Press release

Global Usage Based Insurance Market: How the Business Will Grow by 2026? Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc, Octo Telematics, And others

The usage based insurance market report provides the intrinsic details and fluctuating aspects of the market that the influence the commercial dynamics of the usage based insurance market along with integral factors of the rise in the demand for the product have been mapped across vital geographical regions. An overview of the multifarious applications, business areas and the latest trends observed in the industry has been laid out by this study. Various challenges overlooking the business and the numerous strategies employed by the Industry players for the successful marketing of the product have also been illustrated in the usage based insurance report.The usage based insurance report comprises of the rate of product consumption across the regions like North America, Middle east and Africa, South America, Asia-pacific, Europe and Asia-pacific. The research inspects the sales channels (indirect, direct, marketing) that companies have chosen for the primary product distributors and the superior clientele of the market. The study encompasses the value that each region contributes for collectively along with the anticipated regional market share.

According to Data Bridge Market Research new market report Global usage based insurance market is register a healthy CAGR of 19.1% in the forecast period of 2019 to 2026.

Get Free Sample Report | Table, Charts and More at https://databridgemarketresearch.com/request-a-sample/?dbmr=global-usage-based-insurance-market&utm_source=OpPr-Anik

The usage based insurance report gives estimations on the market status, growth rate, future trends, market drivers, opportunities, challenges, entry barriers, risks, sales channels, and distributors. Global market research analysis report serves a lot for the business and bestows with the solution for the toughest business problems. The adoption of UBI is boosting declining prices of connected devices and mobility technologies. There is an increase in demand for appropriate premium charges among consumers, because a safe and rash driver is equal to conventional insurance costs.

Key Players of Global Usage Based Insurance Market

Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc,Ageas Group, Octo Telematics, TomTom Telematics, Liberty Mutual Insurance, Intelligent Mechatronic Systems – IMS, Mitsui Sumitomo Insurance Co. (Europe) Ltd, Watchstone Group plc, Allianz Australia, Aviva Canada, Allianz Asia Pacific, AXA Insurance Company, AXA US, Aviva Asia, AXA Italia, AXA UK, Ageas UK, Liberty Mutual Insurance Europe Limited.

Increasing use of insurance models such as PAYD and PHYD contributes to the growth in the use-basis insurance market. UBI determined the premium on the basis of driving behavior by insurance companies. In order to monitor motive patterns, telematics and other communication technologies will lead to an excellent growth of the market over the projected timeline. Factors, such as increasing popularity of managing solutions, increased penetration of smartphones and an increase in UBI usage by insurance companies in order to enhance profitability are attributed to the market growth. Use-based insurance enables insurers to assess risks on the basis of the profile of individual drivers, travel characteristics and the actual vehicle condition. This helps them to improve their risk assessment and to prevent fraudulent claims. Insurers use telematics insurance to increase their customer base by using driving information to improve policy pricing.

Market Segmentation of Global Usage-Based Insurance Market

Global Usage Based Insurance Market, By Package type (pay-as-you-drive (PAYD), pay-how-you-drive (PHYD), manage-how-you-drive (MHYD)), vehicle type (light-duty vehicle (LDV), heavy-duty vehicles (HDV)), Device offering (company provided, bring your own device (BYOD)), Technology (OBD-II, smartphone, embedded system, black box and others), Vehicle age (new vehicles, on-road vehicles), Electric and hybrid vehicle (hybrid electric vehicle (HEV), plug-in hybrid vehicle (PHEV), battery electric vehicle (BEV)), Geography (North America, Europe, Asia Pacific, South America, Middle East And Africa) – Industry Trends and Forecast to 2026

Key Strategies of Major Competitors

Growing businesses through serving into new application areas and identifying pockets of growth in emerging markets

Focusing on cost effective production of devices with stability and robustness

Strategies for Product differentiation and adjusting to the life cycle changes

Enhance productivity and optimizing back end manufacturing processes

Product enhancement through integrating new strategies involving big data, advanced analytics into traditional manufacturing processes

