Press release

Trade Finance Market to 2027 – BNP Paribas, Citi, Euler Hermes, HSBC Holdings, JPMorgan Chase, Mitsubishi UFJ Financial, Royal Bank, Standard Chartered

MARKET INTRODUCTIONTrade finance is a type of commercial activity that is closely associated with the story of human trade evolution. In trade businesses it is highly critical to understand the role of trade finance as the former rarely takes place securely and safely without the latter. Besides, the trade finance can also be defined as a center where financial institution facilitate credit facilities like short-term finance for guarantee of exchange of goods. A trade finance might also use medium or long term loans.

MARKET DYNAMICS

Increasing adoption of pricing and structuring tools is projected to be one of the vital trade finance trend, which during the forecast period will gain noteworthy traction. By implementing pricing and structuring tools enables management of individual portfolios and dodge the risk through automation, consistency, and transparency provided by algorithmic trading throughout the company. Hence, the adoption of these tools is projected to optimistically impact the growth of trade finance market.

Get Sample Copy of this Report at http://bit.ly/2YgsgkK

The report also includes the profiles of key Trade Finance companies along with their SWOT analysis and market strategies. In addition, the report focuses on leading industry players with information such as company profiles, components and services offered, financial information of last 3 years, key development in past five years.

Asian Development Bank

Bank Of America Merrill Lynch

BNP Paribas

CITI

Euler Hermes

HSBC Holdings Plc.

JPMorgan Chase

Mitsubishi UFJ Financial

Royal Bank Of Scotland

Standard Chartered

MARKET SCOPE

The "Global Trade Finance Market Analysis to 2027" is a specialized and in-depth study of the Trade Finance industry with a special focus on the global market trend analysis. The report aims to provide an overview of Trade Finance market with detailed market segmentation by trade transactions, service providers, end user and geography. The global Trade Finance market is expected to witness high growth during the forecast period. The report provides key statistics on the market status of the leading Trade Finance market players and offers key trends and opportunities in the market.

MARKET SEGMENTATION

The global Trade Finance market is segmented on the basis of trade transaction, service providers and end user. Based on trade transaction, the market is segmented as domestic, and international. On the basis of the service providers the market is segmented as banks, trade finance institutions & organizations, and others. The market on the basis of the end user is classified as importers, exporters, traders, and others.

Inquire about this Report at http://bit.ly/2X0eeCt

REGIONAL FRAMEWORK

The report provides a detailed overview of the industry including both qualitative and quantitative information. It provides overview and forecast of the global Trade Finance market based on various segments. It also provides market size and forecast estimates from year 2017 to 2027 with respect to five major regions, namely; North America, Europe, Asia-Pacific (APAC), Middle East and Africa (MEA) and South & Central America. The Trade Finance market by each region is later sub-segmented by respective countries and segments. The report covers analysis and forecast of 18 countries globally along with current trend and opportunities prevailing in the region.

The report analyzes factors affecting Trade Finance market from both demand and supply side and further evaluates market dynamics effecting the market during the forecast period i.e., drivers, restraints, opportunities, and future trend. The report also provides exhaustive PEST analysis for all five regions namely; North America, Europe, APAC, MEA and South & Central America after evaluating political, economic, social and technological factors effecting the Trade Finance market in these regions.

MARKET PLAYERS

The reports cover key developments in the Trade Finance market as organic and inorganic growth strategies. Various companies are focusing on organic growth strategies such as product launches, product approvals and others such as patents and events. Inorganic growth strategies activities witnessed in the market were acquisitions, and partnership & collaborations.

Buy now@ http://bit.ly/2RAA7Hv

These activities have paved way for expansion of business and customer base of market players. The market payers from Trade Finance market are anticipated to lucrative growth opportunities in the future with the rising demand for Trade Finance in the global market. Below mentioned is the list of few companies engaged in the Trade Finance market.

