Press release

Asset-Backed Securities Market 2019,Top Key Players are;A.M. Best, Alliance Data Services, American Express, Bank of America, Barclays Bank of Delaware, Barclays Capital

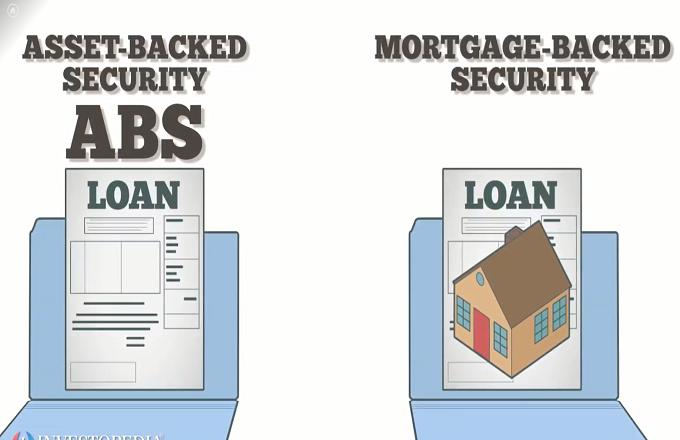

Asset-Backed Securities Market Report 2019An Asset-Backed Security (ABS) is a security whose pay installments and consequently worth is gotten from and collateralized (or sponsored) by a predefined pool of hidden resources. The pool of advantages is regularly a gathering of little and illiquid resources which are unfit to be sold exclusively.

Get a Sample PDF Report: @ https://bit.ly/2x7UfY4

Pooling the advantages into budgetary instruments enables them to be offered to general financial specialists, a procedure called securitization and permits the danger of putting resources into the fundamental resources for be differentiated on the grounds that every security will speak to a small amount of the absolute estimation of the assorted pool of hidden resources.

Market Segment by Manufacturers, this report covers : A.M. Best, Alliance Data Services, American Express, Bank of America, Barclays Bank of Delaware, Barclays Capital, Capital One, Chase, Citi, DBRS, Discover, FICO, Fitch, KBRA, Mastercard, Moody’s, Morningstar, Scotiabank, Securities and Exchange Commission, Sperry Corporation, Standard & Poor’s, Synchrony, TD Securities, US Bank, Wells Fargo Securities.

The study objectives are:

•To analyze and research the global Asset-Backed Securities status and future forecast,involving, production, revenue, consumption, historical and forecast.

•To present the key Asset-Backed Securities manufacturers, production, revenue, market share, and recent development.

•To split the breakdown data by regions, type, manufacturers and applications.

•To analyze the global and key regions market potential and advantage, opportunity and challenge, restraints and risks.

•To identify significant trends, drivers, influence factors in global and regions.

•To analyze competitive developments such as expansions, agreements, new product launches, and acquisitions in the market.

Any special requirements about this report, please let us know and we can provide custom report.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, supply and demand Figures, cost, price, revenue and gross margins.

TABLE OF CONTENT:

•Chapter One Asset-Backed Securities Market Overview

•Chapter Two Asset-Backed Securities Market Data Analysis

•Chapter Three Asset-Backed Securities Market Technical Data Analysis

•Chapter Four Asset-Backed Securities Market Government Policy and News

•Chapter Five Asset-Backed Securities Market Manufacturing Process and Cost Structure

•Chapter Six 2014-2019 Asset-Backed Securities Market Productions Supply Sales Demand Market Status and Forecast

•Chapter Seven Asset-Backed Securities Market Key Manufacturers

•Chapter Eight Asset-Backed Securities Market Up and Down Stream Industry Analysis

•Chapter Nine: Marketing Strategy Asset-Backed Securities Market Analysis

•Chapter Ten 2019-2025 Asset-Backed Securities Market Development Trend Analysis

•Chapter Eleven Asset-Backed Securities Market New Project Investment Feasibility Analysis

Get Complete Report: https://bit.ly/31SqNmT

About Us:

Market research is the new buzzword in the market, which helps in understanding the market potential of any product in the market. Reports And Markets is not just another company in this domain but is a part of a veteran group called Algoro Research Consultants Pvt. Ltd. It offers premium progressive statistical surveying, market research reports, analysis & forecast data for a wide range of sectors both for the government and private agencies all across the world.

