Press release

Conventional/Bank ATM Market: Focus on Advance Technology, Development, Opportunities, Future Plans, Major Players- Fujitsu (Japan), GRG Banking (China), HESS Terminal Solutions (USA), Hitachi Payment Services (Japan), Nautilus Hyosung (South Korea)

Global Conventional/Bank ATM Market Report traverse throughout historic, present, and projected market status to precisely evaluate overall market growth tendency, consumption and Conventional/Bank ATM market trends, and forthcoming opportunities in the market. Conventional/Bank ATM market segments such as product/service type, applications, technology, and regions.Get Sample Copy of this Report @ https://www.orianresearch.com/request-sample/1023667

Automated teller machines (ATM) enhance managing an account and money-related administrations, for example, reserves exchange, money withdrawal, money stores, smaller than normal articulations, charge installments by charge or Visas and other financial enquiries.

The report firstly introduced the Conventional/Bank ATM basics: definitions, classifications, applications and market overview; product specifications; manufacturing processes; cost structures, raw materials and so on. Then it analyzed the world’s main region market conditions, including the product price, profit, capacity, production, supply, demand and market growth rate and forecast etc. In the end, the report introduced new project SWOT analysis, investment feasibility analysis, and investment return analysis.

Inquire More or Share Questions If Any before the Purchase on This Report @

https://www.orianresearch.com/enquiry-before-buying/1023667

No of Pages: 96

The key players covered in this study

• Fujitsu (Japan)

• GRG Banking (China)

• HESS Terminal Solutions (USA)

• Hitachi Payment Services (Japan)

• Nautilus Hyosung (South Korea)

• NCR Corporation (USA)

• Wincor Nixdorf AG. (Germany)

• DIEBOLD INC. (USA)

• ...

Market segment by Type, the product can be split into

• Deployment

• Managed Services

Market segment by Application, split into

• Bank Service Agent

• Bank

Order a Copy of Global Conventional/Bank ATM Market Report 2019 @ https://www.orianresearch.com/checkout/1023667

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins. The report focuses on global major leading Conventional/Bank ATM Industry players providing information such as company profiles, product picture and specification, capacity, production, price, cost, revenue and contact information.

Geographically, the report takes stock of the potential of Conventional/Bank ATM market in the regions of North America including the U.S. and Canada, Latin America including Mexico, Brazil, and Argentina, Europe including the U.K., Germany, France, Italy, Spain, and Nordic, Asia Pacific except Japan (APEJ) including India, China, Thailand, Malaysia, Singapore, and Australia, and the Middle East and Africa including Gulf Cooperation Council (GCC), South Africa, Israel, and Nigeria

Report on (2019-2025 Conventional/Bank ATM Market Report) mainly covers 15(Table of Content) sections acutely display the global market:

