Press release

How Anti-money Laundering Service Market Will Dominate In Coming Years? Key Players: Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, Tonbeller, Banker's Toolbox, Nice Actimize, CS&S, Targens, Verafin, EastNets

Anti-money Laundering Service Market2019 Report gives a clear understanding of the current market situation which includes of the antique and projected upcoming market size based on technological growth, value and volume, projecting cost-effective and leading fundamentals in the Anti-money Laundering Service market. The Anti-money Laundering Service Market report purposefully analyses every sub-segment regarding the individual growth trends, contribution to the total market, and the upcoming forecasts.Get Sample Copy at https://www.orianresearch.com/request-sample/1045955

About this Anti-money Laundering Service Market: Anti-money laundering software is software used in the finance and legal industries to meet the legal requirements for financial institutions and other regulated entities to prevent or report money laundering activities. There are four basic types of software that address anti-money laundering: transaction monitoring systems, currency transaction reporting (CTR) systems, customer identity management systems and compliance management software.

Global Anti-money Laundering Service Market Research Report is a professional and in-depth study of Market size (value, production and consumption), splits the breakdown (data status 2014-2019 and forecast to 2025), by manufacturers, region, type, application and forecast to 2025 on the current state of the industry. This Anti-money Laundering Service Market report research provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. This market analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status.

Anti-money Laundering Service Market Research Report Spread Across 101 Pages with Top Key Manufacturers and List Of Tables and Figures.

Inquire More or Share Questions If Any before the Purchase on This Report @ https://www.orianresearch.com/enquiry-before-buying/1045955

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins.

AML software allows financial institutions and other enterprises to detect suspicious transactions and analyze customer data. Its ability to provide real-time alerts and tools to report suspicious events to maximize security and operational efficiency will foster its adoption during the forecast period.

Global Anti-money Laundering Service Market competition by TOP KEY PLAYERS, with production, price, revenue (value) and each manufacturer including

• Oracle

• Thomson Reuters

• Fiserv

• SAS

• SunGard

• Experian

• ACI Worldwide

• Tonbeller

• Banker's Toolbox

• Nice Actimize

• CS&S

• ………

Global Anti-money Laundering Service Market providing information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information. Upstream raw materials and equipment and downstream demand analysis is also carried out. The Global Anti-money Laundering Service market development trends and marketing channels are analyzed. Finally the feasibility of new investment projects are assessed and overall research conclusions offered.

Order a Copy of Global Anti-money Laundering Service Market Report 2019 @ https://www.orianresearch.com/checkout/1045955

Regional Analysis

A section of the report gives comprehensive information about regional analysis. It provides a market outlook and sets the forecast within the context of the overall global Anti-money Laundering Service market. Orian Research has segmented the global Anti-money Laundering Service market into major geographical regions, such as North America, South America, Europe, Asia-Pacific, and the Middle East and Africa. Potential new entrants wishing to target only high growth areas are also included in this informative section of the global Anti-money Laundering Service market.

An important growth driver for this market is the increasing regulatory compliance requirements, which compels financial institutions to adopt AML software. The growing utilization of predictive analytics to reduce false results and to decrease the compliance cost of AML software is a trend that will impel market growth until the end of 2024.

Europe to be the largest market for AML software during the forecast period. Though the Europe accounts for the largest market share, the APAC region is envisaged to witness the fastest growth during the predicted period. United States will still play an important role which cannot be ignored. Any changes from United States might affect the development trend of Anti-money Laundering Software. Factors such as the rising adoption of stringent AML regulations, increasing regulatory compliance, and the growing adoption of these solutions in emerging economies like China, Mid-east and India will propel the prospects for market growth in APAC during the estimated period.

USA, Canada, Germany, China and Ireland are now the key developers of AML software. Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, Tonbeller, Banker's Toolbox, Nice Actimizem, CS&S, Ascent Technology Consultingm, Cellent Finance Solutions, Verafin and EastNets are the key suppliers in the global AML software market. Top 10 took up about 2/3 of the global market in 2016. Abroad vendors took up about than 50% of the Chinese market. Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, which have leading technology and market position, are key suppliers around the world.