Contact Us:

Sanjay Jain

Manager - Partner Relations & International Marketing

www.reportsandmarkets.com

info@reportsandmarkets.com

Ph: +44-020-3286-9338 (UK)

Ph: +1-214-736-7666 (US)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset-Backed Securities Market 2019,Top Key Players are;A.M. Best, Alliance Data Services, American Express, Bank of America, Barclays Bank of Delaware, Barclays Capital here

News-ID: 1785130 • Views: …

More Releases from REPORTSANDMARKETS

Micro Hotels Market Is Expected to Boom | Nine Hours in Japan, Dean Hotel Dublin …

This report studies the Micro Hotels Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Micro Hotels Market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

IT Consulting and Integration Services Market Overview by Advance Technology, Fu …

This report studies the IT Consulting and Integration Services Market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete IT Consulting and Integration Services Market analysis segmented by companies, region, type and applications in the report.

The report offers valuable insight into the…

Bumping Services Market Growth, Overview with Detailed Analysis 2022-2028| ASE G …

This report studies the Bumping Services market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Bumping Services market analysis segmented by companies, region, type and applications in the report.

New vendors in the market are facing tough competition from established international vendors…

Laser Powder Bed Fusion (LPBF) Technology Market Overview by Advance Technology, …

This report studies the Laser Powder Bed Fusion (LPBF) Technology market with many aspects of the industry like the market size, market status, market trends and forecast, the report also provides brief information of the competitors and the specific growth opportunities with key market drivers. Find the complete Laser Powder Bed Fusion (LPBF) Technology market analysis segmented by companies, region, type and applications in the report.

New vendors in the market…

More Releases for Securities

Supply Chain Securization Market 2023 | Futuristic Technology- Debon Securities, …

The Supply Chain Securization market research report delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions. The Supply Chain Securization report also incorporates the current and future global market outlook in the emerging and developed markets. Moreover, the report also investigates regions/countries expected to witness the fastest growth rates during the forecast period.

The Supply Chain Securization research report also provides insights of different…

Supply Chain Securization Market 2022: Industry Manufacturers Forecasts- Debon S …

The Supply Chain Securization research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Supply Chain Securization market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers…

New Era of Triennial OTC Derivatives Market 2019 Technological Advancement, Tren …

Global Triennial OTC Derivatives Report inspect the Market Size, Share, Demand, Growth Rate, Trend, Business Opportunity, Industry Applications, Analysis and Forecast to 2019-2025. It is based on advance Technology, upcoming growth opportunities. The market is classified into different segments based on regions, application and end-user.

Get Sample Copy @ https://www.orianresearch.com/request-sample/767774 …

Triennial OTC Derivatives Market Projected to Register a Healthy CAGR Wth GF Sec …

Worldwide Market Reports has announced the addition of the “Global Triennial OTC Derivatives Market Size Status and Forecast 2022”, The report classifies the global Triennial OTC Derivatives Market in a precise manner to offer detailed insights about the aspects responsible for augmenting as well as restraining market growth

This report studies the Triennial OTC Derivatives market, Triennial OTC Derivatives are contracts that are traded (and privately negotiated) directly between two parties,…

Global Triennial OTC Derivatives Market 2017 - GF Securities, ZHONGTAI Securitie …

This report studies the Triennial OTC Derivatives market, Triennial OTC Derivatives are contracts that are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. Products such as swaps, forward rate agreements, exotic OTC Options– and other exotic derivatives – are almost always traded in this way.

Scope of the Report:

This report focuses on the Triennial OTC Derivatives in Global market, especially in North America,…

Triennial OTC Derivatives Market 2017 : GF Securities, ZHONGTAI Securities, CITI …

Global (North America, Europe And Asia-Pacific, South America, Middle East And Africa) Triennial OTC Derivatives Market 2017 Forecast To 2022

This report studies the Triennial OTC Derivatives market, Triennial OTC Derivatives are contracts that are traded (and privately negotiated) directly between two parties, without going through an exchange or other intermediary. Products such as swaps, forward rate agreements, exotic OTC Options and other exotic derivatives are almost always traded in this…