Press release

Global Payment Gateways Market Overview 2019, Demand by Regions, Share and Forecast to 2024

Over the last few years, the global payment gateways market has been exhibiting a strong growth. Some of the factors which are driving the market include easy access of the internet, expanding e-commerce sector and introduction of mobile wallets.A payment gateway refers to a service provider which acts as an intermediary between e-commerce websites and bank by facilitating payment transactions. Security plays an integral part in the payment gateways owing to the sensitive data of credit card that needs to be protected from the fraudulent entities. The order submission gets completed by using the HTTPS protocol which helps in securing the personal information. Some of the benefits of using payment gateways include user-friendly interface, expense and loss management, and time efficiency. A new research report titled “Payment Gateways Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2019-2024” by IMARC Group estimates that the global payment gateways market was worth US$ 11 Billion in 2018. The report further anticipates the market to cross US$ 17 Billion by 2024, at a projected CAGR of 7.9% over the forecast period.

Request for a free sample copy of this research report: https://www.imarcgroup.com/payment-gateways-market/requestsample

Global Payment Gateways Market Drivers/Constraints:

One of the vital factors influencing the market demand for payment gateways includes easy access of internet and a rise in the number of people adopting online retailing as well as contactless payment methods such as mobile wallets.

Currently, banks are collaborating with retail vendors in order to provide cashback schemes for expanding the consumer-base and retaining the existing consumers.

Introduction of mobile payment gateways like Amazon Pay, Apple Pay, Samsung Pay, Android Pay, etc. have made the process of bill payments convenient. Further, various companies are expanding their businesses by adapting the digital approach, thereby spurring the growth prospects of payment gateways in the upcoming years.

However, there are various factors which act as a hindrance to the growth of the market. Payment gateways have a limit regarding the number of transactions that can take place in a day. In addition, there is a high risk of being hacked that may lead to information leak.

Browse full report with detailed TOC and list of figures and tables: https://www.imarcgroup.com/payment-gateways-market

Market Breakup by Application:

1. Large Enterprises

2. Micro and Small Enterprises

3. Mid-sized Enterprises

On the basis of application, the payment gateways market is segregated as large enterprise, micro and small enterprises, and mid-sized enterprises. Amongst these, large enterprises account for the majority of the market share.

Market Breakup by Mode of Interaction:

1. Hosted Payment Gateways

2. Pro/Self-Hosted Payment Gateways

3. API/Non-Hosted Payment Gateways

4. Local Bank Integrates

5. Direct Payment Gateways

6. Platform-Based Payment Gateways

Based on mode of interaction, the market is segmented as hosted payment gateways, pro/self-hosted payment gateways, API/non-hosted payment gateways, local bank integrates, direct payment gateways and platform-based payment gateways. Currently, pro/self-hosted gateways exhibit a clear dominance in the global market.

Market Breakup by Region:

1. North America

2. Europe

3. Asia Pacific

4. Middle East and Africa

5. Latin America

On a geographical front, North America enjoys a leading position in the global payment gateways market, accounting for the largest share. North America is followed by Europe, Asia Pacific, Middle East and Africa, and Latin America.

Competitive Landscape:

The market is highly competitive in nature with the presence of numerous manufacturers who compete in terms of prices, features and quality. They are constantly coming up with additional features, thereby enhancing customer experience. Some of the leading players operating in the market are:

Worldpay Group

Wirecard

Adyen

Allied Wallet

PayPal

IMARC Group

309 2nd St, Brooklyn, NY 11215, USA

Website: www.imarcgroup.com

Email: sales@imarcgroup.com

USA: +1-631-791-1145

Follow us on Linkedin: www.linkedin.com/company/imarc-group/

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Payment Gateways Market Overview 2019, Demand by Regions, Share and Forecast to 2024 here

