2019)

12.1.5 United Financial Casualty Company Recent Development

12.2 GEICO

12.2.1 GEICO Company Details

12.2.2 Company Description and Business Overview

12.2.3 General Liability Insurance Introduction

12.2.4 GEICO Revenue in General Liability Insurance Business (2014-2019)

12.2.5 GEICO Recent Development

12.3 Nationwide Mutual Insurance Company

12.3.1 Nationwide Mutual Insurance Company Company Details

12.3.2 Company Description and Business Overview

12.3.3 General Liability Insurance Introduction

12.3.4 Nationwide Mutual Insurance Company Revenue in General Liability Insurance Business (2014-2019)

12.3.5 Nationwide Mutual Insurance Company Recent Development

12.4 insureon

12.4.1 insureon Company Details

12.4.2 Company Description and Business Overview

12.4.3 General Liability Insurance Introduction

12.4.4 insureon Revenue in General Liability Insurance Business (2014-2019)

12.4.5 insureon Recent Development

TOC Continued…!

Buy Full Premium Report With Instant Discount: https://www.supplydemandmarketresearch.com/home/purchase?code=SDMRSE406921

Canada Office:

302-20 Misssisauga Valley Blvd, Missisauga, L5A 3S1, Toronto

Contact Us

Email- info@supplydemandmarketresearch.com

Website-http://www.supplydemandmarketresearch.com/

Phone Number: +1-276-477-5910

About us

We have a strong network of high powered and experienced global consultants who have about 10+ years of experience in the specific industry to deliver quality research and analysis.

Having such an experienced network, our services not only cater to the client who wants the basic reference of market numbers and related high growth areas in the demand side, but also we provide detailed and granular information using which the client can definitely plan the strategies with respect to both supply and demand side

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release General Liability Insurance Market Outlook and in-Depth Analysis 2019-2025 by Top Players: insureon , Aviva , Allianz , AXA , GEICO here

News-ID: 1807158 • Views: …

More Releases from Supply Demand Market Research

Germany Waste Heat Recovery Systems is anticipated to reach USD 2150 Million by …

The Germany Waste Heat Recovery Systems (WHRS) is anticipated to reach USD 2150 million by 2030 growing at a CAGR of 5.7% from 2024-2030. Continued expansion post-2026 aligns with Germany's decarbonization trajectory, as operators increasingly prioritize heat-recovery to reduce fuel consumption and comply with tightening carbon-intensity expectations.

By technology, the exchange waste heat recovery boilers market size is anticipated to reach USD 710 million by 2030. Exchange/WH Boilers and SRC (Steam…

South Korea Flounder Market Anticipated to grow at a CAGR of 8% from 2023-2030

The South Korea flounder is anticipated to grow at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin B1 and B2, which is effective…

Global Flounder Market Anticipated to reach USD 56 Billion by 2030

The global flounder market is anticipated to reach USD 56 Billion by 2030, growing at a CAGR% of 8.0% from 2022-2030. The factors contributing towards the high growth are flounders such as halibut and turbot high-protein and low-calorie food, helps to re-solve the nutritional imbalance from diet because of its rich minerals, carbohydrates and vitamins despite low-calorie. They also offer medical benefits as liver of halibut contains lots of vitamin…

Global Seafood Market Anticipated to reach USD 730 Billion by 2030

The global seafood market is anticipated to reach USD 730 Billion by 2030, growing at a CAGR% of 8.9% from 2022-2030. The factors contributing towards the high growth are increased disposable income, awareness of fish being used as an ingredient in healthy food is growing. USA the government plans to sanction illegal fishing activities, actively promote fair trade, and promote strategies to promote the fishing industry through detailed strategies such…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…