Market segment by Type, the product can be split into

• Transaction Monitoring Software

• Currency Transaction Reporting (CTR) Software

• Customer Identity Management Software

• Compliance Management Software

• Others

Market segment by Application, split into

• Tier 1 Financial Institution

• Tier 2 Financial Institution

• Tier 3 Financial Institution

• Tier 4 Financial Institution

In short, we are of the conclusion that the global market report provides thorough data for the key players, to clearly understand market deeply. Outstanding players influencing the market through production cost, revenue, share, market size, growth rate, by regional revenue, are enclosed in this report along with the market growth strategies. The report primarily helps to realize and learn the most prohibiting and poignant driving forces of market with anticipating the impacts on the global market.

Report on (2019-2025 Anti-money Laundering Service Market Report) mainly covers 12 sections acutely display the global market:

Chapter 1: To describe Anti-money Laundering Service Introduction, product scope, market overview, market opportunities, market risk, market driving force.

Chapter 2: To analyze the top manufacturers of Digital Content Creation, with sales, revenue, and price of Digital Content Creation, in 2014 and 2019.

Chapter 3: Anti-money Laundering Service Creation, to display the competitive situation among the top manufacturers, with sales, revenue and market share in 2014 and 2019.

Chapter 4: To show the global market by regions, with sales, revenue and market share of Digital Content Creation, for each region, from 2014 Anti-money Laundering Service to 2019.

Chapter 5, 6, 7, 8 and 9 To analyze the market by countries, by type, by application and by manufacturers, with sales, revenue and market share by key countries in these regions.

Chapter 10 and 11 To show the market by type and application, with sales market share and growth rate by type, application, from 2014 Anti-money Laundering Service to 2019.

Chapter 11 Anti-money Laundering Service market forecast, by regions, type and application, with sales and revenue, from 2019 to 2025 Digital Content Creation.

Chapter 12: To describe Anti-money Laundering Service sales channel, distributors, traders, dealers, Research Findings and Conclusion, appendix and data source.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Anti-money Laundering Service Market Will Dominate In Coming Years? Key Players: Oracle, Thomson Reuters, Fiserv, SAS, SunGard, Experian, ACI Worldwide, Tonbeller, Banker's Toolbox, Nice Actimize, CS&S, Targens, Verafin, EastNets here

