Press release

What's Driving the Usage Based Insurance Market Immense Growth? AAM - Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Allianz, AXA, Progressive Insurance, AXA UK, And others

The usage based insurance market research report helps market player to execute phenomenal business techniques and therefore, it has featured driving contender's vital moves including acquisitions, business extension, mergers, joint efforts, adventures, limited time exercises, branding, and product dispatches. The SWOT analysis incorporates inner and outside variables, just as present and future capability of the market. The report identifies the key players, key organizations, and the leading region and calculates their share in the global usage based insurance market. What’s more, the usage based insurance market improvement patterns and promoting channels are investigated in this top-notch report.The usage based insurance market report is a meticulous investigation of the usage based insurance market and gives insights about significant methodologies, scope, chronicled information, and factual information of the overall market. It likewise incorporates anticipated insights that are assessed with the help of a reasonable arrangement of systems and hypotheses. The report, with all its significant subtleties, uncovers the self-evident reality information and overall investigation of usage based insurance market. The data incorporated in this report is totally unbiased and researched by market research specialists by utilizing primary and secondary research techniques. It sheds light on challenges hampering market development.

According to Data Bridge Market Research new market report Global usage based insurance market is register a healthy CAGR of 19.1% in the forecast period of 2019 to 2026.

Get a FREE sample report now! With graphs and charts https://databridgemarketresearch.com/request-a-sample/?dbmr=global-usage-based-insurance-market

The adoption of smartphones with telematics applications enables car makers and insurers to collect driving data and record trip parameters of hard braking, and acceleration. The driving data then is used by them to design usage-based insurance policies and in determining the policyholder’s premium. The huge adoption of smart-phone-based telematics is expected to drive the usage-based insurance market growth. Key market players have implemented various strategies such as partnership, acquisition, and expansion to gain competitive advantage and a stronger base in the market. Technological advancement is projected to fuel the growth of usage-based insurance industry during the forecast period, making the process easier with reduced service rate.

Top usage based insurance companies covered in this market research report

The global usage based insurance market is fragmented. To help clients improve their market position, this report provides an analysis of the market’s competitive landscape and offers information on the products offered by various companies. Moreover, this usage based insurance research report also includes information on the upcoming trends and challenges that will influence market growth. This will help companies create strategies to make most of the expanding usage based insurance market size.

The report offers a detailed analysis of several usage based insurance companies, including: Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc,Ageas Group, Octo Telematics, TomTom Telematics, Liberty Mutual Insurance, Intelligent Mechatronic Systems – IMS, Mitsui Sumitomo Insurance Co. (Europe) Ltd, Watchstone Group plc, Allianz Australia, Aviva Canada, Allianz Asia Pacific, AXA Insurance Company, AXA US, Aviva Asia, AXA Italia, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited.

See the complete table of contents | Request FREE at https://databridgemarketresearch.com/toc/?dbmr=global-usage-based-insurance-market

Some of the key findings from our usage based insurance market forecast report are summarized below

Global Usage Based Insurance Market, By Package type (pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), manage-how-you-drive (MHYD)), vehicle type (light-duty vehicle (LDV), heavy-duty vehicles (HDV)), Device offering (company provided, bring your own device (BYOD)), Technology (OBD-II, smartphone, embedded system, black box and others), Vehicle age (new vehicles, on-road vehicles), Electric and hybrid vehicle (hybrid electric vehicle (HEV), plug-in hybrid vehicle (PHEV), battery electric vehicle (BEV)), Geography (North America, Europe, Asia Pacific, South America, Middle East And Africa) – Industry Trends and Forecast to 2026

The report analyzes factors affecting usage based insurance System market from both demand and supply side and further evaluates market dynamics effecting the market during the forecast period i.e., drivers, restraints, opportunities and future trend. The report also provides exhaustive PEST analysis for all five regions namely; Europe, APAC, North America, MEA and South & Central America after evaluating technological factors, political, economic and social affecting the usage based insurance System market in these regions.

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: sopan.gedam@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What's Driving the Usage Based Insurance Market Immense Growth? AAM - Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Allianz, AXA, Progressive Insurance, AXA UK, And others here

News-ID: 1797710 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

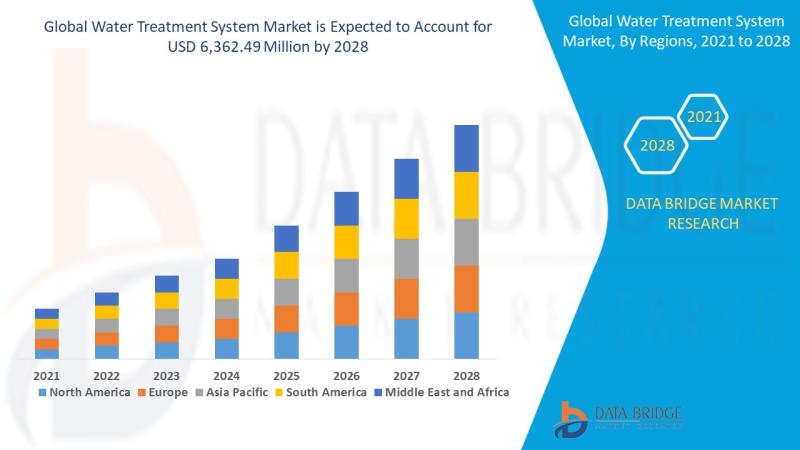

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…