News-ID: 1806159 • Views: …

More Releases from IMARC Group

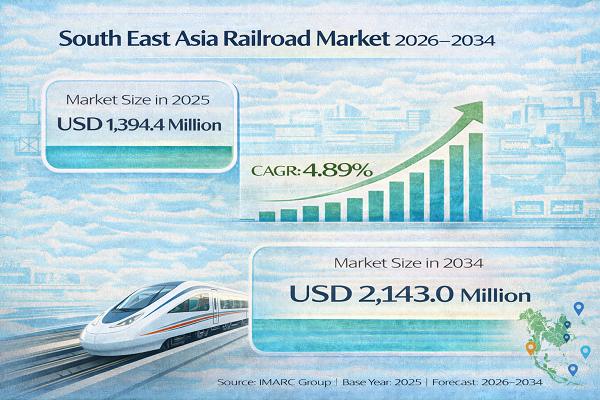

South East Asia Railroad Market Set to Reach USD 2,143.0 Million by 2034, Expand …

South East Asia Railroad Market : Report Introduction

According to IMARC Group's report titled "South East Asia Railroad Market Size, Share | Forecast 2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Get Instant Access to the Free Sample (Corporate Email Required): https://www.imarcgroup.com/south-east-asia-railroad-market/requestsample

South East Asia Railroad Market Overview (2026-2034)

The South East Asia railroad market size reached USD 1,394.4 Million in 2025. The market…

Amino Acid Production Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up an Amino Acid Production Plant positions investors in a rapidly growing industrial segment, driven by increasing global demand for amino acids across multiple end-use sectors. Amino acids are organic compounds that form the building blocks of proteins and play critical roles in metabolism, enzyme function, and nutritional supplementation. The integrated manufacturing process involves raw material handling (such as glucose, molasses, or corn syrup), fermentation or chemical synthesis, purification,…

Flow Battery Manufacturing Plant Cost 2026: Feasibility Study and Profitability …

Setting up a Flow Battery Manufacturing Plant positions investors in a rapidly expanding segment of the energy storage industry. Flow batteries are electrochemical storage systems where energy is stored in liquid electrolytes that flow through electrochemical cells. They offer unique advantages including long cycle life, modular scalability, high safety, and the ability to discharge fully without damage. These attributes make them ideal for grid-scale energy storage, renewable energy integration, EV…

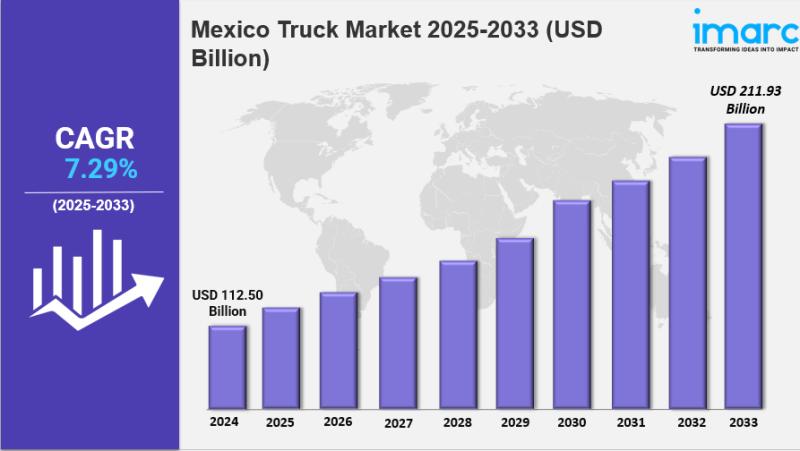

Mexico Truck Market Size, Share, Industry Overview, Trends and Forecast 2033

IMARC Group has recently released a new research study titled "Mexico Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Truck Market Overview

The Mexico truck market size reached USD 112.50 Billion in 2024. Looking forward, IMARC Group expects…

More Releases for Pay

Digital Wallets Market to See Thriving Worldwide | PayPal • Apple Pay • Goog …

The latest study by Coherent Market Insights, titled "Digital Wallets Market Size, Share & Trends Forecast 2026-2033," offers an in-depth analysis of the global and regional dynamics shaping this rapidly evolving industry. This comprehensive report highlights the competitive landscape, key market segments, value chain analysis, and emerging technological and regulatory trends expected between 2026 and 2033. The report provides actionable insights for business leaders, policymakers, investors, and new market entrants…

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…