Press release

What's driving the Loan Origination Systems Market Size? Global Players: Ellie Mae, Calyx Software, FICS, Fiserv, Byte Software, PCLender, LLC, Mortgage Builder Software, Mortgage Cadence, Wipro, Tavant Tech, DH Corp, Lending QB, Black Knight

Global Loan Origination Systems Market research report presents the historic, current and expected future market size, position, of the industry. The report further signifies the upcoming challenges, restraints and unique opportunities in the market. The report demonstrates the trends and technological advancement ongoing in the industry. In addition to the current inclinations over technologies and capabilities, the report also presents variable structure of the market, worldwide.Get Sample Copy of this Report - https://www.orianresearch.com/request-sample/1046183

Additionally, the report enables a market player not only to plan but also execute lucrative Loan Origination Systems business strategies based on growing market needs by emphasizing leading competitor’s strategic moves which include recent mergers, ventures, acquisitions, business expansion, product launches, branding, and promotional activities.

Furthermore, the report encompasses the key strategic developments of the market comprising new product launch, research & development, partnerships, acquisitions & mergers, collaborations & joint ventures agreements, and regional growth of main players in the market on the global and regional basis.

Global Loan Origination Systems Industry 2019 Market Research Report is spread across 108 pages and provides exclusive vital statistics, data, information, trends and competitive landscape details in this niche sector.

Inquire more or share questions if any before the purchase on this report @ https://www.orianresearch.com/enquiry-before-buying/1046183

Global Loan Origination Systems market competition by top manufacturers, with production, price, revenue (value) and market share for each manufacturer; the TOP PLAYERS including

• Tavant Tech

• DH Corp

• Lending QB

• Black Knight

• ISGN Corp

• Pegasystems

• Juris Technologies

• SPARK

• …

This report provides:

1) An overview of the global market for Loan Origination Systems Market and related technologies.

2) Analyses of global market trends, with data from 2013, estimates for 2014 and 2015, and projections of compound annual growth rates (CAGRs) through 2022.

3) Identifications of new market opportunities and targeted promotional plans for Loan Origination Systems Market.

4) Discussion of research and development, and the demand for new products and new applications.

5) Comprehensive company profiles of major players in the industry.

Order a copy of Global Loan Origination Systems Market Report 2019 @ https://www.orianresearch.com/checkout/1046183

Market Segments:

The global Loan Origination Systems market is segmented on the basis of type of product, application, and region. The analysts authoring the report provide a meticulous evaluation of all of the segments included in the report. The segments are studied keeping in view their market share, revenue, market growth rate, and other vital factors. The segmentation study equips interested parties to identify high-growth portions of the global Loan Origination Systems market and understand how the leading segments could grow during the forecast period.

Market segment by Type, the product can be split into

On-demand (Cloud)

On-premise

Market segment by Application, split into

Banks

Credit Unions

Mortgage Lenders & Brokers

Others

There are 13 Chapters to thoroughly display the Loan Origination Systems market. This report included the analysis of market overview, market characteristics, industry chain, competition landscape, historical and future data by types, applications and regions.

Chapter 1: Loan Origination Systems Market Overview, Product Overview, Market Segmentation, Market Overview of Regions, Market Dynamics, Limitations, Opportunities and Industry News and Policies.

Chapter 2: Loan Origination Systems Industry Chain Analysis, Upstream Raw Material Suppliers, Major Players, Production Process Analysis, Cost Analysis, Market Channels and Major Downstream Buyers.

Chapter 3: Value Analysis, Production, Growth Rate and Price Analysis by Type of Loan Origination Systems.

Chapter 4: Downstream Characteristics, Consumption and Market Share by Application of Loan Origination Systems.

Chapter 5: Production Volume, Price, Gross Margin, and Revenue ($) of Loan Origination Systems by Regions (2014-2019).

Chapter 6: Loan Origination Systems Production, Consumption, Export and Import by Regions (2014-2019).

Chapter 7: Loan Origination Systems Market Status and SWOT Analysis by Regions.

Chapter 8: Competitive Landscape, Product Introduction, Company Profiles, Market Distribution Status by Players of Loan Origination Systems.

Chapter 9: Loan Origination Systems Market Analysis and Forecast by Type and Application (2019-2024).

Chapter 10: Market Analysis and Forecast by Regions (2019-2024).

Chapter 11: Industry Characteristics, Key Factors, New Entrants SWOT Analysis, Investment Feasibility Analysis.

Chapter 12: Market Conclusion of the Whole Report.

