Press release

Robo.cash marks the milestone of 1 million funded loans

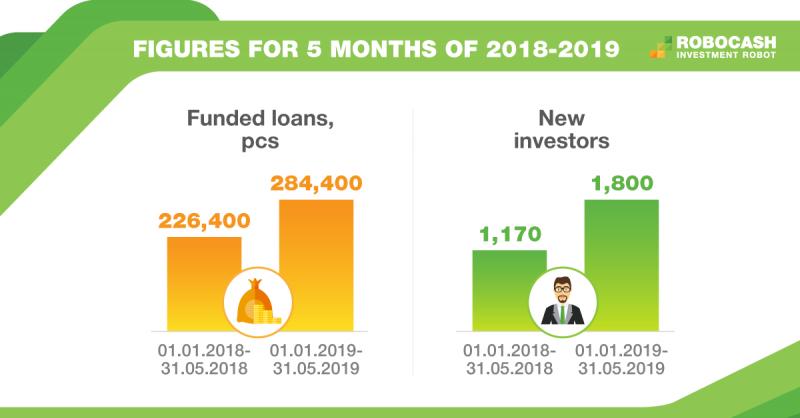

The number of loans financed through the European P2P platform Robo.cash has reached 1 million. For the first five months of 2019, the platform has shown a 26%-increase in the number of funded loans and a 54%-increase in the amount of new investors, compared to the same period last year.Since the launch in 2017, the European P2P platform Robo.cash has financed 1 million loans for the total amount of €89 million. It is notable that the number of loans funded through the platform has increased by 26% from 226,400 for the first five months of 2018 to 284,400 for the same period this year.

The growth is also observed in the amount of investors joining Robo.cash. Thus, from January to the end of May 2018, the platform was joined by 1,170 new investors, while this year, this number has amounted to 1,800 for the analogous period. Today, Robo.cash has 6,700 registered users in total.

“Increasing interest of investors in alternative lending is observed against the explosive growth of this market. According to the Cambridge Center for Alternative Finance, the volumes of alternative lending in Europe, except for the UK, grew on average by 82% annually from 2015 to 2017. In the APAC countries excluding China, the average growth amounted to 80%. We can expect a similar trend in the future, as the market is still far from being saturated. The dynamic development of the alternative lending industry attracts investors with its novelty, prospects and relatively high interest rates compared to bank deposits. Therefore, this market is developing to a great extent due to the attraction of funds from private investors,” - commented Sergey Sedov, Chief Executive Officer of Robocash Group.

ROBOCASH

Radnička cesta 80, Zagreb, Croatia, 10000

Presscontact:

Alyona Sedova

Public Relations Manager

a.sedova@robo.cash

_________________

Robo.cash is a fully automated P2P-platform with a buyback guarantee on investments operating within the European Union and Switzerland. The investment platform is a part of a financial holding Robocash Group uniting non-bank lending companies in Spain, Russia, Kazakhstan, the Philippines, Indonesia, Vietnam and India. The group is specialized in alternative consumer lending. For the time of its work, the group has issued more than 4 million loans. The staff number is over 1,300 employees. The financial group has been developing in the market since 2013.

https://robo.cash/

https://twitter.com/Robocash1

https://www.linkedin.com/robo.cash

https://www.facebook.com/robocash.invest/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Robo.cash marks the milestone of 1 million funded loans here

News-ID: 1783913 • Views: …

More Releases from Robocash

European P2P market reaches €3B as investors seek diversification in 2025

The European P2P market demonstrated relative stability in 2025. It is supported by the sustained dominance of consumer lending and continued investor demand despite a challenging macroeconomic environment.

According to open platforms' aggregated statistics from P2PMarketData, total investment volume of the European P2P Market reached €3.2B in 2025.

Consumer lending continues to be the key market driver (€2.7B), accounting for the majority of invested funds and confirming investors' sustained appetite for…

No boom ahead: The alternative investment market to remain stable in 2026

The platform Robocash has released the results of a latest survey examining investor expectations for the alternative finance market in 2026. The study indicates a slight shift toward a more cautious outlook compared to last year.

According to the survey, 37% of respondents do not expect any changes in the alternative investment market in 2026, while 35% predict growth. However, this is slightly lower than in 2025 (40%), which reflects a…

ETFs and stocks surge while P2P holdings grow in size

According to a recent survey of European investors, ETFs and stocks are gaining ground. The share of consumer P2P lending in investor portfolios has edged down, although the value of P2P holdings continues to rise.

The Robocash platform surveyed European investors about how 2025 performed in terms of investments.

Currently, the top assets in investor portfolios are ETFs (30%), stocks (21%) and P2P loans (21%). The first two have shown growth since…

Alternative investments to gain spotlight among European investors

A recent survey conducted by Robocash reveals that European investors are ready to allocate up to 25% of their investment portfolios to P2P lending. Although this asset class showcases its appeal in generating passive income, the respondents try to be cautious in balancing risk and reward.

A third of European investors see P2P as an attractive addition to their diversified portfolios, although they were initially skeptical about it. Meanwhile, another third…

More Releases for Robo

Robo Advisory Market is Rising

According to the latest research report published by Market Data Forecast, the global robo advisory market is expected to grow at a CAGR of 54.2% from 2024 to 2029, and the global market size is anticipated to be worth USD 154.6 billion by 2029 from USD 17.73 billion in 2024.

The robo advising market is expanding rapidly, fueled by technical developments and rising demand for automated financial solutions. These platforms use…

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo-Advisors: Mapping The Competitive Landscape

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…