Strengthening collaboration with suppliers and distributors

More focused strategies are found in the report

Download FREE | TOC at https://databridgemarketresearch.com/toc/?dbmr=global-usage-based-insurance-market&utm_source=OpPr-Anik

Key Reasons to Purchase:

To gain insightful analyses of the market and have comprehensive understanding of the Global Usage Based Insurance Market and its commercial landscape

Assess the Usage Based Insurance production processes, major issues, and solutions to mitigate the development risk

To understand the most affecting driving and restraining forces in the Usage Based Insurance Market and its impact in the Global market

Learn about the market strategies that are being adopted by leading respective organizations

To understand the future outlook and prospects for Global Usage Based Insurance Market

Contact:

Data Bridge Market Research

Tel: +1-888-387-2818

Email: sopan.gedam@databridgemarketresearch.com

About Data Bridge Market Research:

Data Bridge Market Research set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Usage Based Insurance Market: How the Business Will Grow by 2026? Allianz, AXA, Progressive Insurance, Allstate, Allstate Canada, Desjardins, Generali, MAPFRE, Metromile, Aviva, Admiral Group Plc, Octo Telematics, And others here

News-ID: 1795413 • Views: …

More Releases from Data Bridge Market Research

Scented Candle Market Shows Strong Growth Driven by Wellness and Home Décor Tr …

The global scented candle market is on track for significant expansion, increasing from an estimated USD 3.60 billion in 2024 to USD 6.00 billion by 2032, registering a strong CAGR of 6.60%. Rising consumer interest in home ambiance, wellness, and premium lifestyle products continues to drive market demand.

Get More Detail: https://www.databridgemarketresearch.com/reports/global-scented-candle-market

Market Growth Drivers

The scented candle market has evolved beyond being just a decorative item. Key growth factors include:

Home Fragrance &…

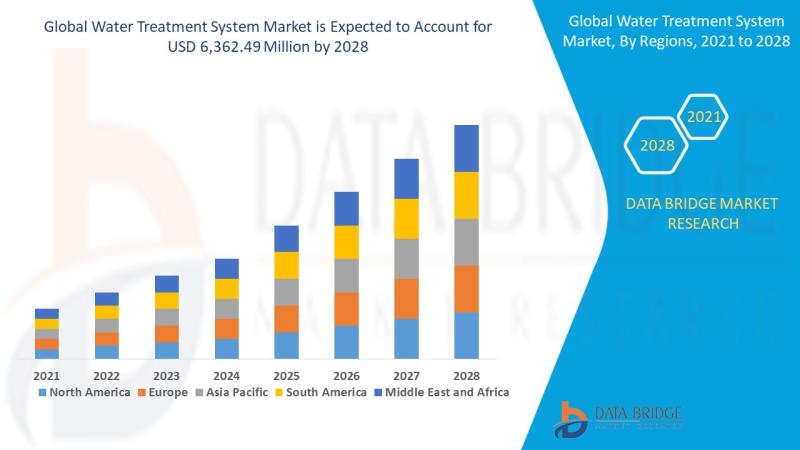

Water Treatment System Market: Sustaining the Future of Clean Water

Introduction

Understanding Water Treatment Systems

Water treatment systems are designed to purify and disinfect water for various uses-drinking, industrial processes, irrigation, and wastewater reuse. These systems eliminate contaminants such as bacteria, viruses, heavy metals, chemicals, and particulates, making water safe and sustainable for consumption and use.

Importance in Global Sustainability

Clean water is essential to life and industrial progress. With growing water demand and pollution, water treatment systems are now critical infrastructure across the…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

Veterinary X-Ray Market Size, Analysis, Scope, Demand, Opportunities, Statistics

According to Data Bridge Market Research The global Veterinary X-Ray market size was valued at USD 915.19 million in 2024 and is projected to reach USD 1576.00 million by 2032, with a CAGR of 7.03 % during the forecast period of 2025 to 2032.

With increasing globalization and digital disruption, the Equine X-Ray Solutions Market is expanding across multiple industries, . Market research data indicates that businesses in the Companion Animal…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…