Chapter 13: Appendix Such as Methodology and Data Resources of This Research.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US: +1 (415) 830-3727 | UK: +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

Follow Us on LinkedIn: https://www.linkedin.com/company-beta/13281002/

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients easy access to the world's most complete and current database of expert insights on global industries, companies, and products. We also specialize in custom research in situations where our syndicate research offerings do not meet the specific requirements of our esteemed clients.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release What's driving the Loan Origination Systems Market Size? Global Players: Ellie Mae, Calyx Software, FICS, Fiserv, Byte Software, PCLender, LLC, Mortgage Builder Software, Mortgage Cadence, Wipro, Tavant Tech, DH Corp, Lending QB, Black Knight here

News-ID: 1796190 • Views: …

More Releases from Orian Research

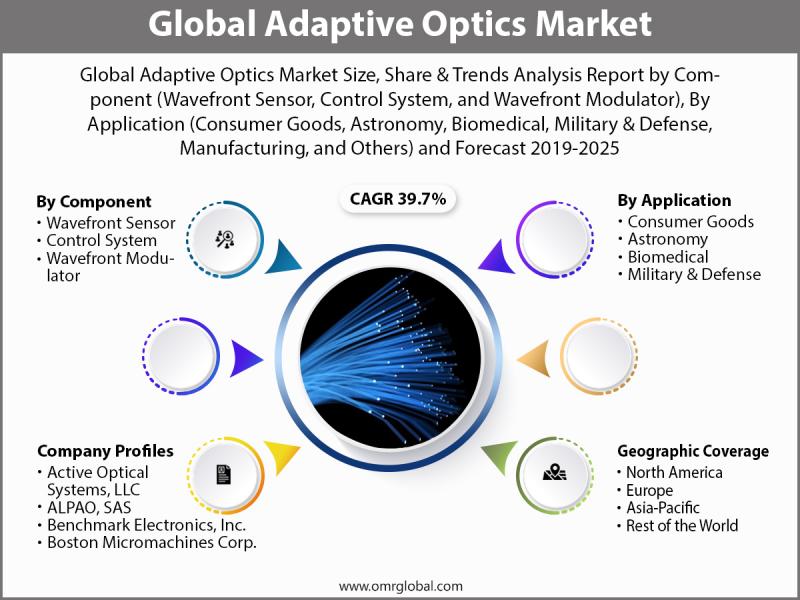

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

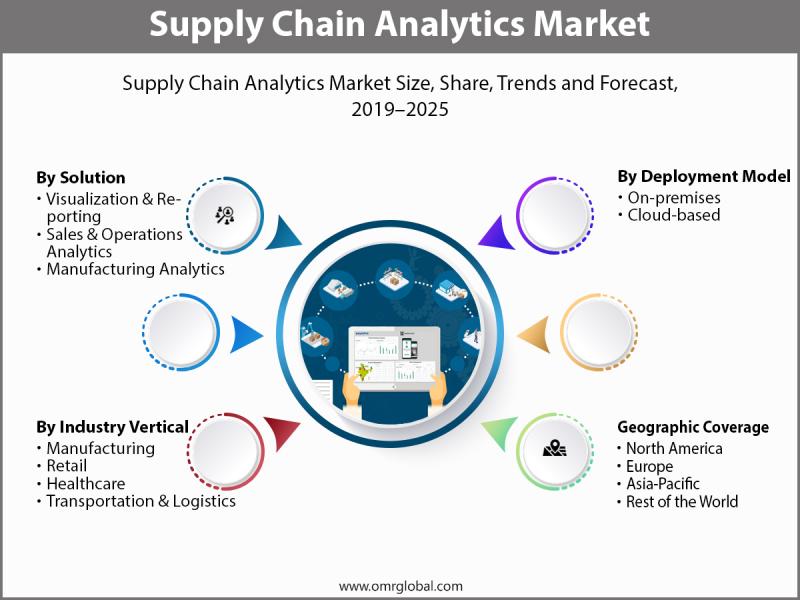

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

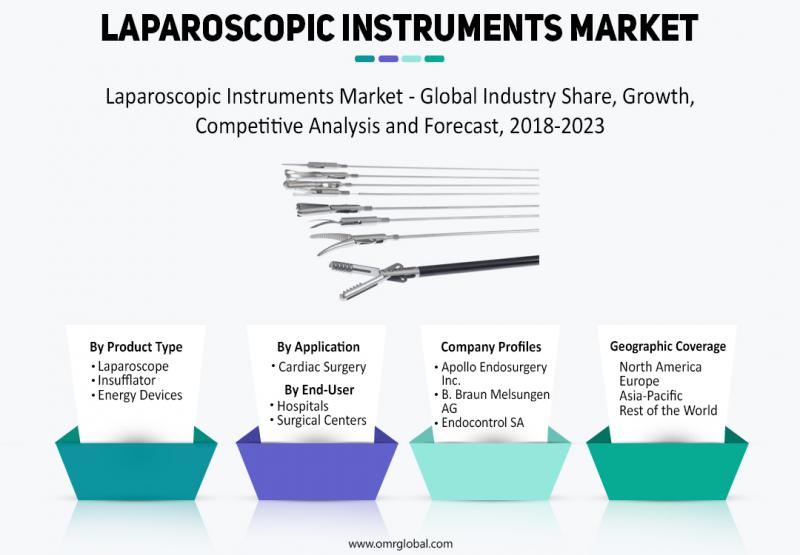

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…