Press release

Booming Strategy For Insurance Fraud Detection Market with Top Key Players: IBM, BAE Systems, FICO, SAP, SAS Institute, Fiserv, LexisNexis, Kount, iovation, ACI Worldwide

Insurance Fraud influences the budgetary wellbeing of the guarantors, yet in addition of guiltless individuals looking for powerful protection inclusion. False cases are a genuine money related weight on back up plans and result in higher generally speaking protection costs.The Global Insurance Fraud Detection Market is expected to grow from USD 2.5 billion in 2019 to USD 7.9 billion by 2024, at a Compound Annual Growth Rate (CAGR) of 25.8% during the forecast period.

To Get The Sample Copy @ https://bit.ly/2FAzRDA

Global Insurance Fraud Detection Market, provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The Insurance Fraud Detection Market analysis is provided for the international Industry including development trends, competitive landscape analysis, and key regions development status.

The Top Key Players include: FICO (US), IBM (US), BAE Systems (UK), SAS Institute (US), Experian (Ireland), LexisNexis (US), iovation (US), FRISS (Netherlands), SAP (Germany), Fiserv (US), ACI Worldwide (US), Simility (US), Kount (US), Software AG (Germany), BRIDGEi2i Analytics Solutions (India), and Perceptiviti (India).

The main goal for the dissemination of this information is to give a descriptive analysis of how the trends could potentially affect the upcoming future of Insurance Fraud Detection Market during the forecast period. This markets competitive manufactures and the upcoming manufactures are studied with their detailed research. Revenue, ion, price, market share of these players is mentioned with precise information.

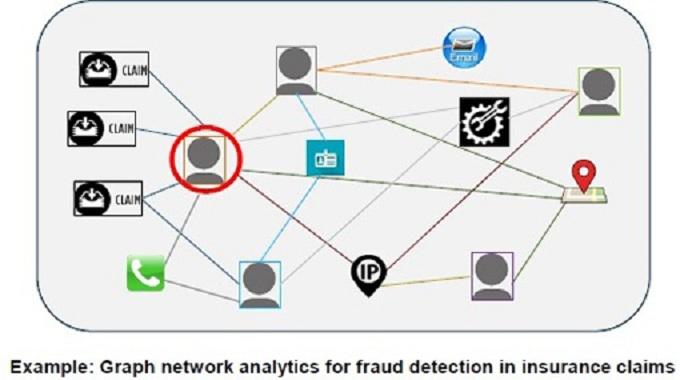

The major aspects driving the Insurance Fraud Detection Market are the need to effectively manage huge volumes of identities by organizations; improving operational efficiency & enhancing the customer experience; increasing adoption of advanced analytics techniques; and stringent regulatory compliances. The Insurance Fraud Detection Market is growing drastically on account of the proliferation of cloud-based services in the insurance sector and increasing threats & frauds in this sector.

The study objectives of this Insurance Fraud Detection Market report are:

• To study and forecast the market size of Insurance Fraud Detection Market in market.

• To analyze the key players, SWOT analysis, value and market share for top players.

• To define, describe and forecast the market by type, end use and region.

• To analyze and compare the market status and forecast among major regions.

• To analyze the key regions market potential and advantage, opportunity and challenge, restraints and risks.

• To identify significant trends and factors driving or inhibiting the market growth.

• To analyze the opportunities in the market for stakeholders by identifying the high growth segments.

• To strategically analyze each submarket with respect to individual growth trend and their contribution to the market

• To analyze competitive developments such as expansions, agreements, new launches, and acquisitions in the market.

• To strategically profile the key players and comprehensively analyze their growth strategies.

TABLE OF CONTENT:

•Chapter One Insurance Fraud Detection Market Overview

•Chapter Two Insurance Fraud Detection Market Data Analysis

•Chapter Three Insurance Fraud Detection Market Technical Data Analysis

•Chapter Four Insurance Fraud Detection Market Government Policy and News

•Chapter Five Insurance Fraud Detection Market Manufacturing Process and Cost Structure

•Chapter Six 2014-2019 Insurance Fraud Detection Market Productions Supply Sales Demand Market Status and Forecast

•Chapter Seven Insurance Fraud Detection Market Key Manufacturers

•Chapter Eight Insurance Fraud Detection Market Up and Down Stream Industry Analysis

•Chapter Nine: Marketing Strategy Insurance Fraud Detection Market Analysis

•Chapter Ten 2019-2025Insurance Fraud Detection Market Development Trend Analysis

•Chapter Eleven Insurance Fraud Detection Market New Project Investment Feasibility Analysis

Access For The Complete Report @ https://bit.ly/2FAzRDA

About Us:

Market research is the new buzzword in the market, which helps in understanding the market potential of any product in the market. Reports And Markets is not just another company in this domain but is a part of a veteran group called Algoro Research Consultants Pvt. Ltd. It offers premium progressive statistical surveying, market research reports, analysis & forecast data for a wide range of sectors both for the government and private agencies all across the world.

Contact Us:

Sanjay Jain

Manager - Partner Relations & International Marketing

www.reportsandmarkets.com

info@reportsandmarkets.com

Ph: +44-020-3286-9338 (UK)

Ph: +1-214-736-7666 (US)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Booming Strategy For Insurance Fraud Detection Market with Top Key Players: IBM, BAE Systems, FICO, SAP, SAS Institute, Fiserv, LexisNexis, Kount, iovation, ACI Worldwide here

News-ID: 1789749 • Views: …

More Releases from REPORTSANDMARKETS

Micro Hotels Market Is Expected to Boom | Nine Hours in Japan, Dean Hotel Dublin …

This report studies the Micro Hotels Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Micro Hotels Market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

IT Consulting and Integration Services Market Overview by Advance Technology, Fu …

This report studies the IT Consulting and Integration Services Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete IT Consulting and Integration Services Market analysis segmented by companies, region, type and applications in the report.

The report offers valuable insight into the…

Bumping Services Market Growth, Overview with Detailed Analysis 2022-2028| ASE G …

This report studies the Bumping Services market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Bumping Services market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

Laser Powder Bed Fusion (LPBF) Technology Market Overview by Advance Technology, …

This report studies the Laser Powder Bed Fusion (LPBF) Technology market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Laser Powder Bed Fusion (LPBF) Technology market analysis segmented by companies, region, type and applications in the report.

New vendors in the market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…