1 Report Overview

1.1 Study Scope

1.2 Key Market Segments

1.3 Players Covered

1.4 Market Analysis by Type

1.4.1 Global Conventional/Bank ATM Market Size Growth Rate by Type (2014-2025)

1.4.2 Deployment

1.4.3 Managed Services

1.5 Market by Application

1.5.1 Global Conventional/Bank ATM Market Share by Application (2014-2025)

1.5.2 Bank Service Agent

1.5.3 Bank

1.6 Study Objectives

1.7 Years Considered

2 Global Growth Trends

2.1 Conventional/Bank ATM Market Size

2.2 Conventional/Bank ATM Growth Trends by Regions

2.2.1 Conventional/Bank ATM Market Size by Regions (2014-2025)

2.2.2 Conventional/Bank ATM Market Share by Regions (2014-2019)

2.3 Industry Trends

2.3.1 Market Top Trends

2.3.2 Market Drivers

2.3.3 Market Opportunities

3 Market Share by Key Players

3.1 Conventional/Bank ATM Market Size by Manufacturers

3.1.1 Global Conventional/Bank ATM Revenue by Manufacturers (2014-2019)

3.1.2 Global Conventional/Bank ATM Revenue Market Share by Manufacturers (2014-2019)

3.1.3 Global Conventional/Bank ATM Market Concentration Ratio (CR5 and HHI)

3.2 Conventional/Bank ATM Key Players Head office and Area Served

3.3 Key Players Conventional/Bank ATM Product/Solution/Service

3.4 Date of Enter into Conventional/Bank ATM Market

3.5 Mergers & Acquisitions, Expansion Plans

4 Breakdown Data by Type and Application

4.1 Global Conventional/Bank ATM Market Size by Type (2014-2019)

4.2 Global Conventional/Bank ATM Market Size by Application (2014-2019)

5 United States

5.1 United States Conventional/Bank ATM Market Size (2014-2019)

5.2 Conventional/Bank ATM Key Players in United States

5.3 United States Conventional/Bank ATM Market Size by Type

5.4 United States Conventional/Bank ATM Market Size by Application

6 Europe

7 China

8 Japan

9 Southeast Asia

10 India

11 Central & South America

12 International Players Profiles

13 Market Forecast 2019-2025

14 Analyst's Viewpoints/Conclusions

15 Appendix

If you have any special requirements, please let us know and we will offer you the report as you want.

Contact Us:

Ruwin Mendez

Vice President – Global Sales & Partner Relations

Orian Research Consultants

US +1 (415) 830-3727 | UK +44 020 8144-71-27

Email: info@orianresearch.com

Website: www.orianresearch.com/

About Us:

Orian Research is one of the most comprehensive collections of market intelligence reports on the World Wide Web. Our reports repository boasts of over 500000+ industry and country research reports from over 100 top publishers. We continuously update our repository so as to provide our clients with easy access to the world's most complete and current database of expert insights on global industries, companies, and products.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Conventional/Bank ATM Market: Focus on Advance Technology, Development, Opportunities, Future Plans, Major Players- Fujitsu (Japan), GRG Banking (China), HESS Terminal Solutions (USA), Hitachi Payment Services (Japan), Nautilus Hyosung (South Korea) here

News-ID: 1792262 • Views: …

More Releases from Orian Research

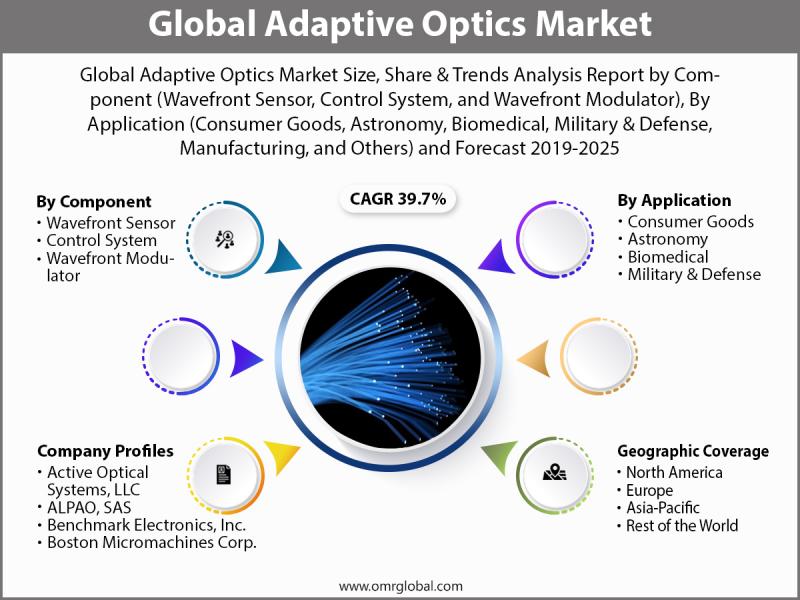

Adaptive Optics Market Size, Competitive Analysis, Share, Forecast- 2019-2025

The global adaptive optics market is projected to grow at a significant CAGR of 39.7% during the forecast period owing to the increasing application of adaptive optics in retinal imaging and ophthalmology to reduce the optical aberrations. The integration of adaptive optics converts an ophthalmoscope into a microscope, allowing visualization of and optical access to individual retinal cells in living human eyes.

