Press release

Mobile Banking Market Developing Trends, Challenges, Size, Potential Revenue and Major Key Players (Atom Bank, Movencorp, Simple Finance Technology, Fidor) | Global Business Outlook Till 2023

BusinessIndustryReports.com has a new report on "Global Mobile Banking Market 2019". The report has been readied dependent on the blend, examination, and translation of data about the global Mobile Banking market gathered from specific sources. Organization diagram, monetary review, item portfolio, new venture propelled, late improvement examination are the parameters incorporated into the profile.Global Mobile Banking Market Overview:

The report spread crosswise over 90 pages is a diagram of the Global Mobile Banking Market 2019. The examination report gives investigation and data as per market sections, as like, geologies, types, and applications. Every one of the fragments has been broke down dependent on present and future patterns and the market is assessed from 2019 to 2023.

Accessible Exclusive Sample Copy of this Report @ https://www.businessindustryreports.com/sample-request/157110 .

Top Industry News:

Atom bank announce, Digital Mortgages by Atom bank announces today it will be rebranding in 2019 to become unified under the Atom bank brand. Digital Mortgages by Atom bank launched in December 2016 with the brand being created to establish a distinction from All Types of Mortgages (AToM), the mortgage broker & distributor, allowing both to trade without confusion in the market.

Simple Finance Technology, a commanding innovator in digital banking, today announced that it will offer a landmark 2.02% Annual Percentage Yield (APY) on all current and newly opened ‘Savings Goals’ with a balance of $2,000 or more. A ‘Savings Goal’ is a protected balance within a customer’s checking account. The current national average annual percentage yield on a checking account is .05%. Simple’s 2.02% APY on balances as low as $2,000 is monumental in today’s financial market.

The central point of the Global Mobile Banking market are Raising adoption of Smartphones and technological advancements.

The Global Mobile Banking Market report additionally covers segment information, including Product Type segment, Application: Industry segment, End User, Channel segment.

According to the Global Mobile Banking Market Analysis, the expanding number of cell phone clients, mobile banking endorsers are likewise expected to develop in millions, having banks move their concentration to client mobile exchanges. Specialist organizations likewise need to beat handset operability issues by creating stable applications to suit different right now accessible stages. Cell phone applications are changing the technique for banking administrations actualized by the clients which are likewise one of the driving variables for development in the mobile banking market. The benefit of utilizing mobile banking is that it is more secure and hazard free than on the web or web banking. The main disadvantage of utilizing mobile banking is that standard utilization of mobile banking can apply additional charges from the banks for offering the administrations.

According to regions, North America is estimated to acquire largest market share due to increase in demand of adopting mobile banking through smartphones where the customers use mobile channels to interact with the banks rather than visiting the banks. Europe is expected to be the fastest growing market due to faster transactions and mobile payments done by the bank which has led to increase in adoption of mobile banking used by the Europeans to make transactions.

Top Leading Key Manufacturers are: Atom Bank, Movencorp, Simple Finance Technology, Fidor Group, N26, Pockit and More.

This examination answers to the underneath key request:

1 What is the present size of the Mobile Banking market on the planet and in different countries?

2 How is the Mobile Banking market parceled into different thing sections?

3 How are the general market and unmistakable thing sections creating?

4 How is the market foreseen to make later on?

5 What is the market potential stood out from various countries?

Discount your report @ https://www.businessindustryreports.com/check-discount/157110 .

Global Mobile Banking Market 2019-2023: The goal of the examination is to depict show sizes of various fragments and countries beginning late and to check the qualities to the coming few of years. The report is intended to join both passionate and quantitative pieces of the business inside the majority of the zones and countries related with the examination. Additionally, the report in addition gives sustenance the point by point data about the critical edges, for example, driving segments and troubles which will portray the future improvement of the market. Moreover, the report will likewise join accessible open gateways in more diminutive scale markets for assistants to contribute near to the point by point examination of intense scene and thing responsibilities of key players.

Significant points in table of contents: Market Definition, Market Overview, Business Introduction, Segmentation (Region Level), Segmentation (Type Level), Segmentation (Industry Level), Segmentation (Channel Level), Market Forecast Year, Segmentation Type, Segmentation Industry, Market Cost Analysis, and Conclusion.