Contact Us:

Call: +1-646-491-9876

Email: sales@theinsightpartners.com

About The Insight Partners

The Insight Partners is a one-stop industry research provider of actionable solutions. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are specialist in industries such as Aerospace & Defense, Automotive, Chemicals, Technology, Media & Telecommunications, Electronics & Semiconductor, Manufacturing & Construction and Healthcare.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market to 2027 – BNP Paribas, Citi, Euler Hermes, HSBC Holdings, JPMorgan Chase, Mitsubishi UFJ Financial, Royal Bank, Standard Chartered here

News-ID: 1789294 • Views: …

More Releases from The Insight Partners

Rising Security and Autonomous Vehicle Adoption Driving Digital Radar Market Gro …

The Digital Radar Market is projected to witness strong growth during the forecast period, with the market size expanding from US$ XX million in 2024 to US$ XX Million by 2031.

The report is segmented by Type (Active and Passive), Dimension (2D, 3D and 4D), Application (Safety, Security and Surveillance), and Vertical (Automotive, Aerospace, Military and Defense). The global analysis is further broken down at the regional level and across major…

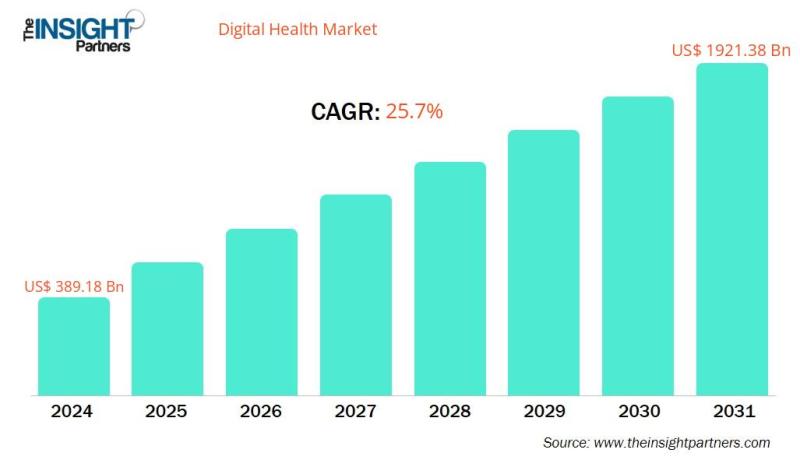

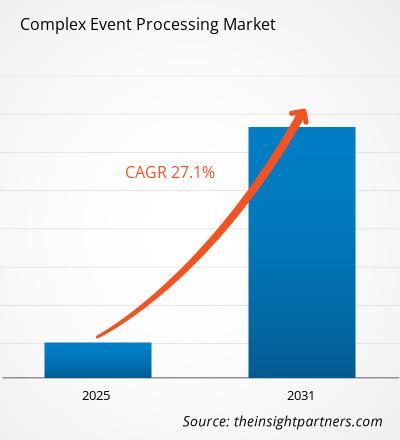

Real-Time Analytics Driving Strong Growth in the Complex Event Processing Market

The report is segmented by Deployment Mode (Cloud, On-Premise); Service Type (Consulting, Installation and Maintenance, Training and Support, Managed Services); Application (Algorithmic Trading, Electronic Transaction Monitoring, Dynamic Pre-Trade Analytics, Data Enrichment, Fraud Detection, Governance, Risk and Compliance, Asset Management and Predictive Scheduling, Geo-fencing and Geospatial Analysis, Others).

The global analysis is further broken down at the regional level and across major countries. The report offers the market value in USD for…

![A Complete Guide to Air Purification Industry [PDF E-Book]](https://cdn.open-pr.com/L/1/L115168461_g.jpg)

A Complete Guide to Air Purification Industry [PDF E-Book]

The increase in airborne diseases owing to the rise in air pollution is a key factor attributed to the market's growth. Furthermore, growing awareness among the consumer about using air purifiers, a rise in disposable income, and an improved standard of living are the prominent factors boosting the market growth. The growing trend toward adopting portable and smart air purifiers is further propelling the market dynamics over the forecast period.…

![A Complete Guide to Rain Gutter Industry [PDF E-Book]](https://cdn.open-pr.com/L/1/L115746839_g.jpg)

A Complete Guide to Rain Gutter Industry [PDF E-Book]

The increasing demand for replacement and renovation construction activities because of the bad weather conditions is driving the rain gutter market. The increase in the number of re-roofing projects, including gutter replacement, resulting from unpredictable weather conditions in various European countries, propels the market growth. In addition, increasing residential and commercial construction activities and rising need for rainwater harvesting are expected to fuel the rain gutter market's growth in the…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…