To learn more about this report request a…

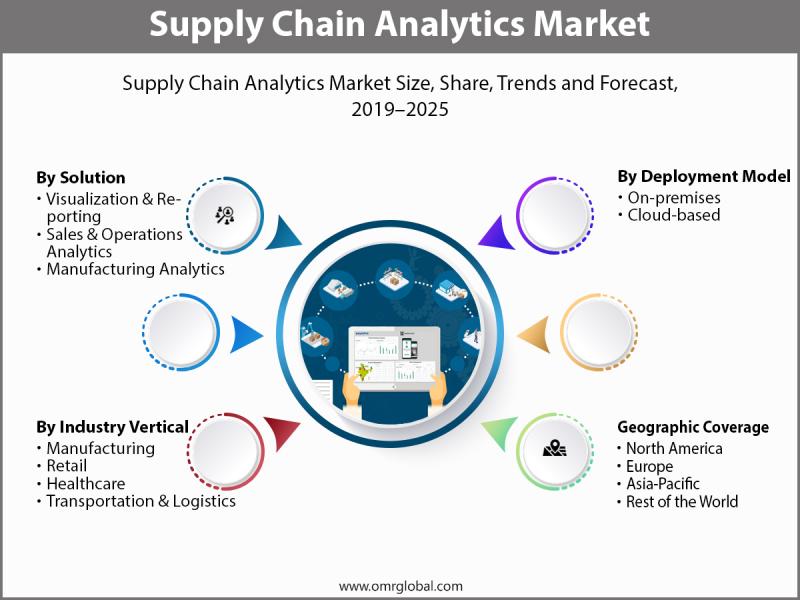

Supply Chain Analytics Market Size, Competitive Analysis, Share, Forecast- 2019- …

The Global Supply Chain Analytics Market is estimated to grow at a significant CAGR during the forecast period 2019- 2025. The impact of e-commerce on retailers and manufacturers is driving a revolution in many sectors and business organization. This has led to the introduction of supply chain analytics solution, which offers mathematics, statistics, predictive modeling and machine-learning techniques to find meaningful patterns and knowledge regarding order, shipment and transactional data.…

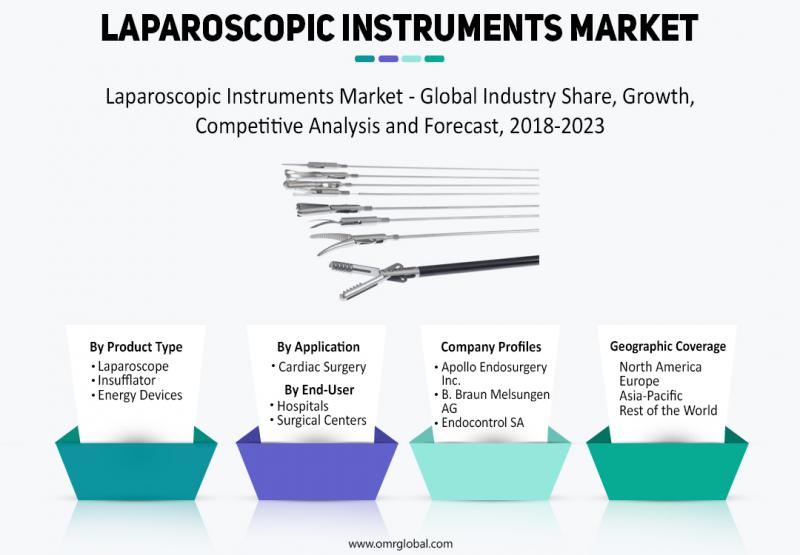

Laparoscopic Instruments Market Size, Competitive Analysis, Share, Forecast- 201 …

The laparoscopic or minimally invasive surgery uses a special surgical instrument known as laparoscope to look inside the body and carry out certain procedures. The laparoscopic instruments market is projected to witness a steady growth rate during the forecast period 2018-2023. The rise in preference of minimal invasive method over invasive surgeries, the high prevalence of lifestyle-oriented diseases, high global expenditure on the laparoscopic market, increasing healthcare market in emerging…

Fertility Drug Market Size, Competitive Analysis, Share, Forecast- 2018-2023

Infertility is one of the major issue now a day due to change in life style & cultural shift. There are various fertility drugs available in market for infertility related problems. Fertility drugs enhance the reproductive ability by improving quality of egg or sperms by increasing the levels of certain hormones in human body. The major factors that are responsible for the growth of fertility drug market are Change in…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…