About us

BusinessindustryReports.com is digital database of comprehensive market reports for global industries. As a market research company we take pride in equipping our clients with insights and data that holds the power to truly make a difference to their business. Our mission is singular and well-defined – we want to help our clients envisage their business environment so that they are able to make informed strategic and therefore successful decisions for themselves.

Media Contact

Business Industry Reports

Pune – India

sales@businessindustryreports.com

+19376349940

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Banking Market Developing Trends, Challenges, Size, Potential Revenue and Major Key Players (Atom Bank, Movencorp, Simple Finance Technology, Fidor) | Global Business Outlook Till 2023 here

News-ID: 1759374 • Views: …

More Releases from Business Industry Reports

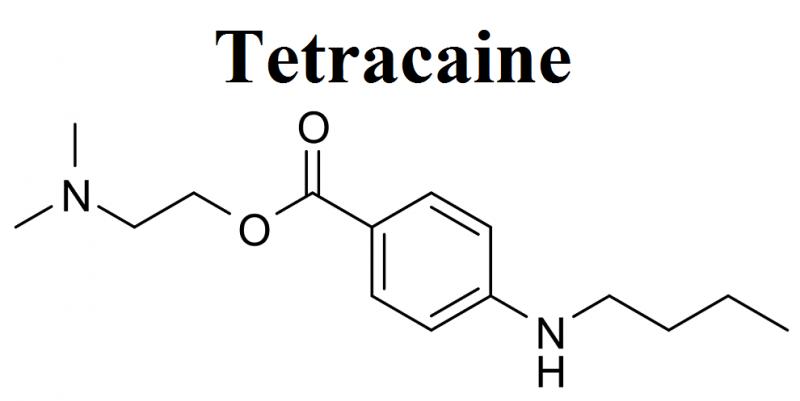

Tetracaine Market Exhibits a Lucrative Growth Potential during 2021-2025 | Endo …

BusinessIndustryReports has recently broadcasted a new study to its broad research portfolio, which is titled as “Global Tetracaine Market” Research Report 2021 provides an in-depth analysis of the Tetracaine with the forecast of market size and growth. The analysis includes addressable market, market by volume, market share by business type and by segment (external and in-house). The research study examines the Tetracaine on the basis of a number of criteria,…

Cyber Warfare Market Evenly Poised To Reach A Market Value of US$ By Share, Size …

Overview of Global Cyber Warfare Market:

This report provides in-depth study of “Global Cyber Warfare Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cyber Warfare Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, the Cyber Warfare is virtual conflict between state, organization, or country by the use of computer technology to disrupt activities…

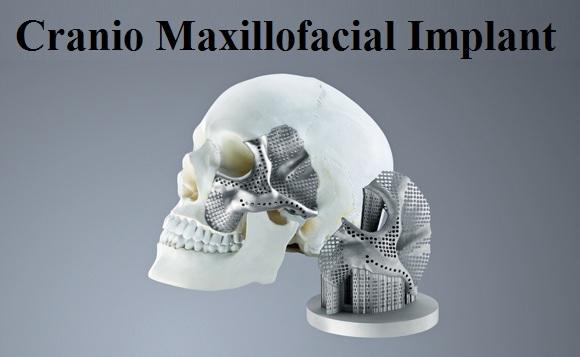

Covid-19 Impact on Cranio Maxillofacial Implant Market 2021-2025: Business Growt …

Overview of Global Cranio Maxillofacial Implant Market:

This report provides in-depth study of “Global Cranio Maxillofacial Implant Market 2021” using SWOT analysis i.e. Strength, Weakness, Opportunities, and Threat to the organization. The Cranio Maxillofacial Implant Market report also provides an in-depth survey of key players in the market organization.

According to the market research study, Craniomaxillofacial Implants are medical implants used in surgeries of maxillofacial region such as, head, face, neck, oral,…

Beginning of the bloom: The Rise of the Biohacking Market 2021-2025 | Global Key …

Global Biohacking Market Synopsis:

The report covers a forecast and an analysis of the Biohacking Market on a global and regional level. The study provides historical data for 2015, 2016, 2017 and 2018 along with a forecast from 2020 to 2025 based on revenue (USD Million) and volume (Kilotons). The study includes drivers and restraints of the Biohacking Market along with the impact they have on the demand over the forecast…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…