News-ID: 1806790 • Views: …

More Releases from Orian Research

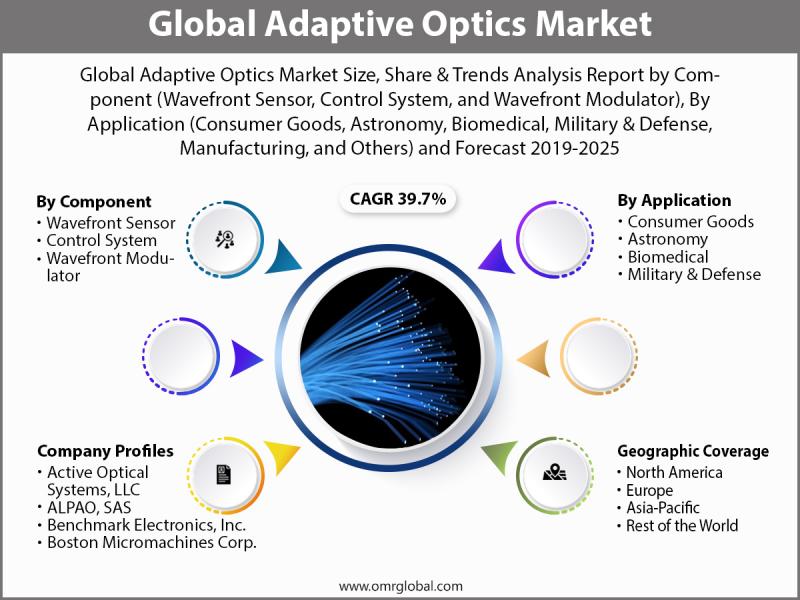

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

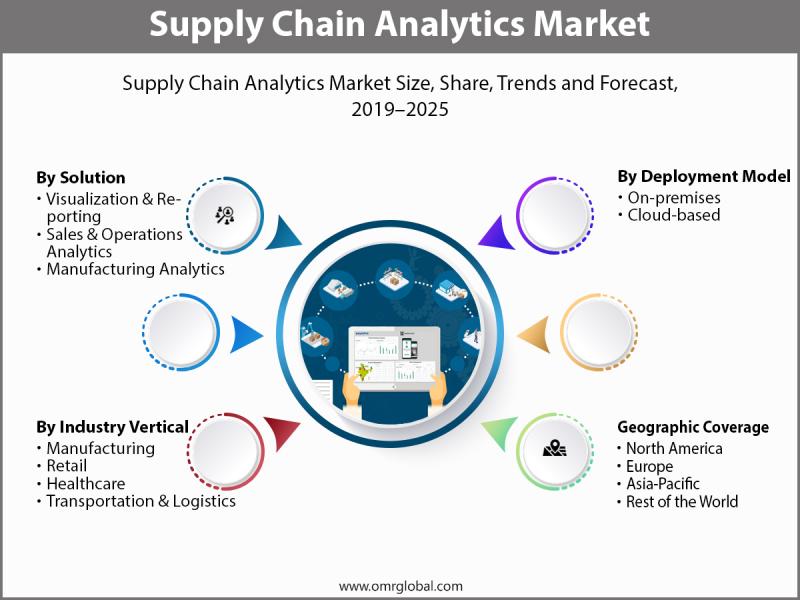

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

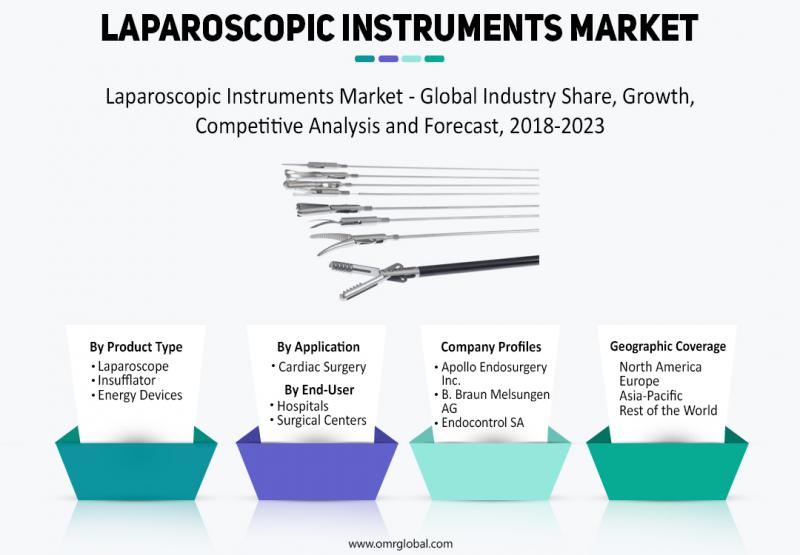

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Laundering

Surge In Money Laundering Cases Drives Growth Of Anti-Money Laundering Software …

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Anti-Money Laundering Software Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for anti-money laundering software has seen swift expansion in the past few years. Its growth is expected to rise from $2.85 billion in 2024 to $3.22 billion in 2025, with a…

Prominent Anti-Money Laundering Market Share Trend for 2025: SaaS Anti-Money Lau …

What industry-specific factors are fueling the growth of the anti-money laundering market?

The increasing emphasis on internet banking and digital transactions is anticipated to drive the anti-money laundering market's expansion in the future. Digital transactions involve money transfer from one payment account to another via a computer, mobile phone, or other digital device. Technologies aimed at preventing money laundering are employed to deter online fraud and mitigate risks associated with digital…

Leading Growth Driver in the Anti-Money Laundering Software Market in 2025: Surg …

Which drivers are expected to have the greatest impact on the over the anti-money laundering software market's growth?

The surge in incidents related to money laundering is anticipated to boost the anti-money laundering software industry. Money laundering typically involves transforming unlawfully obtained capital into lawful funds. The significant growth in money laundering incidents has facilitated the widespread use of anti-money laundering software programs to meet the regulatory demands of organizations seeking…

Anti-Money Laundering: Global Market Outlook

Summary:

Anti-money laundering (AML) comprises laws, policies, and regulations to safeguard financial frauds and illegal activity. Organizations must comply with these regulations even though compliance led financial institutions do have compliance departments and purchase software solutions. As times are changing, organizations are becoming more adaptive to the AML technologies and the end-user industry is reflecting various important trends shaping how they are being utilized. Increasing stringent regulations and compliance obligations for…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…